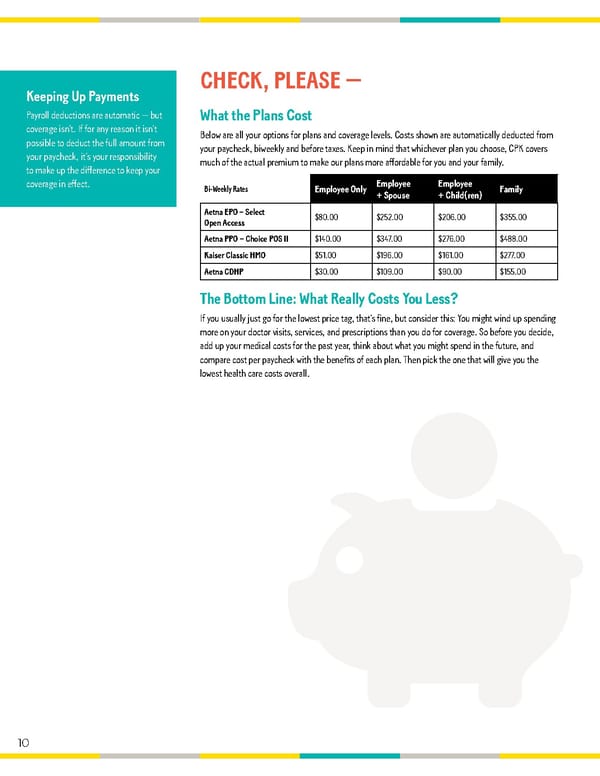

CHECK, PLEASE — Keeping Up Payments Payroll deductions are automatic — but What the Plans Cost coverage isn’t. If for any reason it isn’t Below are all your options for plans and coverage levels. Costs shown are automatically deducted from possible to deduct the full amount from your paycheck, biweekly and before taxes. Keep in mind that whichever plan you choose, CPK covers your paycheck, it’s your responsibility much of the actual premium to make our plans more affordable for you and your family. to make up the difference to keep your coverage in effect. Bi-Weekly Rates Employee Only Employee Employee Family + Spouse + Child(ren) Aetna EPO – Select $80.00 $252.00 $206.00 $355.00 Open Access Aetna PPO – Choice POS II $140.00 $347.00 $276.00 $488.00 Kaiser Classic HMO $51.00 $196.00 $161.00 $277.00 Aetna CDHP $30.00 $109.00 $90.00 $155.00 The Bottom Line: What Really Costs You Less? If you usually just go for the lowest price tag, that’s fine, but consider this: You might wind up spending more on your doctor visits, services, and prescriptions than you do for coverage. So before you decide, add up your medical costs for the past year, think about what you might spend in the future, and compare cost per paycheck with the benefits of each plan. Then pick the one that will give you the lowest health care costs overall. 10

California Pizza Kitchen Flipbook Page 9 Page 11

California Pizza Kitchen Flipbook Page 9 Page 11