Delegate Brochure

Artificial Intelligence & Data Science | Newsweek | 1st - 2nd March

ARTIFICIAL INTELLIGENCE CAPITAL & DATA MARKETS SCIENCE Delegate Brochure 1st - 2nd March 2017 The Barbican, City of London aidataconf.com

ABOUT A so-called “artificial intelligence summer” THE has been ushered in by advancements in areas such as machine learning, deep EVENT learning and neural networks. This has been facilitated by a marked reduction in the cost of computing power and readily available access to very large data sets. Machine learning of one sort or another has been machine learning can be applied at the micro-market happening within the financial arena for some time. Today, level to manage order flow and transaction costs. investment managers and trading operations can apply machine learning algorithms to a range of areas. At a higher level, the use of AI and deep learning raises ethical questions. Could the role of financial analysts This might include mining big data and the challenge of be replaced by smarter algorithms, and how would this extracting useful information from unstructured data, reshape the industry? From a regulatory perspective, what which could extend to social media content, and then grey areas could be opened up when machine learning how to find value using predictive analytics or trading. algorithms are used to police markets? The expanding big data universe opens a whole area of alternative datasets - what is out there, what is hot, what Newsweek’s AI and Data Science - Capital Markets is coming... conference will delve into each of these areas, providing insights from top level industry practitioners at banks and Other interesting areas include advanced quantitative hedge funds, as well as chief technical officers, academics methods of balancing portfolios and managing risk, or how and regulators.

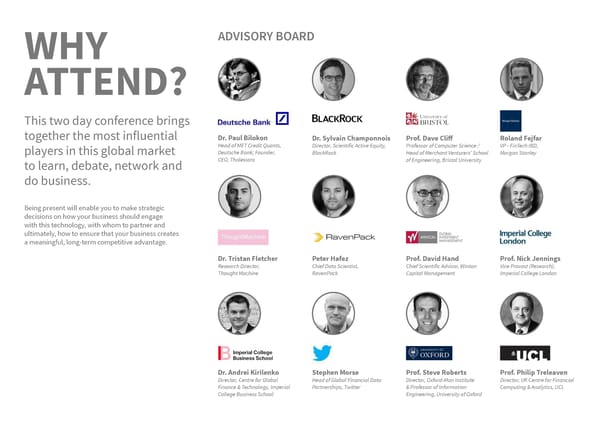

ADVISORY BOARD WHY ATTEND? This two day conference brings together the most influential Dr. Paul Bilokon Dr. Sylvain Champonnois Prof. Dave Cliff Roland Fejfar Head of MET Credit Quants, Director, Scientific Active Equity, Professor of Computer Science / VP - FinTech IBD, players in this global market Deutsche Bank; Founder, BlackRock Head of Merchant Venturers’ School Morgan Stanley to learn, debate, network and CEO, Thalesians of Engineering, Bristol University do business. Being present will enable you to make strategic decisions on how your business should engage with this technology, with whom to partner and ultimately, how to ensure that your business creates a meaningful, long-term competitive advantage. Dr. Tristan Fletcher Peter Hafez Prof. David Hand Prof. Nick Jennings Research Director, Chief Data Scientist, Chief Scientific Advisor, Winton Vice Provost (Research), Thought Machine RavenPack Capital Management Imperial College London Dr. Andrei Kirilenko Stephen Morse Prof. Steve Roberts Prof. Philip Treleaven Director, Centre for Global Head of Global Financial Data Director, Oxford-Man Institute Director, UK Centre for Financial Finance & Technology, Imperial Partnerships, Twitter & Professor of Information Computing & Analytics, UCL College Business School Engineering, University of Oxford

12:40 Panel: Keeping an edge in alpha creation with Big Data Chair - Armando Gonzalez, CEO, RavenPack Matt Ober, Co-head of Data Strategy, WorldQuant CONFERENCE Michael Beal, CEO, Data Capital Management Yin Luo, Vice Chairman Quantitative Research, Economics, and Strategy (QES), Wolfe Research 13:20 Lunch PROGRAMME ADVANCED DATA ANALYTICS AND INTERPRETATION 14:00 Machine learning and natural language processing strategies Gideon Mann, Head of Data Science / CTO Office at Bloomberg LP DAY ONE - INNOVATION IN DATA SCIENCE 14:10 Machine readable news and MarketPsych Indices James Cantarella, Global Proposition Manager for Enterprise Analytics at Thomson Reuters 09:00 Welcome 14:20 The hedge fund landscape “what’s hot and what’s not” Professor David Hand, Emeritus Professor of Mathematics at Imperial College and Chief Scientific Peter Hafez, Chief Data Scientist, RavenPack Advisor to Winton Capital Management 14:30 Strategies that leverage non-traditional sources of information 09:05 Keynote: Moore’s Law versus technology-updated version of Murphy’s Law: guiding principles Ted Bailey, CEO, Dataminr for data science in capital markets 14:40 Panel: A new generation of financial text mining and automated interpretation Andrew W. Lo, Professor of Finance and Director of the Laboratory for Financial Engineering at the MIT Chair - Stephen Morse, Head of Enterprise Financial Data Partnerships, Twitter Sloan School of Management (tbc) Gideon Mann, Head of Data Science / CTO Office at Bloomberg LP NEW DATA SETS James Cantarella, Global Proposition Manager for Enterprise Analytics at Thomson Reuters Peter Hafez, Chief Data Scientist, RavenPack 09:30 Geoanalytics at an unprecedented scale Ted Bailey, CEO, Dataminr A.J. DeRosa, VP, Orbital Insight 15:20 New AI enabled financial data analysis / pattern analysis 09:45 Transaction data enrichment Tim Estes, Founder & CEO digital reasoning (tbc) Thomas Hempel, Senior Vice-President of Engineering, Yodlee 15:40 Coffee break 10:00 Crowdsourced data to generate alpha 16:00 Keeping competitive advantage – Being a quant in five years’ time – what role will people have? Leigh Drogen, Founder and CEO, Estimize Raffaele Savi, Managing Director, Scientific Active Equity, BlackRock 10:15 IoT data sets – a sustainable source of alpha? NEW BUSINESS & MODELS IN ASSET MANAGEMENT Tammer Kamel, Founder & amp; CEO, Quandl 10:30 Panel: The next frontier of big data generation in capital markets 16:20 Quantopian’s business model & the startup ecosystem Chair - Professor David Hand, Chief Scientific Advisor, Winton Capital Management Matthew Granade, Quantopian / Point 72 A.J. DeRosa, VP, Orbital Insight 16:40 Trading with a massively distributed AI platform Thomas Hempel, Senior Vice-President of Engineering, Yodlee Babak Hadjat, Founder and Chief Scientist, Sentient Technologies (tbc) Leigh Drogen, Founder and CEO, Estimize 17:00 Generating alpha from exotic data sets: a hedge fund perspective Tammer Kamel, Founder & amp; CEO, Quandl Michael Beal, CEO, Data Capital Management 11:10 Coffee break 17:20 Panel: Will new data sets, new analysis methods or new hardware be the driver for alpha in the coming years? DATA SOURCING Chair – Andrew W. Lo, Professor of Finance and Director of the Laboratory for Financial Engineering 11:30 Machine learning and it’s practical implementation in actual global stock selection at the MIT Sloan School of Management Yin Luo, Vice Chairman Quantitative Research, Economics, and Strategy (QES), Wolfe Research Professor David Hand, Emeritus Professor of Mathematics at Imperial College and Chief Scientific Advisor to Winton Capital Management 11:50 Delivering global historical limit order book data via AWS cloud Matthew Granade, Quantopian / Point 72 John Macpherson, CEO, BMLL Babak Hadjat, Founder & Chief Scientist, Sentient Technologies 12:10 Panel: The bifurcation between small players using third party market flow data, and large 18:00 Closing remarks hedge funds with in-house research teams Professor David Hand, Emeritus Professor of Mathematics at Imperial College and Chief Scientific Chair - Sylvain Champonnois, Director, Scientific Active Equity, BlackRock Advisor to Winton Capital Management Mark Makepeace, Group Director of Information Services, London Stock Exchange Group (tbc) 18:10 Networking reception, Milton Court John Macpherson, CEO, BMLL 20:00 End of day 1

CONFERENCE PROGRAMME DAY TWO – PORTFOLIO MANAGEMENT, RISK AND REGULATION PORTFOLIO MANAGEMENT 13:30 CEO Panel: What are the right guiding principles for AI applications in Capital Markets? 09:00 Keynote: The journey of AI/ML in quantitative trading strategies so far, and what’s really Chair – Professor Dave Cliff, Professor of Computer Science / Head of Merchant Venturers’ School of possible now? Engineering, Bristol University Professor Steve Roberts, Director, Oxford-Man Institute & Professor of Information Engineering, Marty Chavez, CIO, Goldman Sachs (tbc) University of Oxford Anthony Ledford, CIO, Man AHL Chris Corrado, Group CIO, London Stock Exchange Group (tbc) 09:30 How machine learning can help overcome mathematical intractability in some portfolio Andrew Bailey, Head of FCA (tbc) selection methods. RISK Yves-Laurent Kom Samo, Google Scholar in Machine Learning, DPhil student, Oxford-Man Institute of Quantitative Finance 14:10 Using machine learning to identify insider trading 09:50 Fintech’s approach to AI & Data applications in Capital Markets Dr Tom Doris, CEO, OTAS Technologies Dr Tristan Fletcher, Research Director, Thought Machine 14:30 Supercomputers that watch supercomputers 10:10 Stochastic filtering in electronic trading Anthony D. Amicangioli, Founder and CEO, Hyannis Port Research Paul A. Bilokon, Director at Thalesians Ltd 14:50 Protecting portfolios from tail risk and grey swans 10:30 Panel: What are the implications of AI for discretionary / fundamental Dr Jeremy Sosabowski, CEO, AlgoDynamix investment strategies? 15:10 Coffee break Chair - Professor Steve Roberts, Director, Oxford-Man Institute & Professor of Information Engineering, 15:30 Panel: Would machines have manipulated Libor? University of Oxford Chair – Roland Fejfar, VP Fintech IDB, Morgan Stanley Yves-Laurent Kom Samo, Google Scholar in Machine Learning, DPhil student, Oxford-Man Institute of Dr Tom Doris, CEO, OTAS Technologies Quantitative Finance Anthony D. Amicangioli, Founder and CEO, Hyannis Port Research Dr Tristan Fletcher, Research Director, Thought Machine Dr Jeremy Sosabowski, CEO, AlgoDynamix Paul A. Bilokon, Director at Thalesians Ltd Rod Hall, Senior Analyst, US Networking & IT Hardware Equity Research, JP Morgan Chase & Co. 16:10 Panel: The future of AI & data science in Capital Markets 11:10 Coffee break Chair – Professor Dave Cliff, Professor of Computer Science / Head of Merchant Venturers’ School of Engineering, Bristol University REGULATION Professor Steve Roberts, Oxford-Man Institute & Professor of Information Engineering, 11:30 Keynote: The intersection of technology, finance and regulation University of Oxford Dr Andrei Kirilenko, Director, Centre for Global Finance & Technology, Imperial College Business School Rod Hall, Senior Analyst, US Networking & IT Hardware Equity Research, JP Morgan Chase & Co. Anthony Ledford, CIO, Man AHL 12:00 Keynote: How to regulate the brave new world of advancing algorithms Further panel members to be announced Edwin Schooling Latter, Head of Markets Policy, Financial Conduct Authority (tbc) 16:50 Closing remarks 12:30 Lunch Professor Nick Jennings CB, FREng, Vice-Provost (Research) at Imperial College 20:00 Conference close

ORGANISED BY: KNOWLEDGE PARTNER: Since 1932, Newsweek has brought a unique global International Business Times is a 21st century news Imperial College London is a science-based perspective on the world of current affairs. brand that delivers free-to-read global, political and university with an international reputation for From exclusive interviews with leading figures economic business news for the future captains of excellence in teaching and research. in politics, business, entertainment and sports, industry. Consistently rated amongst the world’s best to in-depth investigations and insight into the universities, Imperial is committed to developing most important events in global news, business, As a digital-first news publisher they are free of print the next generation of researchers, scientists and technology, politics and culture. Newsweek makes restrictions which allows them to react quickly to academics through collaboration across disciplines. sense of a rapidly changing world, and does it with rapidly-changing news consumption habits and flair, wit and curiosity. embrace journalistic innovation. Located in the heart of London, Imperial is a Newsweek International reaches its affluent and Their team of multilingual correspondents give multidisciplinary space for education, research, discerning audience across multiple platforms. Its them a strong advantage in breaking foreign news, translation and commercialisation, harnessing reach spans over 70 countries across Europe, the ensuring that they remain a trusted destination for science and innovation to tackle global challenges. Middle East, Asia and Africa. accurate international stories. Building on the strengths of its socially diverse newsroom they are proud to reflect true society on many levels; race, ethnicity, gender, sexuality, culture and disability.

DATES & LOCATION WHEN 1st – 2nd March 2017 WHERE Milton Court, Barbican Centre Silk St, London EC2Y 8DS United Kingdom In the heart of the City of London, with excellent national and international transport links, the Barbican is Europe’s largest combined arts and events centre. It is within walking distance from a number of London Underground stations, the closest being Barbican, St Paul’s and Moorgate. Recently opened to great acclaim, Milton Court Concert Hall is an exciting addition to the venue hire opportunities at the Barbican. The hall boasts a maximum capacity of 608, world class acoustic design and state-of-the-art technical capability. Bright, open foyers compliment the hall and are the ideal space to host catering and drinks receptions.

To book your place, please visit the website where you can register and pay via major cards, or request an invoice for payment by direct bank transfer. For payment queries please contact [email protected] For general queries please contact events@ newsweek.com or call +44 (0) 20 3040 4381 For event news and updates please follow