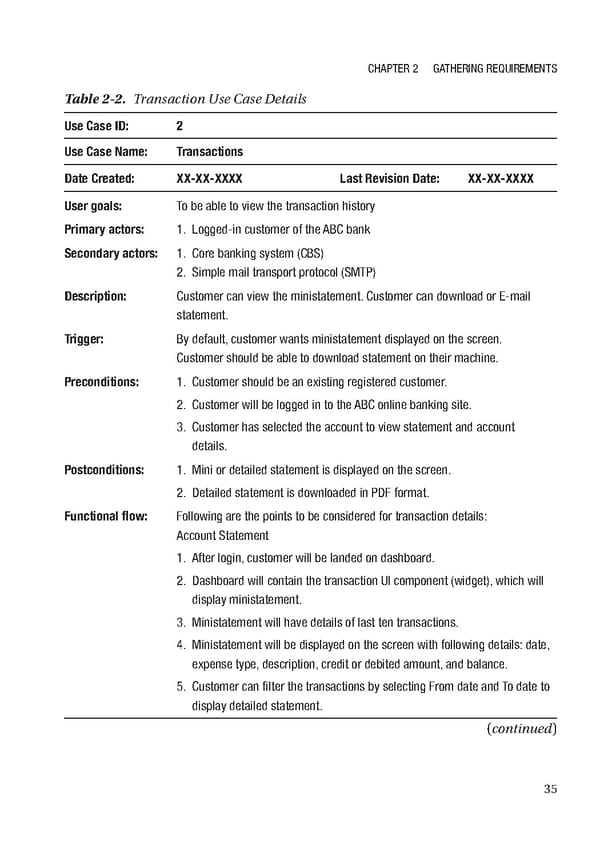

Chapter 2 GatherinG requirements Table 2-2. Transaction Use Case Details Use Case ID: 2 Use Case Name: Transactions Date Created: XX-XX-XXXX Last Revision Date: XX-XX- XXXX User goals: to be able to view the transaction history Primary actors: 1. Logged-in customer of the aBC bank Secondary actors: 1. Core banking system (CBs) 2. simple mail transport protocol (smtp) Description: Customer can view the ministatement. Customer can download or e-mail statement. Trigger: By default, customer wants ministatement displayed on the screen. Customer should be able to download statement on their machine. Preconditions: 1. Customer should be an existing registered customer. 2. Customer will be logged in to the aBC online banking site. 3. Customer has selected the account to view statement and account details. Postconditions: 1. mini or detailed statement is displayed on the screen. 2. Detailed statement is downloaded in pDF format. Functional flow: Following are the points to be considered for transaction details: account statement 1. after login, customer will be landed on dashboard. 2. Dashboard will contain the transaction ui component (widget), which will display ministatement. 3. ministatement will have details of last ten transactions. 4. ministatement will be displayed on the screen with following details: date, expense type, description, credit or debited amount, and balance. 5. Customer can filter the transactions by selecting From date and to date to display detailed statement. (continued) 35

Building Digital Experience Platforms Page 55 Page 57

Building Digital Experience Platforms Page 55 Page 57