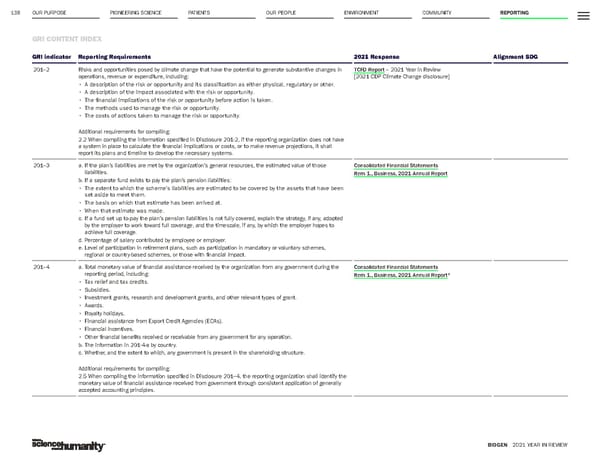

OUR PURPOSE PIONEERING SCIENCE 138 GRI CONTENT INDEX BIOGEN 2021 YEAR IN REVIEW PATIENTS OUR PEOPLE ENVIRONMENT COMMUNITY REPORTING GRI indicator Reporting Requirements 2021 Response Alignment SDG 201–2 Risks and opportunities posed by climate change that have the potential to generate substantive changes in operations, revenue or expenditure, including: • A description of the risk or opportunity and its classification as either physical, regulatory or other. • A description of the impact associated with the risk or opportunity. • The financial implications of the risk or opportunity before action is taken. • The methods used to manage the risk or opportunity. • The costs of actions taken to manage the risk or opportunity. Additional requirements for compiling: 2.2 When compiling the information specified in Disclosure 201-2, if the reporting organization does not have a system in place to calculate the financial implications or costs, or to make revenue projections, it shall report its plans and timeline to develop the necessary systems. TCFD Report – 2021 Year in Review [2021 CDP Climate Change disclosure] 201–3 a. If the plan’s liabilities are met by the organization’s general resources, the estimated value of those liabilities. b. If a separate fund exists to pay the plan’s pension liabilities: • The extent to which the scheme’s liabilities are estimated to be covered by the assets that have been set aside to meet them. • The basis on which that estimate has been arrived at. • When that estimate was made. c. If a fund set up to pay the plan’s pension liabilities is not fully covered, explain the strategy, if any, adopted by the employer to work toward full coverage, and the timescale, if any, by which the employer hopes to achieve full coverage. d. Percentage of salary contributed by employee or employer. e. Level of participation in retirement plans, such as participation in mandatory or voluntary schemes, regional or country-based schemes, or those with financial impact. Consolidated Financial Statements Item 1., Business, 2021 Annual Report 201–4 a. Total monetary value of financial assistance received by the organization from any government during the reporting period, including: • Tax relief and tax credits. • Subsidies. • Investment grants, research and development grants, and other relevant types of grant. • Awards. • Royalty holidays. • Financial assistance from Export Credit Agencies (ECAs). • Financial incentives. • Other financial benefits received or receivable from any government for any operation. b. The information in 201-4-a by country. c. Whether, and the extent to which, any government is present in the shareholding structure. Additional requirements for compiling: 2.5 When compiling the information specified in Disclosure 201–4, the reporting organization shall identify the monetary value of financial assistance received from government through consistent application of generally accepted accounting principles. Consolidated Financial Statements Item 1., Business, 2021 Annual Report *

Biogen Year In Review Page 137 Page 139

Biogen Year In Review Page 137 Page 139