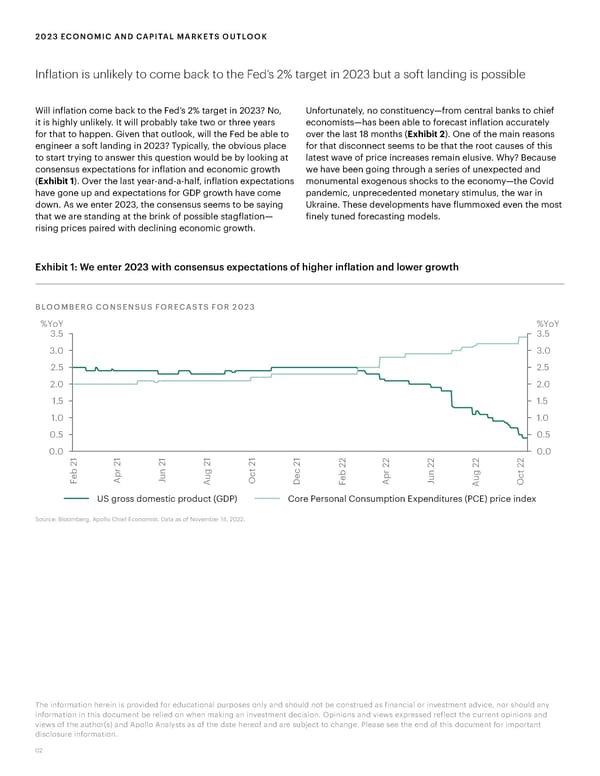

2023 ECONOMIC AND CAPITAL MARKETS OUTLOOK Inflation is unlikely to come back to the Fed’s 2% target in 2023 but a soft landing is possible Will inflation come back to the Fed’s 2% target in 2023? No, Unfortunately, no constituency—from central banks to chief it is highly unlikely. It will probably take two or three years economists—has been able to forecast inflation accurately for that to happen. Given that outlook, will the Fed be able to over the last 18 months (Exhibit 2). One of the main reasons engineer a soft landing in 2023? Typically, the obvious place for that disconnect seems to be that the root causes of this to start trying to answer this question would be by looking at latest wave of price increases remain elusive. Why? Because consensus expectations for inflation and economic growth we have been going through a series of unexpected and (Exhibit 1). Over the last year-and-a-half, inflation expectations monumental exogenous shocks to the economy—the Covid have gone up and expectations for GDP growth have come pandemic, unprecedented monetary stimulus, the war in down. As we enter 2023, the consensus seems to be saying Ukraine. These developments have flummoxed even the most that we are standing at the brink of possible stagflation— finely tuned forecasting models. rising prices paired with declining economic growth. Exhibit 1: We enter 2023 with consensus expectations of higher inflation and lower growth BLOOMBERG CONSENSUS FORECASTS FOR 2023 o o .5 .5 .0 .0 2.5 2.5 2.0 2.0 1.5 1.5 1.0 1.0 0.5 0.5 0.0 1 1 1 1 1 1 2 2 2 2 2 0.0 2 2 2 2 2 2 2 2 2 2 2 r n g t c r n g t e p u u c e e p u u c D US gross domestic product (GDP) Core Personal Consumption Expenditures (PCE) price index Source: Bloomberg, Apollo Chief Economist. Data as of November 14, 2022. The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the author(s) and Apollo Analysts as of the date hereof and are subject to change. Please see the end of this document for important disclosure information. 02

Apollo 2023 Economic and Capital Markets Outlook Page 1 Page 3

Apollo 2023 Economic and Capital Markets Outlook Page 1 Page 3