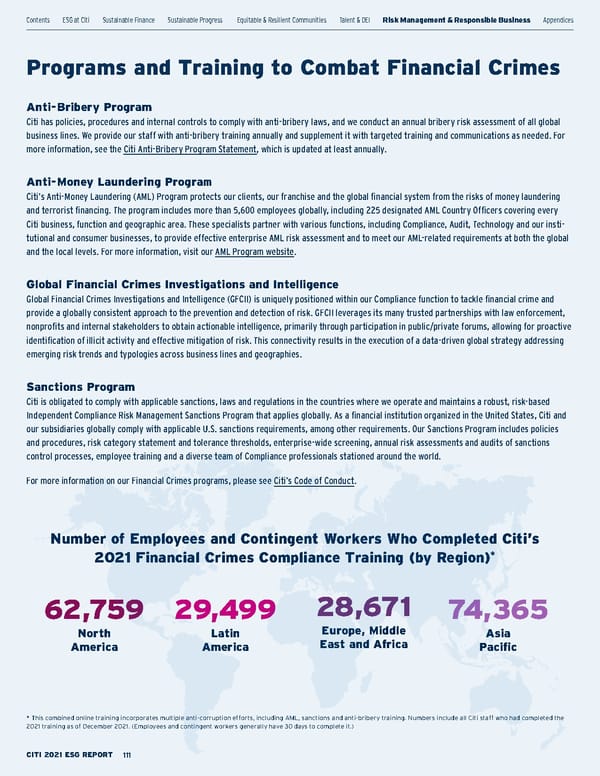

Programs and Training to Combat Financial Crimes Anti-Bribery Program Citi has policies, procedures and internal controls to comply with anti-bribery laws, and we conduct an annual bribery risk assessment of all global business lines. We provide our staff with anti-bribery training annually and supplement it with targeted training and communications as needed. For more information, see the Citi Anti-Bribery Program Statement , which is updated at least annually. Anti-Money Laundering Progra m Citi’s Anti-Money Laundering (AML) Program protects our clients, our franchise and the global financial system from the risks of money laundering and terrorist financing. The program includes more than 5,600 employees globally, including 225 designated AML Country Officers covering every Citi business, function and geographic area. These specialists partner with various functions, including Compliance, Audit, Technology and our insti - tutional and consumer businesses, to provide effective enterprise AML risk assessment and to meet our AML-related requirements at both the global and the local levels. For more information, visit our AML Program website . Global Financial Crimes Investigations and Intelligence Global Financial Crimes Investigations and Intelligence (GFCII) is uniquely positioned within our Compliance function to tackle financial crime and provide a globally consistent approach to the prevention and detection of risk. GFCII leverages its many trusted partnerships with law enforcement, nonprofits and internal stakeholders to obtain actionable intelligence, primarily through participation in public/private forums, allowing for proactive identification of illicit activity and effective mitigation of risk. This connectivity results in the execution of a data-driven global strategy addressing emerging risk trends and typologies across business lines and geographies. Sanctions Program Citi is obligated to comply with applicable sanctions, laws and regulations in the countries where we operate and maintains a robust, risk-based Independent Compliance Risk Management Sanctions Program that applies globally. As a financial institution organized in the United States, Citi and our subsidiaries globally comply with applicable U.S. sanctions requirements, among other requirements. Our Sanctions Program includes policies and procedures, risk category statement and tolerance thresholds, enterprise-wide screening, annual risk assessments and audits of sanctions control processes, employee training and a diverse team of Compliance professionals stationed around the world. For more information on our Financial Crimes programs, please see Citi’s Code of Conduct . Number of Employees and Contingent Workers Who Completed Citi’s 2021 Financial Crimes Compliance Training (by Region) * 62,759 North America 29,499 Latin America 28,671 Europe, Middle East and Africa 74,365 Asia Pacific * This combined online training incorporates multiple anti-corruption efforts, including AML, sanctions and anti-bribery training. Numbers include all Citi staff who had completed the 2021 training as of December 2021. (Employees and contingent workers generally have 30 days to complete it.) Contents ESGatCiti SustainableFinance SustainableProgress Equitable&ResilientCommunities Talent&DEI RiskManagement&ResponsibleBusiness Appendices CITI 2021 ESG REPORT 111

Citi ESG Report Page 110 Page 112

Citi ESG Report Page 110 Page 112