Store Electronic Systems

SESL:FP

"What are the major digital issues facing retail in France?"

LA TRIBUNE - Exclusive interview with Thierry Gadou, CEO of Store Electronic Systems (SES), a French company created in 1992 and now world leader in point of sale electronics labeling.What practical steps is Store Electronic Systems taking?

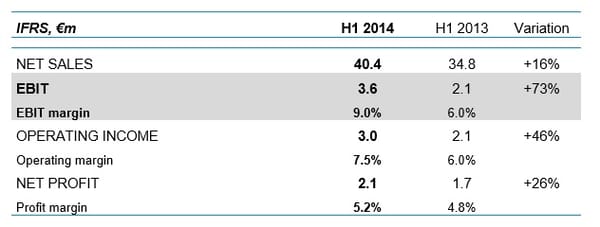

Store Electronic Systems (SES) is a French technology company specialized in electronic labeling systems for retail. We are the world number 1 in this specialty, with nearly 9,000 fitted stores around the world and total sales of more than €80m, half of which is achieved internationally. We export our solutions to more than 50 countries. The company has 220 employees and is quoted on the Paris Stock Exchange, on Euronext compartment B. French mass retail has always been very innovative and has pioneered electronic labeling, but there is still a lot to do in the rest of the world. The international market is a crucial issue for SES; our international sales have increased four-fold in five years.

How many companies are there in this market?

There are about ten specialized companies in the European, American and Asian markets; we are the only French company in this sector, and we hold more than 40% of the global market. In France, we can be found in nearly all the major retail chains. Electronic labeling demands real technological expertise, meaning that our potential in this world market calls for rapid development in the coming years. There are about 250 million electronic labels in the world, including nearly 120 million manufactured by SES; sector analysts forecast more than a billion labels in store within five years.

Why is this digitalization of labels inevitable?

Firstly, for a store, the labeling process is very time-consuming. Changing all the prices in a hypermarket takes several days for an entire team; our solutions only require a few minutes. We bring the retailer agility, productivity and accuracy, where too often paper labeling generates errors between prices displayed on the shelf and prices at the checkout. This error rate in France is the lowest in Europe, thanks to extensive implementation of electronic labels.

For the consumer, electronic labeling is therefore synonymous with accurate prices, but also low prices because it make price competition more fluid. Under the pressure of competition and the development of e-commerce, the frequency of price changes is increasing rapidly and has doubled in five years. This movement is widespread in Europe. In parallel, we are also witnessing a rise in labor costs that is increasing the need for mass retail to switch to digital technology.

How many labels are there in a store?

There can be a very significant number: between 30,000 and 70,000 labels in a hypermarket, depending on the size, and 5,000 to 20,000 in a supermarket. We are also fitting a lot of small sales outlets such as convenience stores or pharmacies, with 1,000 to 5,000 labels. What's more, stores in a network can either be managed at point of sale or be centralized for the whole retail chain.

You put great emphasis on innovation. What does this mean in practice?

Every year we invest 8% of sales revenue in R&D, which is more than all our competitors put together. Through this innovation effort, electronic labeling is becoming intelligent and interactive: it is the ultimate connected object. We were the first to introduce NFC technology (Near Field Communication), able to communicate with consumers' smartphones. In this way, our intelligent labels are becoming real on-shelf communication tools. They can send information about a product, a discount coupon, help you fill your basket, guide you in the store, tell you about ingredients you might be allergic to, and more. For retailers, the intelligent label is also used to geolocalize products, improve real-time management of their planogram, which is the in-store product layout plan. Physical stores have to make better use of technologies to offer more services and information to customers and improve productivity. The electronic label is the 'Swiss army knife' of this digital revolution.

What are the main opportunities for SES to diversify?

Electronic labeling has substantial development potential.

And through innovation, applications based on intelligent labels will multiply in different areas: multi-channel synchronization, on-shelf interactive marketing, nutritional information, operational excellence, productivity of the Drive, optimized merchandising, and so on. Our mission is to help retailers make a success of converting to digital and make technology a business driver.

How can you continue to move forward?

By continuing to focus on quality and innovation, and by maintaining our investments in international development. We want to accelerate the return on investment from our solutions to stay market leader. We are currently working on offering Cloud solutions to make our products more accessible. Marketing our offer as a service, with a rent and no longer as an investment, should increase the rate of adoption. Many other future innovations will contribute to making a physical store an increasingly connected and interactive environment. The other big project is our international market. In 5 years, SES will be a reflection of its market, a global company.

Research Disclaimer This publication has been prepared by Enterprise Sponsored Research (“ESpR”) and is intended for professional or qualified investors only. This document is provided for informational purposes only. No investment opinion or advice is provided, intended, or solicited. This research material is not investment research and has not been prepared in accordance with legal requirements designed to promote the independence of investment research. It is not subject to any prohibition on dealing ahead of the dissemination of investment research. This material does not take into account the particular investment objectives, financial situation or needs of individual clients or other recipients. Before acting on this material, clients and other recipients should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. This material should not be construed in any circumstances as an offer to sell or solicitation of any offer to buy any security or other financial instrument, nor shall it, or the fact of its distribution, form the basis of, or be relied upon in connection with, any contract relating to such action. ESpR offers no warranty, either expressed or implied, regarding the veracity of data or interpretations of data included in this report. ESpR shall not be held responsible for any damage caused by the use of this report. Opinions expressed will be the current opinions of those producing the research as of the date appearing on this material only. We expect those producing the material in this report to update it on a timely basis but can give no undertaking that they will do so and regulatory compliance or other reasons may prevent them from doing so (or us from disseminating updated material). Members and employees of ESpR may from time to time have long or short positions in securities, warrants, futures, options, derivatives or other financial instruments referred to in this material. The copyright of this report and the rights regarding the creation and exploitation of the derivative work of this and other ESpR reports belong to ESpR. Neither the whole nor any part of this material may be duplicated in any form or by any means. Neither should any of this material be redistributed or disclosed to anyone without prior consent. This material is issued for general information and discussion purposes only. ESpR does not accept any liability whatsoever for any direct, indirect or consequential loss or damage of any kind arising out of the use of all or any of this material. The services, securities and investments discussed in this material may not be available to, nor are suitable for all investors. Investors should make their own investment decisions based upon their own financial objectives and financial resources and it should be noted that investment involves risk, including the risk of capital loss. Past performance is no guide to future performance. In relation to securities denominated in foreign currency, movements in exchange rates will have an effect on the value, either favorable or unfavorable.