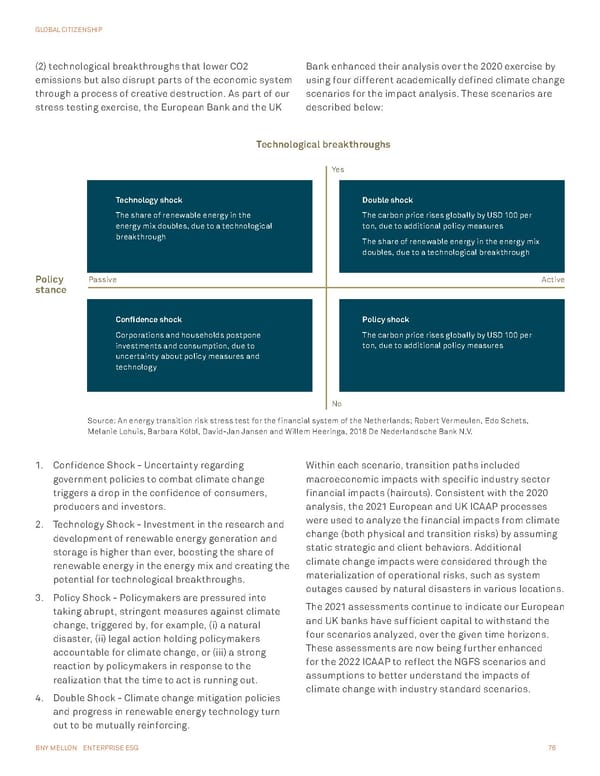

BNY MELLON ENTERPRISE ESG 76 GLOBAL CITIZENSHIP 1. Confidence Shock - Uncertainty regarding government policies to combat climate change triggers a drop in the confidence of consumers, producers and investors. 2. Technology Shock - Investment in the research and development of renewable energy generation and storage is higher than ever, boosting the share of renewable energy in the energy mix and creating the potential for technological breakthroughs. 3. Policy Shock - Policymakers are pressured into taking abrupt, stringent measures against climate change, triggered by, for example, (i) a natural disaster, (ii) legal action holding policymakers accountable for climate change, or (iii) a strong reaction by policymakers in response to the realization that the time to act is running out. 4. Double Shock - Climate change mitigation policies and progress in renewable energy technology turn out to be mutually reinforcing. Within each scenario, transition paths included macroeconomic impacts with specific industry sector financial impacts (haircuts). Consistent with the 2020 analysis, the 2021 European and UK ICAAP processes were used to analyze the financial impacts from climate change (both physical and transition risks) by assuming static strategic and client behaviors. Additional climate change impacts were considered through the materialization of operational risks, such as system outages caused by natural disasters in various locations. The 2021 assessments continue to indicate our European and UK banks have sufficient capital to withstand the four scenarios analyzed, over the given time horizons. These assessments are now being further enhanced for the 2022 ICAAP to reflect the NGFS scenarios and assumptions to better understand the impacts of climate change with industry standard scenarios. (2) technological breakthroughs that lower CO2 emissions but also disrupt parts of the economic system through a process of creative destruction. As part of our stress testing exercise, the European Bank and the UK Bank enhanced their analysis over the 2020 exercise by using four different academically defined climate change scenarios for the impact analysis. These scenarios are described below: Passive Yes No Active Technological breakthroughs Policy stance Technology shock The share of renewable energy in the energy mix doubles, due to a technological breakthrough Confidence shock Corporations and households postpone investments and consumption, due to uncertainty about policy measures and technology Double shock The carbon price rises globally by USD 100 per ton, due to additional policy measures The share of renewable energy in the energy mix doubles, due to a technological breakthrough Policy shock The carbon price rises globally by USD 100 per ton, due to additional policy measures Source: An energy transition risk stress test for the financial system of the Netherlands; Robert Vermeulen, Edo Schets, Melanie Lohuis, Barbara Kölbl, David-Jan Jansen and Willem Heeringa, 2018 De Nederlandsche Bank N.V.

BNY Mellon ESG Report Page 75 Page 77

BNY Mellon ESG Report Page 75 Page 77