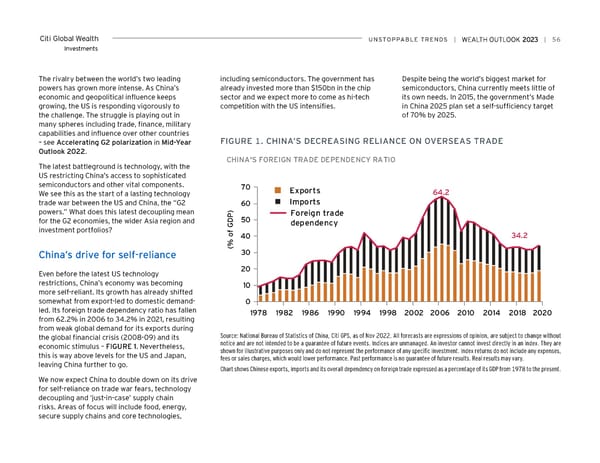

Citi Global Wealth UNSToPPABLe TreNDS | | 56 Investments The rivalry between the world’s two leading including semiconductors. The government has Despite being the world’s biggest market for powers has grown more intense. As China’s already invested more than $150bn in the chip semiconductors, China currently meets little of economic and geopolitical influence keeps sector and we expect more to come as hi-tech its own needs. In 2015, the government’s Made growing, the US is responding vigorously to competition with the US intensifies. in China 2025 plan set a self-sufficiency target the challenge. The struggle is playing out in of 70% by 2025. many spheres including trade, finance, military capabilities and influence over other countries – see Accelerating G2 polarization in Mid-Year FiGUre 1. CHiNA’S DeCreASiNG reLiANCe oN overSeAS TrADe Outlook 2022. CHINA'S FOREIGN TRADE DEPENDENCY RATIO The latest battleground is technology, with the US restricting China’s access to sophisticated semiconductors and other vital components. 70 Exports We see this as the start of a lasting technology 64.2 trade war between the US and China, the “G2 ) 60 Imports powers.” What does this latest decoupling mean P Foreign trade for the G2 economies, the wider Asia region and D 50 dependency G investment portfolios? f o 40 34.2 % ( China’s drive for self-reliance 30 Even before the latest US technology 20 restrictions, China’s economy was becoming 10 more self-reliant. Its growth has already shifted somewhat from export-led to domestic demand- 0 led. Its foreign trade dependency ratio has fallen 1978 1982 1986 1990 1994 1998 2002 2006 2010 2014 2018 2020 from 62.2% in 2006 to 34.2% in 2021, resulting from weak global demand for its exports during the global financial crisis (2008-09) and its Source: National Bureau of Statistics of China, Citi GPS, as of Nov 2022. All forecasts are expressions of opinion, are subject to change without economic stimulus – FIGURE 1. Nevertheless, notice and are not intended to be a guarantee of future events. Indices are unmanaged. An investor cannot invest directly in an index. They are this is way above levels for the US and Japan, shown for illustrative purposes only and do not represent the performance of any specific investment. Index returns do not include any expenses, fees or sales charges, which would lower performance. Past performance is no guarantee of future results. Real results may vary. leaving China further to go. Chart shows Chinese exports, imports and its overall dependency on foreign trade expressed as a percentage of its GDP from 1978 to the present. We now expect China to double down on its drive for self-reliance on trade war fears, technology decoupling and ‘just-in-case’ supply chain risks. Areas of focus will include food, energy, secure supply chains and core technologies,

Citi Wealth Outlook 2023 Page 55 Page 57

Citi Wealth Outlook 2023 Page 55 Page 57