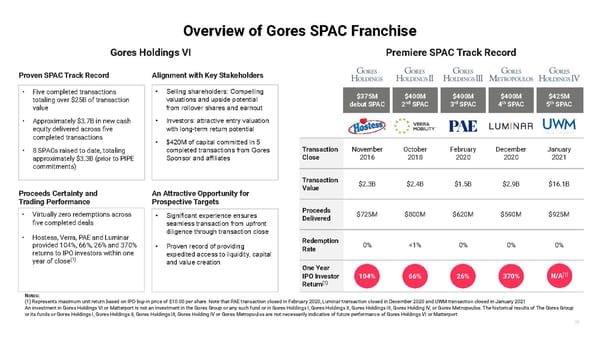

36 Overview of Gores SPAC Franchise Selling shareholders: Compelling valuations and upside potential from rollover shares and earnout Investors: attractive entry valuation with long-term return potential $420M of capital committed in 5 completed transactions from Gores Sponsor and affiliates Significant experience ensures seamless transaction from upfront diligence through transaction close Proven record of providing expedited access to liquidity, capital and value creation Five completed transactions totaling over $25B of transaction value Approximately $3.7B in new cash equity delivered across five completed transactions 8 SPACs raised to date, totaling approximately $3.3B (prior to PIPE commitments) $375M debut SPAC $400M 2 nd SPAC $400M 3 rd SPAC $400M 4 th SPAC $425M 5 th SPAC Transaction Close November 2016 October 2018 February 2020 December 2020 January 2021 Transaction Value $2.3B $2.4B $1.5B $2.9B $16.1B Proceeds Delivered $725M $800M $620M $590M $925M Redemption Rate 0% <1% 0% 0% 0% One Year IPO Investor Return (1) Gores Holdings VI 104% 66% 26% Premiere SPAC Track Record 370% Proven SPAC Track Record Alignment with Key Stakeholders Virtually zero redemptions across five completed deals Hostess, Verra, PAE and Luminar provided 104%, 66%, 26% and 370% returns to IPO investors within one year of close (1) Proceeds Certainty and Trading Performance An Attractive Opportunity for Prospective Targets N/A (1) Notes: (1) Represents maximum unit return based on IPO buy-in price of $10.00 per share. Note that PAE transaction closed in February 2020, Luminar transaction closed in December 2020 and UWM transaction closed in January 2021 An investment in Gores Holdings VI or Matterport is not an investment in the Gores Group or any such fund or in Gores Holdings I, Gores Holdings II, Gores Holdings III, Gores Holding IV, or Gores Metropoulos. The historical results of The Gores Group or its funds or Gores Holdings I, Gores Holdings II, Gores Holdings III, Gores Holding IV or Gores Metropoulos are not necessarily indicative of future performance of Gores Holdings VI or Matterport

Matterport Overview Page 36 Page 38

Matterport Overview Page 36 Page 38