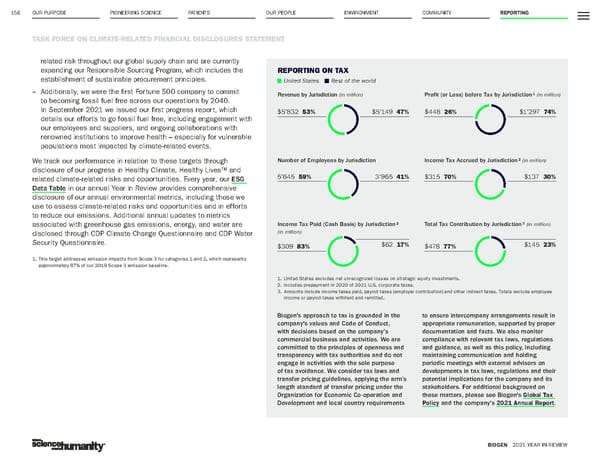

OUR PURPOSE PIONEERING SCIENCE 156 TASK FORCE ON CLIMATE-RELATED FINANCIAL DISCLOSURES STATEMENT BIOGEN 2021 YEAR IN REVIEW PATIENTS OUR PEOPLE ENVIRONMENT COMMUNITY REPORTING related risk throughout our global supply chain and are currently expanding our Responsible Sourcing Program, which includes the establishment of sustainable procurement principles. – Additionally, we were the first Fortune 500 company to commit to becoming fossil fuel free across our operations by 2040. In September 2021 we issued our first progress report, which details our efforts to go fossil fuel free, including engagement with our employees and suppliers, and ongoing collaborations with renowned institutions to improve health – especially for vulnerable populations most impacted by climate-related events. We track our performance in relation to these targets through disclosure of our progress in Healthy Climate, Healthy Lives™ and related climate-related risks and opportunities. Every year, our ESG Data Table in our annual Year in Review provides comprehensive disclosure of our annual environmental metrics, including those we use to assess climate-related risks and opportunities and in efforts to reduce our emissions. Additional annual updates to metrics associated with greenhouse gas emissions, energy, and water are disclosed through CDP Climate Change Questionnaire and CDP Water Security Questionnaire. 1. This target addresses emission impacts from Scope 3 for categories 1 and 2, which represents approximately 87% of our 2019 Scope 3 emission baseline. REPORTING ON TAX $5'149 47% $1'297 74% 3'965 41% $137 30% $62 17% $145 23% $5'832 53% $448 26% 5'645 59% $315 70% $309 83% $478 77% Revenue by Jurisdiction (in million) Number of Employees by Jurisdiction Income Tax Paid (Cash Basis) by Jurisdiction 2 (in million) Profit (or Loss) before Tax by Jurisdiction 1 (in million) Income Tax Accrued by Jurisdiction 2 (in million) Total Tax Contribution by Jurisdiction 3 (in million) United States Rest of the world 1. United States excludes net unrecognized losses on strategic equity investments. 2. Includes prepayment in 2020 of 2021 U.S. corporate taxes. 3. Amounts include income taxes paid, payroll taxes (employer contribution) and other indirect taxes. Totals exclude employee income or payroll taxes withheld and remitted. Biogen's approach to tax is grounded in the company's values and Code of Conduct, with decisions based on the company's commercial business and activities. We are committed to the principles of openness and transparency with tax authorities and do not engage in activities with the sole purpose of tax avoidance. We consider tax laws and transfer pricing guidelines, applying the arm’s length standard of transfer pricing under the Organization for Economic Co-operation and Development and local country requirements to ensure intercompany arrangements result in appropriate remuneration, supported by proper documentation and facts. We also monitor compliance with relevant tax laws, regulations and guidance, as well as this policy, including maintaining communication and holding periodic meetings with external advisors on developments in tax laws, regulations and their potential implications for the company and its stakeholders. For additional background on these matters, please see Biogen's Global Tax Policy and the company's 2021 Annual Report .

Biogen Year In Review Page 155 Page 157

Biogen Year In Review Page 155 Page 157