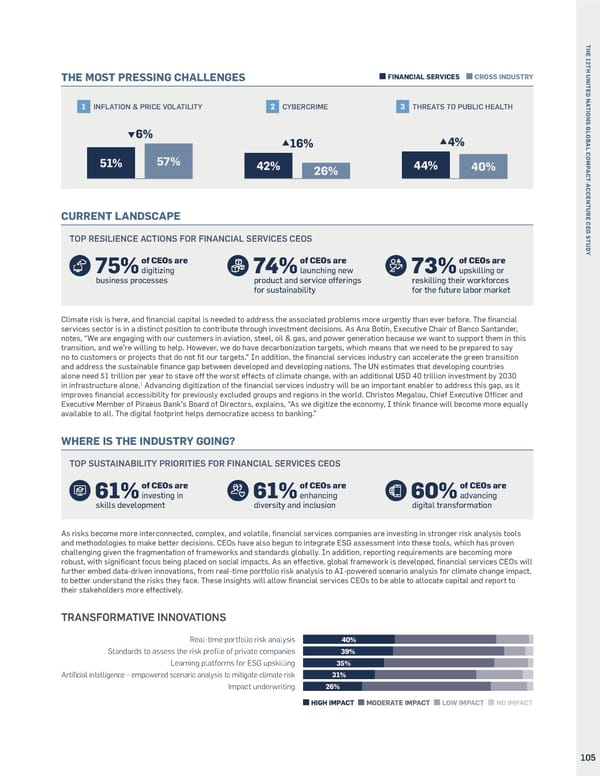

T H E 1 2 T H U THE MOST PRESSING CHALLENGES FINANCIAL SERVICES CROSS INDUSTRY N I T E D N A 1 INFLATION & PRICE VOLATILITY 2 CYBERCRIME 3 THREATS TO PUBLIC HEALTH T I O N S G SE L 6% O B 4% A 16% L C O 57% M 51% P 42% 44% 40% A 26% C CEOs in the financial services T - A C sector are in a unique position to C E N drive sustainability action, as they T U R have the power and capital to fuel CURRENT LANDSCAPE E C R E progress on global sustainability O S TOP RESILIENCE ACTIONS FOR FINANCIAL SERVICES CEOS T U goals, which are often hindered D by a lack of access to finance. Y of CEOs are of CEOs are of CEOs are digitizing launching new upskilling or While significant progress has L75% 74% 73% been made in deploying capital for Vbusiness processes product and service offerings reskilling their workforces for sustainability for the future labor market sustainability progress, it is not uniform and is largely yet to reach Climate risk is here, and financial capital is needed to address the associated problems more urgently than ever before. The financial the Global South.AIservices sector is in a distinct position to contribute through investment decisions. As Ana Botín, Executive Chair of Banco Santander, notes, “We are engaging with our customers in aviation, steel, oil & gas, and power generation because we want to support them in this transition, and we’re willing to help. However, we do have decarbonization targets, which means that we need to be prepared to say ICE no to customers or projects that do not fit our targets.” In addition, the financial services industry can accelerate the green transition and address the sustainable finance gap between developed and developing nations. The UN estimates that developing countries alone need $1 trillion per year to stave off the worst effects of climate change, with an additional USD 40 trillion investment by 2030 1 in infrastructure alone. Advancing digitization of the financial services industry will be an important enabler to address this gap, as it C improves financial accessibility for previously excluded groups and regions in the world. Christos Megalou, Chief Executive Officer and Executive Member of Piraeus Bank’s Board of Directors, explains, “As we digitize the economy, I think finance will become more equally available to all. The digital footprint helps democratize access to banking.” WHERE IS THE INDUSTRY GOING? “We are entering a new era where NSTOP SUSTAINABILITY PRIORITIES FOR FINANCIAL SERVICES CEOS the S side of ESG is on the rise. Investors and regulators are accelerating their demands on of CEOs are of CEOs are of CEOs are investing in enhancing advancing 61% 61% 60% reporting and disclosures on both skills development diversity and inclusion digital transformation climate change and social impact. A Investors’ consciousness has been raised, and now the reporting and As risks become more interconnected, complex, and volatile, financial services companies are investing in stronger risk analysis tools disclosure bar is being raised.”and methodologies to make better decisions. CEOs have also begun to integrate ESG assessment into these tools, which has proven challenging given the fragmentation of frameworks and standards globally. In addition, reporting requirements are becoming more Suni Harford, robust, with significant focus being placed on social impacts. As an effective, global framework is developed, financial services CEOs will President Asset Management and further embed data-driven innovations, from real-time portfolio risk analysis to AI-powered scenario analysis for climate change impact, to better understand the risks they face. These insights will allow financial services CEOs to be able to allocate capital and report to UBS Group Executive Board Lead for their stakeholders more effectively. Sustainability and Impact TRANSFORMATIVE INNOVATIONS FIN Real-time portfolio risk analysis 40% Standards to assess the risk profile of private companies 39% Learning platforms for ESG upskilling 35% Artificial intelligence – empowered scenario analysis to mitigate climate risk 31% mpact underwriting 26% HIGH IMPACT MODERATE IMPACT LOW IMPACT NO IMPACT 104 105

Accenture CEO Study United Nations Global Compact Page 104 Page 106

Accenture CEO Study United Nations Global Compact Page 104 Page 106