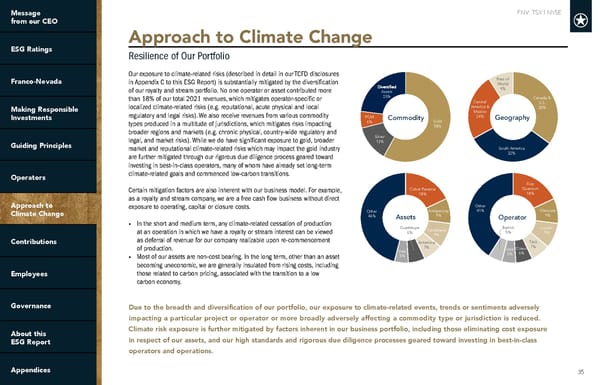

FNV: TSX | NYSE 35 Approach to Climate Change Resilience of Our Portfolio Our exposure to climate-related risks (described in detail in our TCFD disclosures in Appendix C to this ESG Report) is substantially mitigated by the diversification of our royalty and stream portfolio. No one operator or asset contributed more than 18% of our total 2021 revenues, which mitigates operator-specific or localized climate-related risks (e.g. reputational, acute physical and local regulatory and legal risks). We also receive revenues from various commodity types produced in a multitude of jurisdictions, which mitigates risks impacting broader regions and markets (e.g. chronic physical, country-wide regulatory and legal, and market risks). While we do have significant exposure to gold, broader market and reputational climate-related risks which may impact the gold industry are further mitigated through our rigorous due diligence process geared toward investing in best-in-class operators, many of whom have already set long-term climate-related goals and commenced low-carbon transitions. Certain mitigation factors are also inherent with our business model. For example, as a royalty and stream company, we are a free cash flow business without direct exposure to operating, capital or closure costs. • In the short and medium term, any climate-related cessation of production at an operation in which we have a royalty or stream interest can be viewed as deferral of revenue for our company realizable upon re-commencement of production. • Most of our assets are non-cost bearing. In the long term, other than an asset becoming uneconomic, we are generally insulated from rising costs, including those related to carbon pricing, associated with the transition to a low carbon economy. Due to the breadth and diversification of our portfolio, our exposure to climate-related events, trends or sentiments adversely impacting a particular project or operator or more broadly adversely affecting a commodity type or jurisdiction is reduced. Climate risk exposure is further mitigated by factors inherent in our business portfolio, including those eliminating cost exposure in respect of our assets, and our high standards and rigorous due diligence processes geared toward investing in best-in-class operators and operations. Gold 58% Silver 13% PG M 6% Assets 23% Commodity Canada & U.S. 35% South Americ a 32% Central America & Mexico 24% Rest of World 9% Geograph y Cobre Panam a 18% Antapaccay 9% Candelari a 9% Antamin a 7% Guadalupe 6% Vale 5% Other 46% Assets First Quantum 18% Glencor e 9% Lundi n 9% Teck 7% Coeur 6% Vale 5% Barric k 5% Other 41% Operator

2022 ESG Report | Franco-Nevada Page 34 Page 36

2022 ESG Report | Franco-Nevada Page 34 Page 36