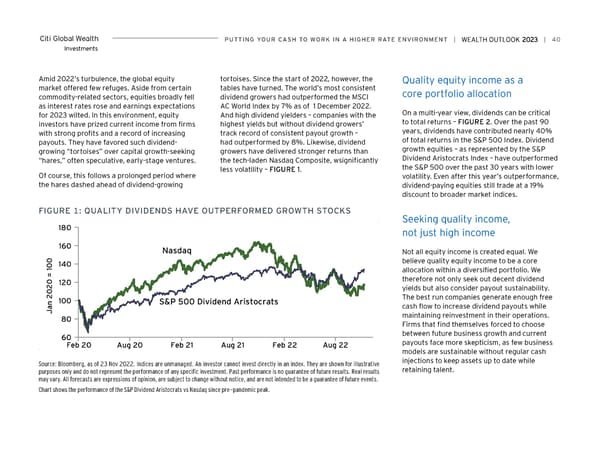

Citi Global Wealth PUTTiNG YoUr CASH To worK iN A HiGHer rATe eNviroNMeNT | | 40 Investments Amid 2022’s turbulence, the global equity tortoises. Since the start of 2022, however, the Quality equity income as a market offered few refuges. Aside from certain tables have turned. The world’s most consistent core portfolio allocation commodity-related sectors, equities broadly fell dividend growers had outperformed the MSCI as interest rates rose and earnings expectations AC World Index by 7% as of 1 December 2022. for 2023 wilted. In this environment, equity And high dividend yielders – companies with the On a multi-year view, dividends can be critical investors have prized current income from firms highest yields but without dividend growers’ to total returns – FIGURE 2. Over the past 90 with strong profits and a record of increasing track record of consistent payout growth – years, dividends have contributed nearly 40% payouts. They have favored such dividend- had outperformed by 8%. Likewise, dividend of total returns in the S&P 500 Index. Dividend growing “tortoises” over capital growth-seeking growers have delivered stronger returns than growth equities – as represented by the S&P “hares,” often speculative, early-stage ventures. the tech-laden Nasdaq Composite, wsignificantly Dividend Aristocrats Index – have outperformed less volatility – FIGURE 1. the S&P 500 over the past 30 years with lower Of course, this follows a prolonged period where volatility. Even after this year’s outperformance, the hares dashed ahead of dividend-growing dividend-paying equities still trade at a 19% discount to broader market indices. FiGUre 1: QUALiTY DiviDeNDS HAve oUTPerForMeD GrowTH SToCKS Seeking quality income, 180 not just high income 160 Nasdaq Not all equity income is created equal. We 0 140 believe quality equity income to be a core 0 1 allocation within a diversified portfolio. We = therefore not only seek out decent dividend 0 120 2 yields but also consider payout sustainability. 0 2 The best run companies generate enough free 100 S&P 500 Dividend Aristocrats n cash flow to increase dividend payouts while a J maintaining reinvestment in their operations. 80 Firms that find themselves forced to choose 60 between future business growth and current Feb 20 Aug 20 Feb 21 Aug 21 Feb 22 Aug 22 payouts face more skepticism, as few business models are sustainable without regular cash Source: Bloomberg, as of 23 Nov 2022. Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative injections to keep assets up to date while purposes only and do not represent the performance of any specific investment. Past performance is no guarantee of future results. Real results retaining talent. may vary. All forecasts are expressions of opinion, are subject to change without notice, and are not intended to be a guarantee of future events. Chart shows the performance of the S&P Dividend Aristocrats vs Nasdaq since pre-pandemic peak.

Citi Wealth Outlook 2023 Page 39 Page 41

Citi Wealth Outlook 2023 Page 39 Page 41