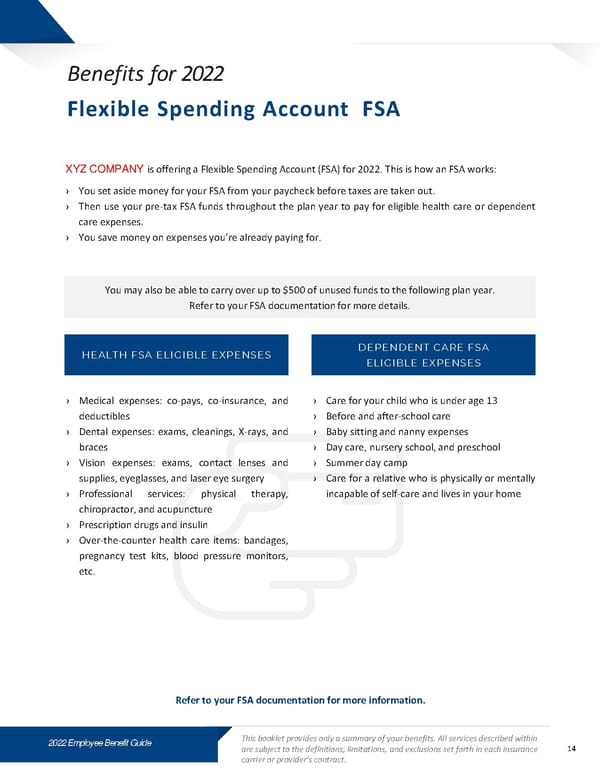

2022 Employee Benefit Guide This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract. Benefits f or 2022 XYZ COMPANY is offering a Flexible Spending Account (FSA) for 2022 . This is how an FSA works : › You set aside money for your FSA from your paycheck before taxes are taken out . › Then use your pre - tax FSA funds throughout the plan year to pay for eligible health care or dependent care expenses . › You save money on expenses you’re already paying for . You may also be able to carry over up to $500 of unused funds to the following plan year. Refer to your FSA documentation for more details. HE A L T H F S A E L I G I B L E E XP E NS E S D E P E ND E NT C A R E F S A E L I G I B L E E XP E NS E S › Medical expenses : co - pays, co - insurance, and deductibles › Dental expenses : exams, cleanings, X - rays, and braces › Vision expenses : exams, contact lenses and supplies, eyeglasses, and laser eye surgery › Professional services : physical therapy, chiropractor, and acupuncture › Prescription drugs and insulin › Over - the - counter health care items : bandages, pregnancy test kits, blood pressure monitors, etc . › Care for your child who is under age 13 › Before and after - school care › Baby sitting and nanny expenses › Day care, nursery school, and preschool › Summer day camp › Care for a relative who is physically or mentally incapable of self - care and lives in your home Refer to your FSA documentation for more information. Flexible Spending Account FSA 14

Benefits Guide - Contemporary Style Template Page 13 Page 15

Benefits Guide - Contemporary Style Template Page 13 Page 15