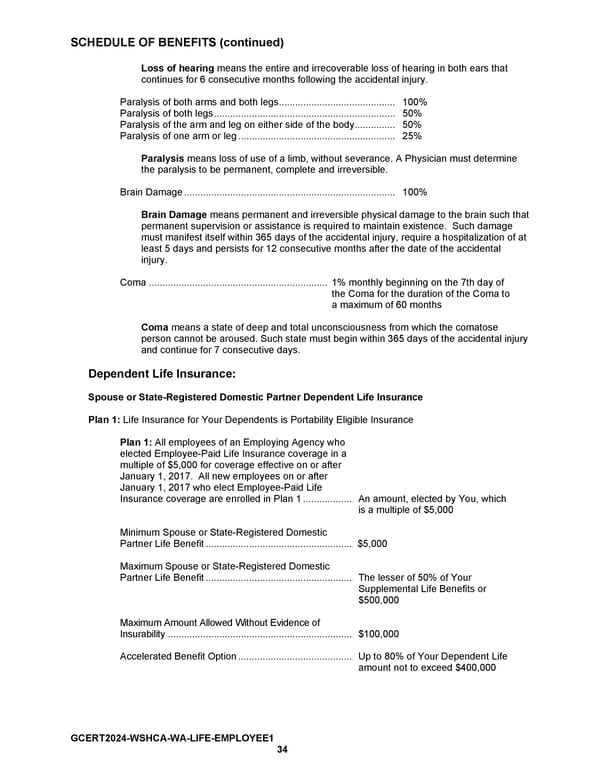

SCHEDULE OF BENEFITS (continued) Loss of hearing means the entire and irrecoverable loss of hearing in both ears that continues for 6 consecutive months following the accidental injury. Paralysis of both arms and both legs ........................................... 100% Paralysis of both legs ................................................................... 50% Paralysis of the arm and leg on either side of the body ............... 50% Paralysis of one arm or leg .......................................................... 25% Paralysis means loss of use of a limb, without severance. A Physician must determine the paralysis to be permanent, complete and irreversible. Brain Damage .............................................................................. 100% Brain Damage means permanent and irreversible physical damage to the brain such that permanent supervision or assistance is required to maintain existence. Such damage must manifest itself within 365 days of the accidental injury, require a hospitalization of at least 5 days and persists for 12 consecutive months after the date of the accidental injury. Coma .................................................................. 1% monthly beginning on the 7th day of the Coma for the duration of the Coma to a maximum of 60 months Coma means a state of deep and total unconsciousness from which the comatose person cannot be aroused. Such state must begin within 365 days of the accidental injury and continue for 7 consecutive days. Dependent Life Insurance: Spouse or State-Registered Domestic Partner Dependent Life Insurance Plan 1: Life Insurance for Your Dependents is Portability Eligible Insurance Plan 1: All employees of an Employing Agency who elected Employee-Paid Life Insurance coverage in a multiple of $5,000 for coverage effective on or after January 1, 2017. All new employees on or after January 1, 2017 who elect Employee-Paid Life Insurance coverage are enrolled in Plan 1 ................... An amount, elected by You, which is a multiple of $5,000 Minimum Spouse or State-Registered Domestic Partner Life Benefit ....................................................... $5,000 Maximum Spouse or State-Registered Domestic Partner Life Benefit ....................................................... The lesser of 50% of Your Supplemental Life Benefits or $500,000 Maximum Amount Allowed Without Evidence of Insurability ..................................................................... $100,000 Accelerated Benefit Option ........................................... Up to 80% of Your Dependent Life amount not to exceed $400,000 GCERT2024-WSHCA-WA-LIFE-EMPLOYEE1 34

Certificate of Coverage Page 35 Page 37

Certificate of Coverage Page 35 Page 37