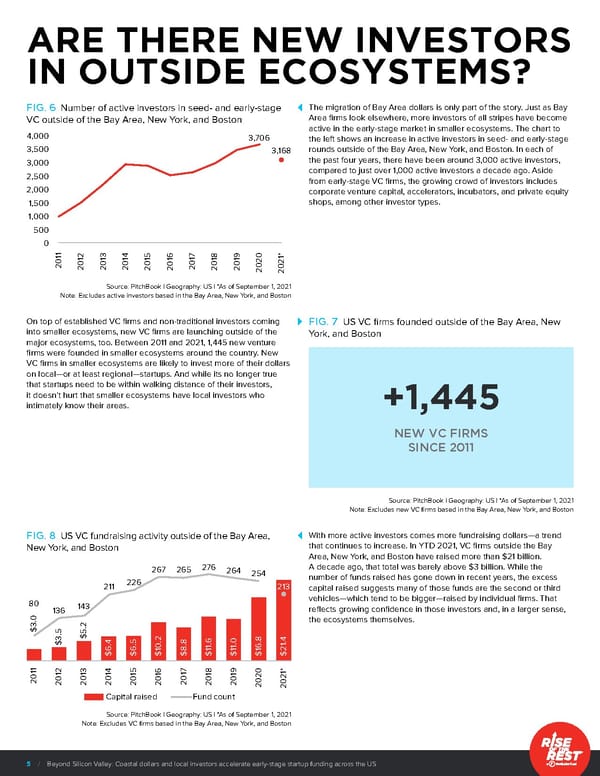

ARE THERE NEW INVESTORS IN OUTSIDE ECOSYSTEMS? FIG. 6 Number of active investors in seed- and early-stage The migration of Bay Area dollars is only part of the story. Just as Bay VC outside of the Bay Area, New York, and Boston Area firms look elsewhere, more investors of all stripes have become active in the early-stage market in smaller ecosystems. The chart to 4,000 3,706 the left shows an increase in active investors in seed- and early-stage 3,500 3,168 rounds outside of the Bay Area, New York, and Boston. In each of 3,000 the past four years, there have been around 3,000 active investors, 2,500 compared to just over 1,000 active investors a decade ago. Aside from early-stage VC firms, the growing crowd of investors includes 2,000 corporate venture capital, accelerators, incubators, and private equity 1,500 shops, among other investor types. 1,000 500 0 1 2 3 4 5 6 7 8 9 * 1 1 1 1 1 1 1 1 1 20 1 20 20 20 20 20 20 20 20 20 20 02 2 Source: PitchBook | Geography: US | *As of September 1, 2021 Note: Excludes active investors based in the Bay Area, New York, and Boston On top of established VC firms and non-traditional investors coming FIG. 7 US VC firms founded outside of the Bay Area, New into smaller ecosystems, new VC firms are launching outside of the York, and Boston major ecosystems, too. Between 2011 and 2021, 1,445 new venture firms were founded in smaller ecosystems around the country. New VC firms in smaller ecosystems are likely to invest more of their dollars on local—or at least regional—startups. And while its no longer true that startups need to be within walking distance of their investors, it doesn’t hurt that smaller ecosystems have local investors who intimately know their areas. +1,445 NEW VC FIRMS SINCE 2011 Source: PitchBook | Geography: US | *As of September 1, 2021 Note: Excludes new VC firms based in the Bay Area, New York, and Boston FIG. 8 US VC fundraising activity outside of the Bay Area, With more active investors comes more fundraising dollars—a trend New York, and Boston that continues to increase. In YTD 2021, VC firms outside the Bay Area, New York, and Boston have raised more than $21 billion. 267 265 276 264 254 A decade ago, that total was barely above $3 billion. While the 226 number of funds raised has gone down in recent years, the excess 211 213 capital raised suggests many of those funds are the second or third 80 vehicles—which tend to be bigger—raised by individual firms. That 136 143 reflects growing confidence in those investors and, in a larger sense, .0 2 the ecosystems themselves. 3 . $ .5 $5 3 2 8 .4 . 8 6 . $ .4 0 . . .0 6 1 6 6.5 1 1 2 $ $ $1 $8 $1 $1 $1 $ 1 2 3 4 5 6 7 8 9 * 1 1 1 1 1 1 1 1 1 20 1 20 20 20 20 20 20 20 20 20 20 02 2 Capital raised Fund count Source: PitchBook | Geography: US | *As of September 1, 2021 Note: Excludes VC firms based in the Bay Area, New York, and Boston 5 / Beyond Silicon Valley: Coastal dollars and local investors accelerate early-stage startup funding across the US

Beyond Silicon Valley | Rise of the Rest Page 4 Page 6

Beyond Silicon Valley | Rise of the Rest Page 4 Page 6