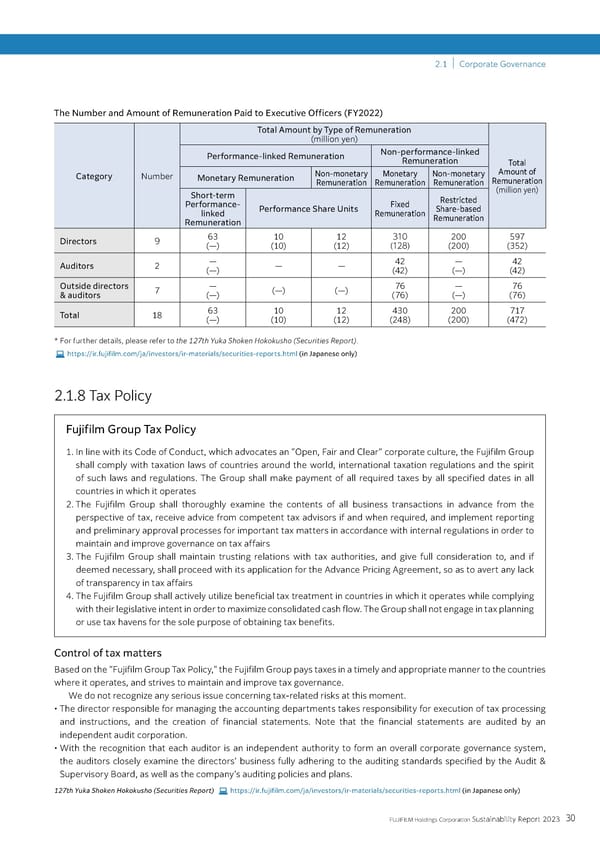

2.1 | Corporate Governance The Number and Amount of Remuneration Paid to Executive Officers (FY2022) Total Amount by Type of Remuneration (million yen) Performance-linked Remuneration Non-performance-linked Remuneration Total Category Number Monetary Remuneration Non-monetary Monetary Non-monetary Amount of Remuneration Remuneration Remuneration Remuneration Short-term (million yen) Performance- Fixed Restricted linked Performance Share Units Remuneration Share-based Remuneration Remuneration 63 10 12 200 597 Directors 310 9 (—) (10) (12) (200) (352) (128) Auditors 2 — — — 42 — 42 (—) (42) (—) (42) Outside directors 7 — (—) (—) 76 — 76 & auditors (—) (76) (—) (76) Total 18 63 10 12 430 200 717 (—) (10) (12) (248) (200) (472) * For further details, please refer to the 127th Yuka Shoken Hokokusho (Securities Report). https://ir.fujifilm.com/ja/investors/ir-materials/securities-reports.html (in Japanese only) 2.1.8 Tax Policy Fujifilm Group Tax Policy 1. In line with its Code of Conduct, which advocates an “Open, Fair and Clear” corporate culture, the Fujifilm Group shall comply with taxation laws of countries around the world, international taxation regulations and the spirit of such laws and regulations. The Group shall make payment of all required taxes by all specified dates in all countries in which it operates 2. The Fujifilm Group shall thoroughly examine the contents of all business transactions in advance from the perspective of tax, receive advice from competent tax advisors if and when required, and implement reporting and preliminary approval processes for important tax matters in accordance with internal regulations in order to maintain and improve governance on tax affairs 3. The Fujifilm Group shall maintain trusting relations with tax authorities, and give full consideration to, and if deemed necessary, shall proceed with its application for the Advance Pricing Agreement, so as to avert any lack of transparency in tax affairs 4. The Fujifilm Group shall actively utilize beneficial tax treatment in countries in which it operates while complying with their legislative intent in order to maximize consolidated cash flow. The Group shall not engage in tax planning or use tax havens for the sole purpose of obtaining tax benefits. Control of tax matters Based on the “Fujifilm Group Tax Policy,” the Fujifilm Group pays taxes in a timely and appropriate manner to the countries where it operates, and strives to maintain and improve tax governance. We do not recognize any serious issue concerning tax-related risks at this moment. • The director responsible for managing the accounting departments takes responsibility for execution of tax processing and instructions, and the creation of financial statements. Note that the financial statements are audited by an independent audit corporation. • With the recognition that each auditor is an independent authority to form an overall corporate governance system, the auditors closely examine the directors’ business fully adhering to the auditing standards specified by the Audit & Supervisory Board, as well as the company’s auditing policies and plans. 127th Yuka Shoken Hokokusho (Securities Report) https://ir.fujifilm.com/ja/investors/ir-materials/securities-reports.html (in Japanese only) 30 FUJIFILM Holdings Corporation Sustainability Report 2023

2023 | Sustainability Report Page 30 Page 32

2023 | Sustainability Report Page 30 Page 32