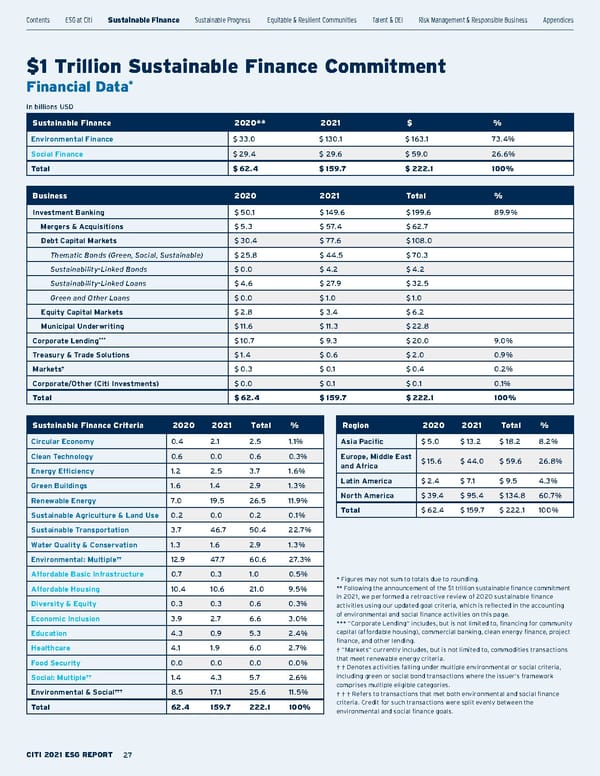

$1 Trillion Sustainable Finance Commitment Financial Data * In billions USD Sustainable Finance 2020** 2021 $ % Environmental Finance $ 33.0 $ 130.1 $ 163.1 73.4% Social Finance $ 29.4 $ 2 9.6 $ 59.0 26.6% Total $ 62.4 $ 159.7 $ 222 .1 100% Sustainable Finance Criteria 2020 2021 Total % Circular Economy 0.4 2.1 2.5 1.1% Clean Technology 0.6 0.0 0.6 0.3% Energy Efficiency 1.2 2.5 3.7 1.6% Green Buildings 1.6 1.4 2.9 1.3% Renewable Energy 7.0 19.5 26.5 11.9% Sustainable Agriculture & Land Use 0.2 0.0 0.2 0.1% Sustainable Transportation 3.7 46.7 50.4 22.7% Water Quality & Conservation 1.3 1.6 2.9 1.3% Environmental: Multiple †† 12.9 47.7 60.6 27.3% Affordable Basic Infrastructure 0.7 0.3 1.0 0.5% Affordable Housing 10.4 10.6 21.0 9.5% Diversity & Equity 0.3 0.3 0.6 0.3% Economic Inclusion 3.9 2.7 6.6 3.0% Education 4.3 0.9 5.3 2.4% Healthcare 4.1 1.9 6.0 2.7% Food Security 0.0 0.0 0.0 0.0% Social: Multiple †† 1.4 4.3 5.7 2.6% Environmental & Social ††† 8.5 17.1 25.6 11.5% Total 62.4 159.7 222.1 100% Region 2020 2021 Total % Asia Pacific $ 5.0 $ 13.2 $ 18.2 8.2% Europe, Middle East and Africa $ 1 5.6 $ 44.0 $ 59.6 26.8% Latin America $ 2.4 $ 7. 1 $ 9.5 4.3% North America $ 39.4 $ 95.4 $ 134.8 60.7% Total $ 62.4 $ 159.7 $ 222 .1 100% Business 2020 2021 Total % Investment Banking $ 50.1 $ 149.6 $ 199.6 89.9% Mergers & Acquisitions $ 5.3 $ 5 7.4 $ 62.7 Debt Capital Markets $ 30.4 $ 77 .6 $ 108.0 Thematic Bonds (Green, Social, Sustainable) $ 25.8 $ 44.5 $ 70.3 Sustainability-Linked Bonds $ 0.0 $ 4.2 $ 4.2 Sustainability-Linked Loans $ 4.6 $ 2 7.9 $ 32.5 Green and Other Loans $ 0.0 $ 1.0 $ 1.0 Equity Capital Markets $ 2.8 $ 3.4 $ 6.2 Municipal Underwriting $ 11.6 $ 11.3 $ 22.8 Corporate Lending *** $ 10.7 $ 9.3 $ 20.0 9.0% Treasury & Trade Solutions $ 1.4 $ 0.6 $ 2.0 0.9% Markets † $ 0.3 $ 0.1 $ 0.4 0.2% Corporate/Other (Citi Investments) $ 0.0 $ 0.1 $ 0.1 0.1% Total $ 62.4 $ 159.7 $ 222 .1 100% * Figures may not sum to totals due to rounding. ** Following the announcement of the $1 trillion sustainable finance commitment in 2021, we performed a retroactive review of 2020 sustainable finance activities using our updated goal criteria, which is reflected in the accounting of environmental and social finance activities on this page. *** “Corporate Lending” includes, but is not limited to, financing for community capital (affordable housing), commercial banking, clean energy finance, project finance, and other lending. † “Markets” currently includes, but is not limited to, commodities transactions that meet renewable energy criteria. † † Denotes activities falling under multiple environmental or social criteria, including green or social bond transactions where the issuer’s framework comprises multiple eligible categories. † † † Refers to transactions that met both environmental and social finance criteria. Credit for such transactions were split evenly between the environmental and social finance goals. Contents ESGatCiti SustainableFinance SustainableProgress Equitable&ResilientCommunities Talent&DEI RiskManagement&ResponsibleBusiness Appendices CITI 2021 ESG REPORT 27

Citi ESG Report Page 26 Page 28

Citi ESG Report Page 26 Page 28