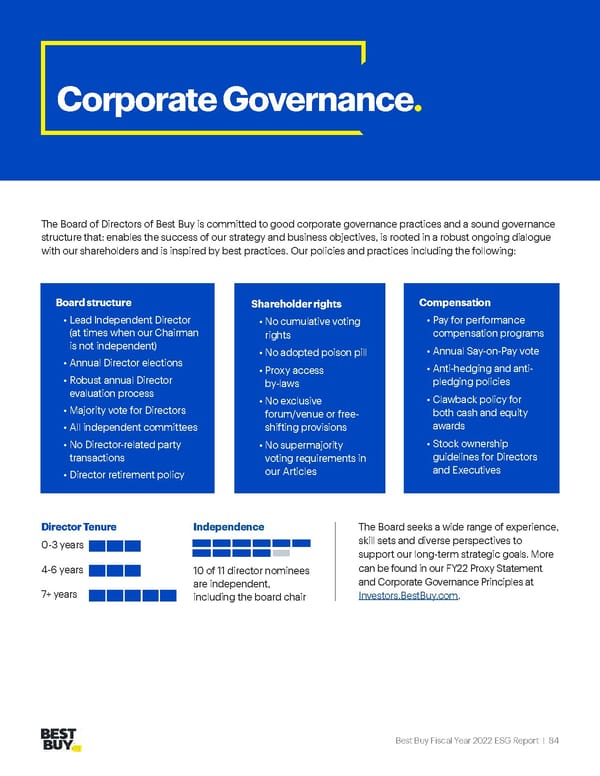

Best Buy Fiscal Year 2022 ESG Report | 84 The Board of Directors of Best Buy is committed to good corporate governance practices and a sound governance structure that: enables the success of our strategy and business objectives, is rooted in a robust ongoing dialogue with our shareholders and is inspired by best practices. Our policies and practices including the following: Board structure • Lead Independent Director (at times when our Chairman is not independent) • Annual Director elections • Robust annual Director evaluation process • Majority vote for Directors • All independent committees • No Director-related party transactions • Director retirement policy Shareholder rights • No cumulative voting rights • No adopted poison pill • Proxy access by-laws • No exclusive forum/venue or free- shifting provisions • No supermajority voting requirements in our Articles Compensation • Pay for performance compensation programs • Annual Say-on-Pay vote • Anti-hedging and anti- pledging policies • Clawback policy for both cash and equity awards • Stock ownership guidelines for Directors and Executives Corporate Governance . The Board seeks a wide range of experience, skill sets and diverse perspectives to support our long-term strategic goals. More can be found in our FY22 Proxy Statement and Corporate Governance Principles at Investors.BestBuy.com . 0-3 years 4-6 years 7+ years Director Tenure Independence 10 of 11 director nominees are independent, including the board chair

Best Buy ESG Report Page 83 Page 85

Best Buy ESG Report Page 83 Page 85