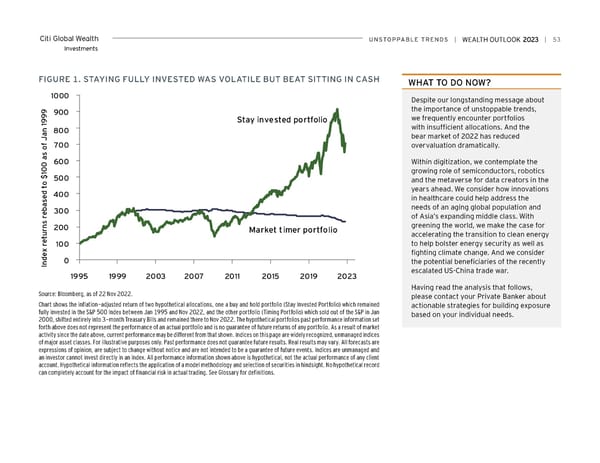

Citi Global Wealth UNSToPPABLe TreNDS | | 53 Investments FiGUre 1. STAYiNG FULLY iNveSTeD wAS voLATiLe BUT BeAT SiTTiNG iN CASH wHAT To Do Now? 1000 Despite our longstanding message about the importance of unstoppable trends, 9 900 9 Stay invested portfolio we frequently encounter portfolios 9 1 with insufficient allocations. And the n 800 a bear market of 2022 has reduced f J700 overvaluation dramatically. o s a 600 Within digitization, we contemplate the 0 0 growing role of semiconductors, robotics 1 $ 500 and the metaverse for data creators in the o t years ahead. We consider how innovations d 400 e in healthcare could help address the s a needs of an aging global population and b 300 e r of Asia’s expanding middle class. With s greening the world, we make the case for n 200 r Market timer portfolio u accelerating the transition to clean energy t e to help bolster energy security as well as r 100 x fighting climate change. And we consider e d 0 the potential beneficiaries of the recently n I 1995 1999 2003 2007 2011 2015 2019 2023 escalated US-China trade war. Having read the analysis that follows, Source: Bloomberg, as of 22 Nov 2022. please contact your Private Banker about Chart shows the inflation-adjusted return of two hypothetical allocations, one a buy and hold portfolio (Stay Invested Portfolio) which remained actionable strategies for building exposure fully invested in the S&P 500 Index between Jan 1995 and Nov 2022, and the other portfolio (Timing Portfolio) which sold out of the S&P in Jan based on your individual needs. 2000, shifted entirely into 3-month Treasury Bills and remained there to Nov 2022. The hypothetical portfolios past performance information set forth above does not represent the performance of an actual portfolio and is no guarantee of future returns of any portfolio. As a result of market activity since the date above, current performance may be different from that shown. Indices on this page are widely recognized, unmanaged indices of major asset classes. For illustrative purposes only. Past performance does not guarantee future results. Real results may vary. All forecasts are expressions of opinion, are subject to change without notice and are not intended to be a guarantee of future events. Indices are unmanaged and an investor cannot invest directly in an index. All performance information shown above is hypothetical, not the actual performance of any client account. Hypothetical information reflects the application of a model methodology and selection of securities in hindsight. No hypothetical record can completely account for the impact of financial risk in actual trading. See Glossary for definitions.

Citi Wealth Outlook 2023 Page 52 Page 54

Citi Wealth Outlook 2023 Page 52 Page 54