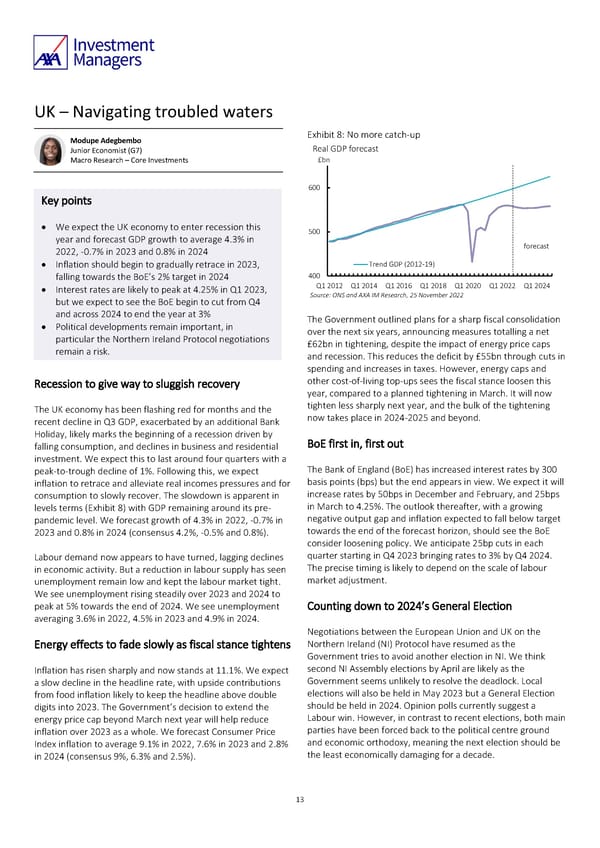

UK – Navigating troubled waters Modupe Adegbembo Exhibit 8: No more catch-up Junior Economist (G7) Real GDP forecast Macro Research – Core Investments £bn 600 Key points • We expect the UK economy to enter recession this 500 year and forecast GDP growth to average 4.3% in forecast 2022, -0.7% in 2023 and 0.8% in 2024 • Inflation should begin to gradually retrace in 2023, Trend GDP (2012-19) falling towards the BoE’s 2% target in 2024 400 • Interest rates are likely to peak at 4.25% in Q1 2023, Q1 2012 Q1 2014 Q1 2016 Q1 2018 Q1 2020 Q1 2022 Q1 2024 but we expect to see the BoE begin to cut from Q4 Source: ONS and AXA IM Research, 25 November 2022 and across 2024 to end the year at 3% • Political developments remain important, in The Government outlined plans for a sharp fiscal consolidation particular the Northern Ireland Protocol negotiations over the next six years, announcing measures totalling a net remain a risk. £62bn in tightening, despite the impact of energy price caps and recession. This reduces the deficit by £55bn through cuts in spending and increases in taxes. However, energy caps and Recession to give way to sluggish recovery other cost-of-living top-ups sees the fiscal stance loosen this year, compared to a planned tightening in March. It will now The UK economy has been flashing red for months and the tighten less sharply next year, and the bulk of the tightening recent decline in Q3 GDP, exacerbated by an additional Bank now takes place in 2024-2025 and beyond. Holiday, likely marks the beginning of a recession driven by falling consumption, and declines in business and residential BoE first in, first out investment. We expect this to last around four quarters with a peak-to-trough decline of 1%. Following this, we expect The Bank of England (BoE) has increased interest rates by 300 inflation to retrace and alleviate real incomes pressures and for basis points (bps) but the end appears in view. We expect it will consumption to slowly recover. The slowdown is apparent in increase rates by 50bps in December and February, and 25bps levels terms (Exhibit 8) with GDP remaining around its pre- in March to 4.25%. The outlook thereafter, with a growing pandemic level. We forecast growth of 4.3% in 2022, -0.7% in negative output gap and inflation expected to fall below target 2023 and 0.8% in 2024 (consensus 4.2%, -0.5% and 0.8%). towards the end of the forecast horizon, should see the BoE consider loosening policy. We anticipate 25bp cuts in each Labour demand now appears to have turned, lagging declines quarter starting in Q4 2023 bringing rates to 3% by Q4 2024. in economic activity. But a reduction in labour supply has seen The precise timing is likely to depend on the scale of labour unemployment remain low and kept the labour market tight. market adjustment. We see unemployment rising steadily over 2023 and 2024 to peak at 5% towards the end of 2024. We see unemployment Counting down to 2024’s General Election averaging 3.6% in 2022, 4.5% in 2023 and 4.9% in 2024. Negotiations between the European Union and UK on the Energy effects to fade slowly as fiscal stance tightens Northern Ireland (NI) Protocol have resumed as the Government tries to avoid another election in NI. We think Inflation has risen sharply and now stands at 11.1%. We expect second NI Assembly elections by April are likely as the a slow decline in the headline rate, with upside contributions Government seems unlikely to resolve the deadlock. Local from food inflation likely to keep the headline above double elections will also be held in May 2023 but a General Election digits into 2023. The Government’s decision to extend the should be held in 2024. Opinion polls currently suggest a energy price cap beyond March next year will help reduce Labour win. However, in contrast to recent elections, both main inflation over 2023 as a whole. We forecast Consumer Price parties have been forced back to the political centre ground Index inflation to average 9.1% in 2022, 7.6% in 2023 and 2.8% and economic orthodoxy, meaning the next election should be in 2024 (consensus 9%, 6.3% and 2.5%). the least economically damaging for a decade. 13

AXA IM Outlook 2023 full report Page 12 Page 14

AXA IM Outlook 2023 full report Page 12 Page 14