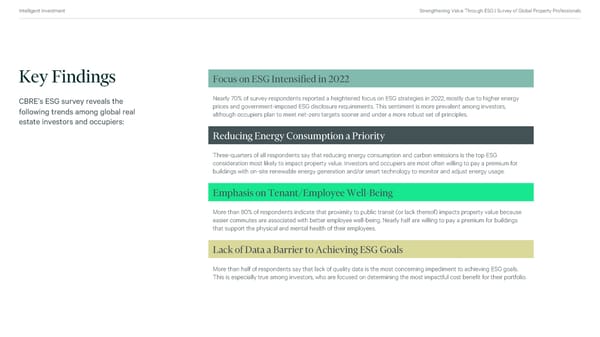

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Key Findings Focus on ESG Intensified in 2022 CBRE’s ESG survey reveals the Nearly 70% of survey respondents reported a heightened focus on ESG strategies in 2022, mostly due to higher energy following trends among global real prices and government-imposed ESG disclosure requirements. This sentiment is more prevalent among investors, although occupiers plan to meet net-zero targets sooner and under a more robust set of principles. estate investors and occupiers: Reducing Energy Consumption a Priority Three-quarters of all respondents say that reducing energy consumption and carbon emissions is the top ESG consideration most likely to impact property value. Investors and occupiers are most often willing to pay a premium for buildings with on-site renewable energy generation and/or smart technology to monitor and adjust energy usage. Emphasis on Tenant/Employee Well-Being More than 80% of respondents indicate that proximity to public transit (or lack thereof) impacts property value because easier commutes are associated with better employee well-being. Nearly half are willing to pay a premium for buildings that support the physical and mental health of their employees. Lack of Data a Barrier to Achieving ESG Goals More than half of respondents say that lack of quality data is the most concerning impediment to achieving ESG goals. This is especially true among investors, who are focused on determining the most impactful cost benefit for their portfolio.

2022 Global ESG Survey Page 3 Page 5

2022 Global ESG Survey Page 3 Page 5