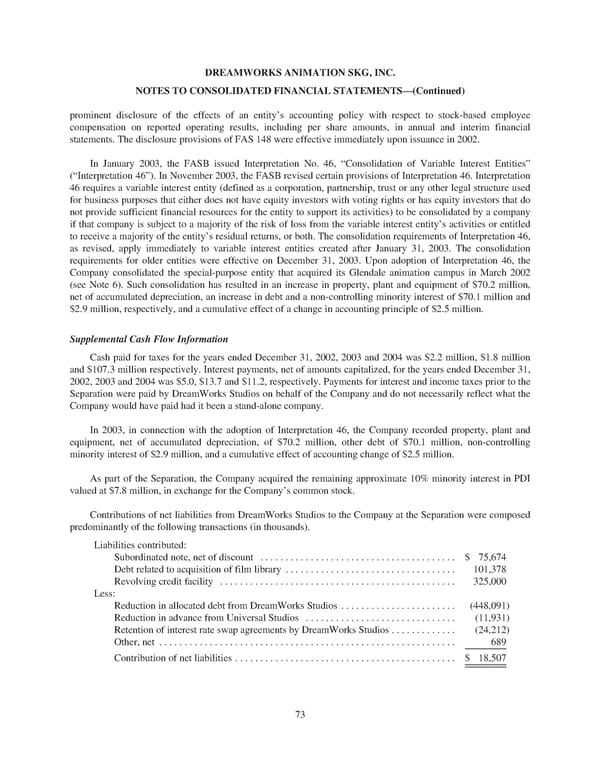

DREAMWORKSANIMATIONSKG,INC. NOTESTOCONSOLIDATEDFINANCIALSTATEMENTS—(Continued) prominent disclosure of the effects of an entity’s accounting policy with respect to stock-based employee compensation on reported operating results, including per share amounts, in annual and interim financial statements. The disclosure provisions of FAS 148 were effective immediately upon issuance in 2002. In January 2003, the FASB issued Interpretation No. 46, “Consolidation of Variable Interest Entities” (“Interpretation 46”). In November 2003, the FASB revised certain provisions of Interpretation 46. Interpretation 46 requires a variable interest entity (defined as a corporation, partnership, trust or any other legal structure used for business purposes that either does not have equity investors with voting rights or has equity investors that do not provide sufficient financial resources for the entity to support its activities) to be consolidated by a company if that company is subject to a majority of the risk of loss from the variable interest entity’s activities or entitled to receive a majority of the entity’s residual returns, or both. The consolidation requirements of Interpretation 46, as revised, apply immediately to variable interest entities created after January 31, 2003. The consolidation requirements for older entities were effective on December 31, 2003. Upon adoption of Interpretation 46, the Company consolidated the special-purpose entity that acquired its Glendale animation campus in March 2002 (see Note 6). Such consolidation has resulted in an increase in property, plant and equipment of $70.2 million, net of accumulated depreciation, an increase in debt and a non-controlling minority interest of $70.1 million and $2.9 million, respectively, and a cumulative effect of a change in accounting principle of $2.5 million. Supplemental Cash Flow Information Cash paid for taxes for the years ended December 31, 2002, 2003 and 2004 was $2.2 million, $1.8 million and $107.3 million respectively. Interest payments, net of amounts capitalized, for the years ended December 31, 2002, 2003 and 2004 was $5.0, $13.7 and $11.2, respectively. Payments for interest and income taxes prior to the Separation were paid by DreamWorks Studios on behalf of the Company and do not necessarily reflect what the Companywouldhavepaidhaditbeenastand-alonecompany. In 2003, in connection with the adoption of Interpretation 46, the Company recorded property, plant and equipment, net of accumulated depreciation, of $70.2 million, other debt of $70.1 million, non-controlling minority interest of $2.9 million, and a cumulative effect of accounting change of $2.5 million. As part of the Separation, the Company acquired the remaining approximate 10% minority interest in PDI valued at $7.8 million, in exchange for the Company’s common stock. Contributions of net liabilities from DreamWorks Studios to the Company at the Separation were composed predominantly of the following transactions (in thousands). Liabilities contributed: Subordinated note, net of discount ....................................... $ 75,674 Debt related to acquisition of film library .................................. 101,378 Revolving credit facility ............................................... 325,000 Less: Reduction in allocated debt from DreamWorks Studios ....................... (448,091) Reduction in advance from Universal Studios .............................. (11,931) Retention of interest rate swap agreements by DreamWorks Studios ............. (24,212) Other, net ........................................................... 689 Contribution of net liabilities ............................................ $ 18,507 73

DreamWorks Annual Report Page 78 Page 80

DreamWorks Annual Report Page 78 Page 80