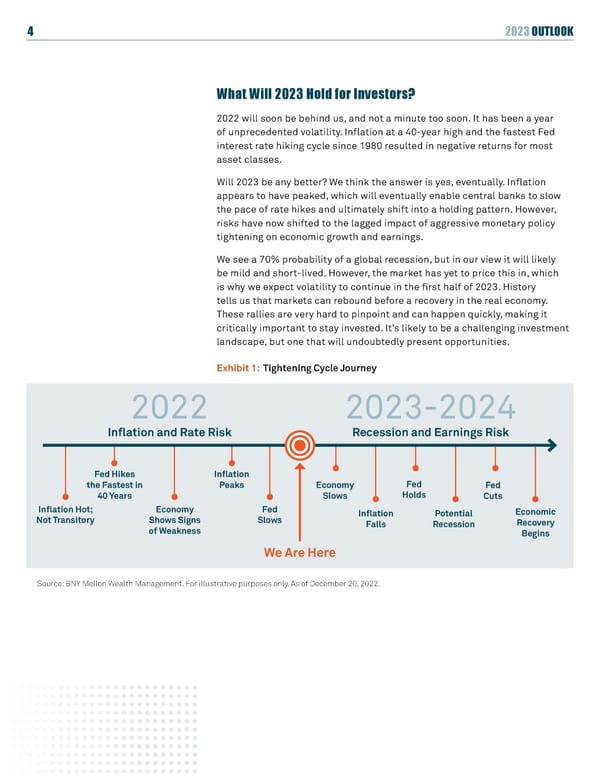

4 2023 OUTLOOK What Will 2023 Hold for Investors? 2022 will soon be behind us, and not a minute too soon. It has been a year of unprecedented volatility. Inflation at a 40-year high and the fastest Fed interest rate hiking cycle since 1980 resulted in negative returns for most asset classes. Will 2023 be any better? We think the answer is yes, eventually. Inflation appears to have peaked, which will eventually enable central banks to slow the pace of rate hikes and ultimately shift into a holding pattern. However, risks have now shifted to the lagged impact of aggressive monetary policy tightening on economic growth and earnings. We see a 70% probability of a global recession, but in our view it will likely be mild and short-lived. However, the market has yet to price this in, which is why we expect volatility to continue in the first half of 2023. History tells us that markets can rebound before a recovery in the real economy. These rallies are very hard to pinpoint and can happen quickly, making it critically important to stay invested. It’s likely to be a challenging investment landscape, but one that will undoubtedly present opportunities. Exhibit 1: Tightening Cycle Journey 2022 2023-2024 Inflation and Rate Risk Recession and Earnings Risk Fed Hikes Inflation the Fastest in Peaks Economy Fed Fed 40 Years Slows Holds Cuts Inflation Hot; Economy Fed Inflation Potential Economic Not Transitory Shows Signs Slows Falls Recession Recovery of Weakness Begins We Are Here Source: BNY Mellon Wealth Management. For illustrative purposes only. As of December 20, 2022.

BNY Mellon 2023 Outlook Page 3 Page 5

BNY Mellon 2023 Outlook Page 3 Page 5