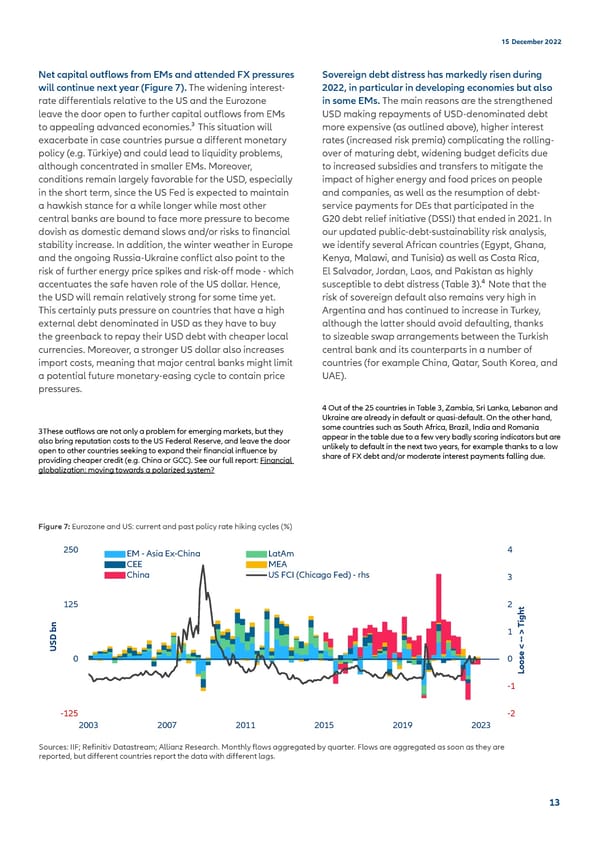

15 December 2022 Net capital outflows from EMs and attended FX pressures Sovereign debt distress has markedly risen during will continue next year (Figure 7). The widening interest- 2022, in particular in developing economies but also rate differentials relative to the US and the Eurozone in some EMs. The main reasons are the strengthened leave the door open to further capital outflows from EMs USD making repayments of USD-denominated debt 1 to appealing advanced economies.³ This situation will more expensive (as outlined above), higher interest exacerbate in case countries pursue a different monetary rates (increased risk premia) complicating the rolling- policy (e.g. Türkiye) and could lead to liquidity problems, over of maturing debt, widening budget deficits due although concentrated in smaller EMs. Moreover, to increased subsidies and transfers to mitigate the conditions remain largely favorable for the USD, especially impact of higher energy and food prices on people in the short term, since the US Fed is expected to maintain and companies, as well as the resumption of debt- a hawkish stance for a while longer while most other service payments for DEs that participated in the central banks are bound to face more pressure to become G20 debt relief initiative (DSSI) that ended in 2021. In dovish as domestic demand slows and/or risks to financial our updated public-debt-sustainability risk analysis, stability increase. In addition, the winter weather in Europe we identify several African countries (Egypt, Ghana, and the ongoing Russia-Ukraine conflict also point to the Kenya, Malawi, and Tunisia) as well as Costa Rica, risk of further energy price spikes and risk-off mode - which El Salvador, Jordan, Laos, and Pakistan as highly accentuates the safe haven role of the US dollar. Hence, susceptible to debt distress (Table 3).⁴2Note that the the USD will remain relatively strong for some time yet. risk of sovereign default also remains very high in This certainly puts pressure on countries that have a high Argentina and has continued to increase in Turkey, external debt denominated in USD as they have to buy although the latter should avoid defaulting, thanks the greenback to repay their USD debt with cheaper local to sizeable swap arrangements between the Turkish currencies. Moreover, a stronger US dollar also increases central bank and its counterparts in a number of import costs, meaning that major central banks might limit countries (for example China, Qatar, South Korea, and a potential future monetary-easing cycle to contain price UAE). pressures. 4 Out of the 25 countries in Table 3, Zambia, Sri Lanka, Lebanon and Ukraine are already in default or quasi-default. On the other hand, 3These outflows are not only a problem for emerging markets, but they some countries such as South Africa, Brazil, India and Romania also bring reputation costs to the US Federal Reserve, and leave the door appear in the table due to a few very badly scoring indicators but are open to other countries seeking to expand their financial influence by unlikely to default in the next two years, for example thanks to a low providing cheaper credit (e.g. China or GCC). See our full report: Financial share of FX debt and/or moderate interest payments falling due. globalization: moving towards a polarized system? Figure 7: Eurozone and US: current and past policy rate hiking cycles (%) 250 EM - Asia Ex-China LatAm 4 CEE MEA China US FCI (Chicago Fed) - rhs 3 125 2 t h g bn i D 1 > T -- S U 0 0 < oose L -1 -125 -2 2003 2007 2011 2015 2019 2023 Sources: IIF; Refinitiv Datastream; Allianz Research. Monthly flows aggregated by quarter. Flows are aggregated as soon as they are reported, but different countries report the data with different lags. 13

Allianz 2022 Outlook final Page 12 Page 14

Allianz 2022 Outlook final Page 12 Page 14