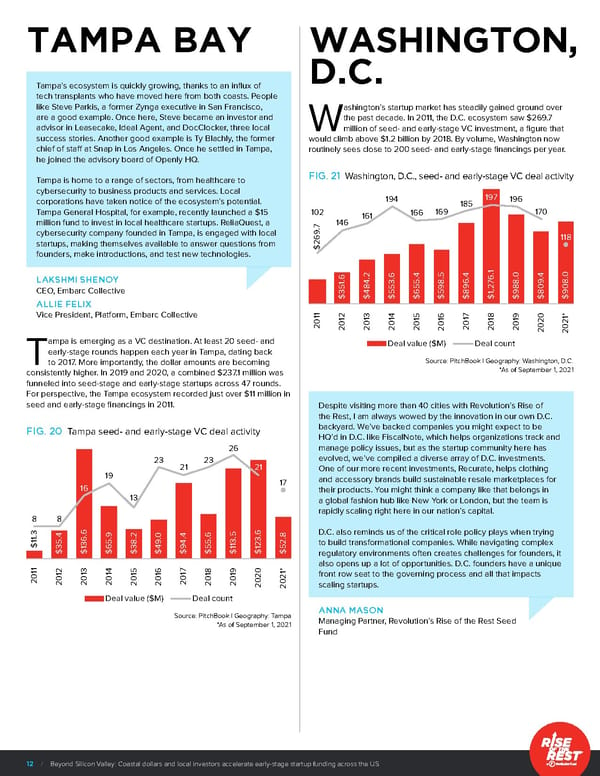

TAMPA BAY WASHINGTON, D.C. Tampa’s ecosystem is quickly growing, thanks to an influx of tech transplants who have moved here from both coasts. People like Steve Parkis, a former Zynga executive in San Francisco, ashington’s startup market has steadily gained ground over are a good example. Once here, Steve became an investor and the past decade. In 2011, the D.C. ecosystem saw $269.7 advisor in Leasecake, Ideal Agent, and DocClocker, three local Wmillion of seed- and early-stage VC investment, a figure that success stories. Another good example is Ty Blachly, the former would climb above $1.2 billion by 2018. By volume, Washington now chief of staff at Snap in Los Angeles. Once he settled in Tampa, routinely sees close to 200 seed- and early-stage financings per year. he joined the advisory board of Openly HQ. Tampa is home to a range of sectors, from healthcare to FIG. 21 Washington, D.C., seed- and early-stage VC deal activity cybersecurity to business products and services. Local 197 corporations have taken notice of the ecosystem’s potential. 194 185 196 Tampa General Hospital, for example, recently launched a $15 102 161 166 169 170 million fund to invest in local healthcare startups. ReliaQuest, a 7 146 cybersecurity company founded in Tampa, is engaged with local 9. 118 6 startups, making themselves available to answer questions from 2 $ founders, make introductions, and test new technologies. 2 4 5 .4 .1 .0 4 .0 6 .6 . 6 LAKSHMI SHENOY . 4. 3 5. 8 6 7 8 9. 8 51 8 5 9 2 8 0 0 CEO, Embarc Collective 3 4 55 59 8 , 9 8 9 1 $ $ $ $6 $ $ $ $ $ $ ALLIE FELIX Vice President, Platform, Embarc Collective 1 2 3 4 5 6 7 8 9 * 1 1 1 1 1 1 1 1 1 20 1 20 20 20 20 20 20 20 20 20 20 02 2 ampa is emerging as a VC destination. At least 20 seed- and Deal value ($M) Deal count early-stage rounds happen each year in Tampa, dating back Tto 2017. More importantly, the dollar amounts are becoming Source: PitchBook | Geography: Washington, D.C. consistently higher. In 2019 and 2020, a combined $237.1 million was *As of September 1, 2021 funneled into seed-stage and early-stage startups across 47 rounds. For perspective, the Tampa ecosystem recorded just over $11 million in seed and early-stage financings in 2011. Despite visiting more than 40 cities with Revolution’s Rise of the Rest, I am always wowed by the innovation in our own D.C. FIG. 20 Tampa seed- and early-stage VC deal activity backyard. We’ve backed companies you might expect to be HQ’d in D.C. like FiscalNote, which helps organizations track and 26 manage policy issues, but as the startup community here has 23 23 evolved, we’ve compiled a diverse array of D.C. investments. 21 21 One of our more recent investments, Recurate, helps clothing 19 17 and accessory brands build sustainable resale marketplaces for 16 their products. You might think a company like that belongs in 13 a global fashion hub like New York or London, but the team is rapidly scaling right here in our nation’s capital. 8 8 3 6 6 D.C. also reminds us of the critical role policy plays when trying . 9 2 .6 .5 . 8 1 .4 6. .0 .4 3 . $1 5 5. 8. 9 4 13 2 to build transformational companies. While navigating complex 3 13 3 4 9 55 1 52 $ $ $6 $ $ $ $ $ $1 $ regulatory environments often creates challenges for founders, it 1 2 3 4 5 6 7 8 9 * also opens up a lot of opportunities. D.C. founders have a unique 1 1 1 1 1 1 1 1 1 20 1 front row seat to the governing process and all that impacts 20 20 20 20 20 20 20 20 20 20 02 scaling startups. 2 Deal value ($M) Deal count Source: PitchBook | Geography: Tampa ANNA MASON *As of September 1, 2021 Managing Partner, Revolution’s Rise of the Rest Seed Fund 12 / Beyond Silicon Valley: Coastal dollars and local investors accelerate early-stage startup funding across the US

Beyond Silicon Valley | Rise of the Rest Page 11 Page 13

Beyond Silicon Valley | Rise of the Rest Page 11 Page 13