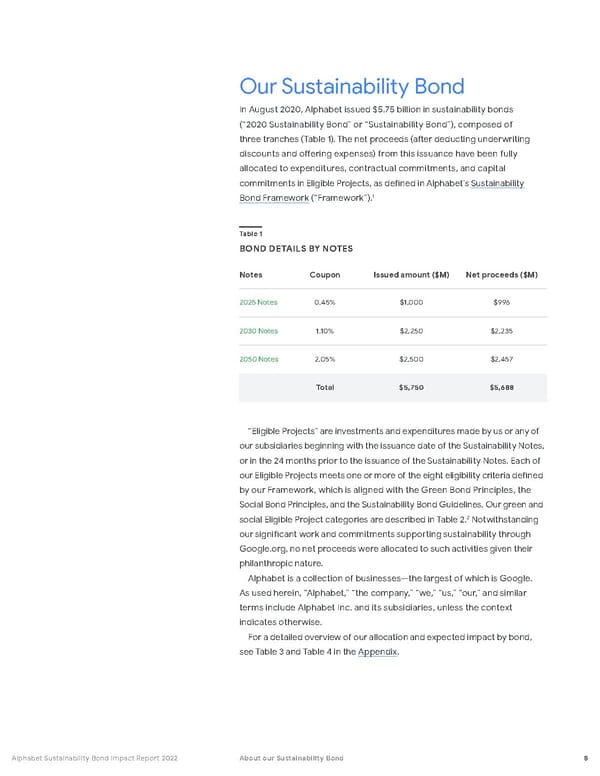

Our Sustainability Bond In August 2020, Alphabet issued $5.75 billion in sustainability bonds (“2020 Sustainability Bond” or “Sustainability Bond”), composed of three tranches (Table 1). The net proceeds (after deducting underwriting discounts and offering expenses) from this issuance have been fully allocated to expenditures, contractual commitments, and capital commitments in Eligible Projects, as defined in Alphabet’s Sustainability Bond Framework (“Framework”). 1 Notes Coupon Issued amount ($M) Net proceeds ($M) 2025 Notes 0.45% $1,000 $996 2030 Notes 1.10% $2,250 $2,235 2050 Notes 2.05% $2,500 $2,457 Tota l $5,750 $5,688 Table 1 BOND DETAILS BY NOTES “Eligible Projects” are investments and expenditures made by us or any of our subsidiaries beginning with the issuance date of the Sustainability Notes, or in the 24 months prior to the issuance of the Sustainability Notes. Each of our Eligible Projects meets one or more of the eight eligibility criteria defined by our Framework, which is aligned with the Green Bond Principles, the Social Bond Principles, and the Sustainability Bond Guidelines. Our green and social Eligible Project categories are described in Table 2. 2 Notwithstanding our significant work and commitments supporting sustainability through Google.org, no net proceeds were allocated to such activities given their philanthropic nature. Alphabet is a collection of businesses—the largest of which is Google. As used herein, “Alphabet,” “the company,” “we,” “us,” “our,” and similar terms include Alphabet Inc. and its subsidiaries, unless the context indicates otherwise. For a detailed overview of our allocation and expected impact by bond, see Table 3 and Table 4 in the Appendix . 8 Alphabet Sustainability Bond Impact Report 2022 About our Sustainability Bond

Alphabet ESG Report Page 8 Page 10

Alphabet ESG Report Page 8 Page 10