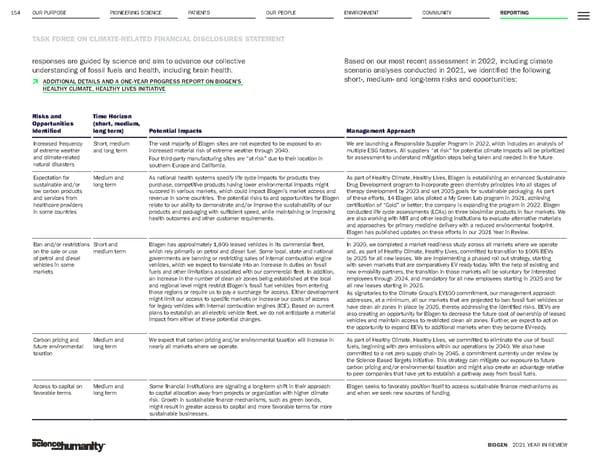

OUR PURPOSE PIONEERING SCIENCE 154 TASK FORCE ON CLIMATE-RELATED FINANCIAL DISCLOSURES STATEMENT BIOGEN 2021 YEAR IN REVIEW PATIENTS OUR PEOPLE ENVIRONMENT COMMUNITY REPORTING Risks and Opportunities Identified Time Horizon (short, medium, long term) Potential Impacts Management Approach Increased frequency of extreme weather and climate-related natural disasters Short, medium and long term The vast majority of Biogen sites are not expected to be exposed to an increased material risk of extreme weather through 2040. Four third-party manufacturing sites are “at risk” due to their location in southern Europe and California. We are launching a Responsible Supplier Program in 2022, which includes an analysis of multiple ESG factors. All suppliers “at risk” for potential climate impacts will be prioritized for assessment to understand mitigation steps being taken and needed in the future. Expectation for sustainable and/or low carbon products and services from healthcare providers in some countries Medium and long term As national health systems specify life cycle impacts for products they purchase, competitive products having lower environmental impacts might succeed in various markets, which could impact Biogen’s market access and revenue in some countries. The potential risks to and opportunities for Biogen relate to our ability to demonstrate and/or improve the sustainability of our products and packaging with sufficient speed, while maintaining or improving health outcomes and other customer requirements. As part of Healthy Climate, Healthy Lives, Biogen is establishing an enhanced Sustainable Drug Development program to incorporate green chemistry principles into all stages of therapy development by 2023 and set 2025 goals for sustainable packaging. As part of these efforts, 14 Biogen labs piloted a My Green Lab program in 2021, achieving certification of “Gold” or better; the company is expanding the program in 2022. Biogen conducted life cycle assessments (LCAs) on three biosimilar products in four markets. We are also working with MIT and other leading institutions to evaluate alternative materials and approaches for primary medicine delivery with a reduced environmental footprint. Biogen has published updates on these efforts in our 2021 Year in Review. Ban and/or restrictions on the sale or use of petrol and diesel vehicles in some markets Short and medium term Biogen has approximately 1,800 leased vehicles in its commercial fleet, which rely primarily on petrol and diesel fuel. Some local, state and national governments are banning or restricting sales of internal combustion engine vehicles, which we expect to translate into an increase in duties on fossil fuels and other limitations associated with our commercial fleet. In addition, an increase in the number of clean air zones being established at the local and regional level might restrict Biogen’s fossil fuel vehicles from entering those regions or require us to pay a surcharge for access. Either development might limit our access to specific markets or increase our costs of access for legacy vehicles with internal combustion engines (ICE). Based on current plans to establish an all-electric vehicle fleet, we do not anticipate a material impact from either of these potential changes. In 2020, we completed a market readiness study across all markets where we operate and, as part of Healthy Climate, Healthy Lives, committed to transition to 100% BEVs by 2025 for all new leases. We are implementing a phased roll out strategy, starting with seven markets that are comparatively EV ready today. With the help of existing and new e-mobility partners, the transition in those markets will be voluntary for interested employees through 2024, and mandatory for all new employees starting in 2025 and for all new leases starting in 2025. As signatories to the Climate Group’s EV100 commitment, our management approach addresses, at a minimum, all our markets that are projected to ban fossil fuel vehicles or have clean air zones in place by 2025, thereby addressing the identified risks. BEVs are also creating an opportunity for Biogen to decrease the future cost of ownership of leased vehicles and maintain access to restricted clean air zones. Further, we expect to act on the opportunity to expand BEVs to additional markets when they become EV-ready. Carbon pricing and future environmental taxation Medium and long term We expect that carbon pricing and/or environmental taxation will increase in nearly all markets where we operate. As part of Healthy Climate, Healthy Lives, we committed to eliminate the use of fossil fuels, beginning with zero emissions within our operations by 2040. We also have committed to a net zero supply chain by 2045, a commitment currently under review by the Science Based Targets initiative. This strategy can mitigate our exposure to future carbon pricing and/or environmental taxation and might also create an advantage relative to peer companies that have yet to establish a pathway away from fossil fuels. Access to capital on favorable terms Medium and long term Some financial institutions are signaling a long-term shift in their approach to capital allocation away from projects or organization with higher climate risk. Growth in sustainable finance mechanisms, such as green bonds, might result in greater access to capital and more favorable terms for more sustainable businesses. Biogen seeks to favorably position itself to access sustainable finance mechanisms as and when we seek new sources of funding. Based on our most recent assessment in 2022, including climate scenario analyses conducted in 2021, we identified the following short-, medium- and long-term risks and opportunities: responses are guided by science and aim to advance our collective understanding of fossil fuels and health, including brain health. Þ ADDITIONAL DETAILS AND A ONE-YEAR PROGRESS REPORT ON BIOGEN’S HEALTHY CLIMATE, HEALTHY LIVES INITIATIVE

Biogen Year In Review Page 153 Page 155

Biogen Year In Review Page 153 Page 155