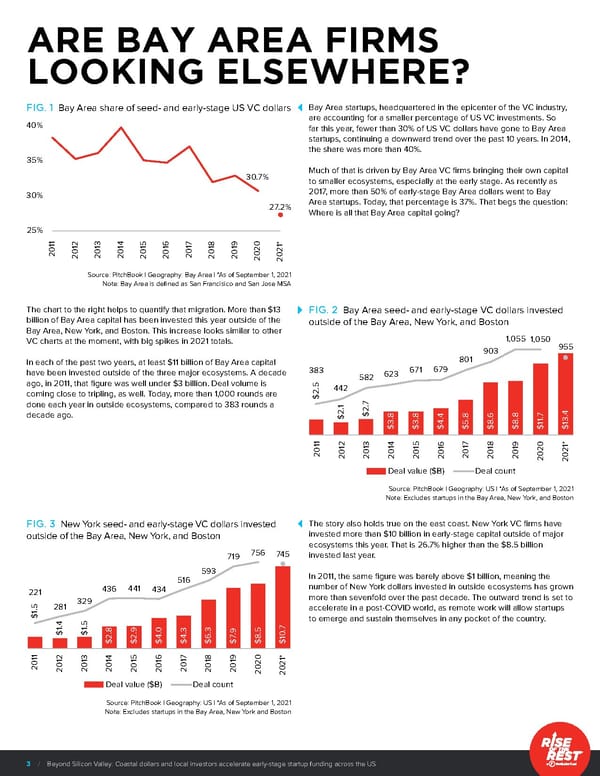

ARE BAY AREA FIRMS LOOKING ELSEWHERE? FIG. 1 Bay Area share of seed- and early-stage US VC dollars Bay Area startups, headquartered in the epicenter of the VC industry, 40% are accounting for a smaller percentage of US VC investments. So far this year, fewer than 30% of US VC dollars have gone to Bay Area startups, continuing a downward trend over the past 10 years. In 2014, the share was more than 40%. 35% 30.7% Much of that is driven by Bay Area VC firms bringing their own capital to smaller ecosystems, especially at the early stage. As recently as 30% 2017, more than 50% of early-stage Bay Area dollars went to Bay 27.2% Area startups. Today, that percentage is 37%. That begs the question: Where is all that Bay Area capital going? 25% 1 2 3 4 5 6 7 8 9 * 1 1 1 1 1 1 1 1 1 20 1 20 20 20 20 20 20 20 20 20 20 02 2 Source: PitchBook | Geography: Bay Area | *As of September 1, 2021 Note: Bay Area is defined as San Francisico and San Jose MSA The chart to the right helps to quantify that migration. More than $13 FIG. 2 Bay Area seed- and early-stage VC dollars invested billion of Bay Area capital has been invested this year outside of the outside of the Bay Area, New York, and Boston Bay Area, New York, and Boston. This increase looks similar to other VC charts at the moment, with big spikes in 2021 totals. 1,055 1,050 903 955 In each of the past two years, at least $11 billion of Bay Area capital 801 have been invested outside of the three major ecosystems. A decade 383 623 671 679 ago, in 2011, that figure was well under $3 billion. Deal volume is 5 582 . 442 coming close to tripling, as well. Today, more than 1,000 rounds are $2 done each year in outside ecosystems, compared to 383 rounds a .1 .7 2 2 4 decade ago. $ 8 .6 8 .7 . $ .4 . . 1 3 3.8 3.8 4 8 1 $ $ $ $5 $ $8 $ $1 1 2 3 4 5 6 7 8 9 * 1 1 1 1 1 1 1 1 1 20 1 20 20 20 20 20 20 20 20 20 20 02 2 Deal value ($B) Deal count Source: PitchBook | Geography: US | *As of September 1, 2021 Note: Excludes startups in the Bay Area, New York, and Boston FIG. 3 New York seed- and early-stage VC dollars invested The story also holds true on the east coast. New York VC firms have outside of the Bay Area, New York, and Boston invested more than $10 billion in early-stage capital outside of major ecosystems this year. That is 26.7% higher than the $8.5 billion 719 756 745 invested last year. 593 In 2011, the same figure was barely above $1 billion, meaning the 516 number of New York dollars invested in outside ecosystems has grown 221 436 441 434 5 329 more than sevenfold over the past decade. The outward trend is set to . 281 accelerate in a post-COVID world, as remote work will allow startups $1 4 5 to emerge and sustain themselves in any pocket of the country. . . 8 9 3 3 9 .7 $1 $1 . . .0 . .5 0 4 4. 7. 8 1 $2 $2 $ $ $6 $ $ $ 1 2 3 4 5 6 7 8 9 * 1 1 1 1 1 1 1 1 1 20 1 20 20 20 20 20 20 20 20 20 20 02 2 Deal value ($B) Deal count Source: PitchBook | Geography: US | *As of September 1, 2021 Note: Excludes startups in the Bay Area, New York and Boston 3 / Beyond Silicon Valley: Coastal dollars and local investors accelerate early-stage startup funding across the US

Beyond Silicon Valley | Rise of the Rest Page 2 Page 4

Beyond Silicon Valley | Rise of the Rest Page 2 Page 4