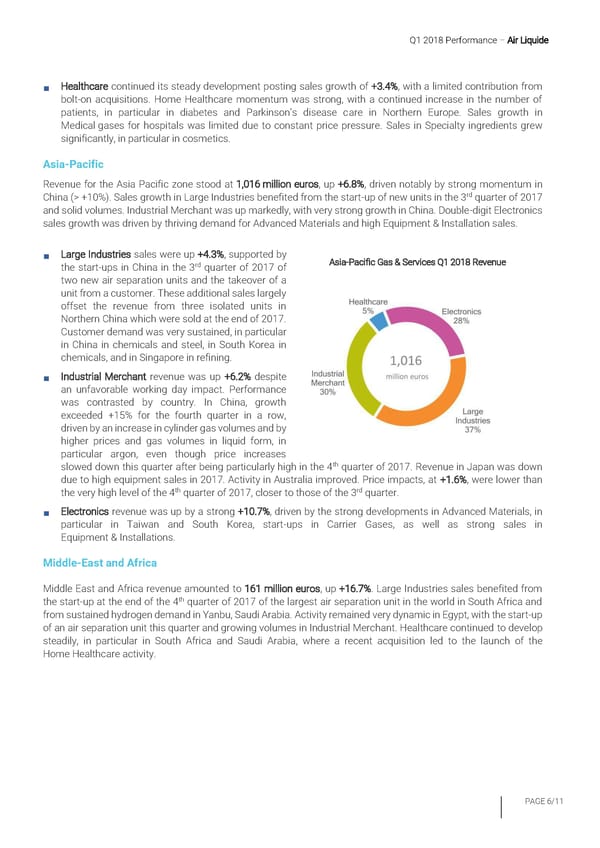

Q1 2018 Performance – Air Liquide Healthcare continued its steady development posting sales growth of +3.4%, with a limited contribution from bolt-on acquisitions. Home Healthcare momentum was strong, with a continued increase in the number of patients, in particular in diabetes and Parkinson's disease care in Northern Europe. Sales growth in Medical gases for hospitals was limited due to constant price pressure. Sales in Specialty ingredients grew significantly, in particular in cosmetics. Asia-Pacific Revenue for the Asia Pacific zone stood at 1,016 million euros, up +6.8%, driven notably by strong momentum in China (> +10%). Sales growth in Large Industries benefited from the start-up of new units in the 3rd quarter of 2017 and solid volumes. Industrial Merchant was up markedly, with very strong growth in China. Double-digit Electronics sales growth was driven by thriving demand for Advanced Materials and high Equipment & Installation sales. Large Industries sales were up +4.3%, supported by Asia-Pacific Gas & Services Q1 2018 Revenue the start-ups in China in the 3rd quarter of 2017 of two new air separation units and the takeover of a unit from a customer. These additional sales largely offset the revenue from three isolated units in Northern China which were sold at the end of 2017. Customer demand was very sustained, in particular in China in chemicals and steel, in South Korea in chemicals, and in Singapore in refining. Industrial Merchant revenue was up +6.2% despite an unfavorable working day impact. Performance was contrasted by country. In China, growth exceeded +15% for the fourth quarter in a row, driven by an increase in cylinder gas volumes and by higher prices and gas volumes in liquid form, in particular argon, even though price increases slowed down this quarter after being particularly high in the 4th quarter of 2017. Revenue in Japan was down due to high equipment sales in 2017. Activity in Australia improved. Price impacts, at +1.6%, were lower than the very high level of the 4th quarter of 2017, closer to those of the 3rd quarter. Electronics revenue was up by a strong +10.7%, driven by the strong developments in Advanced Materials, in particular in Taiwan and South Korea, start-ups in Carrier Gases, as well as strong sales in Equipment & Installations. Middle-East and Africa Middle East and Africa revenue amounted to 161 million euros, up +16.7%. Large Industries sales benefited from the start-up at the end of the 4th quarter of 2017 of the largest air separation unit in the world in South Africa and from sustained hydrogen demand in Yanbu, Saudi Arabia. Activity remained very dynamic in Egypt, with the start-up of an air separation unit this quarter and growing volumes in Industrial Merchant. Healthcare continued to develop steadily, in particular in South Africa and Saudi Arabia, where a recent acquisition led to the launch of the Home Healthcare activity. PAGE 6/11

Q1 2018 Revenue Page 8 Page 10

Q1 2018 Revenue Page 8 Page 10