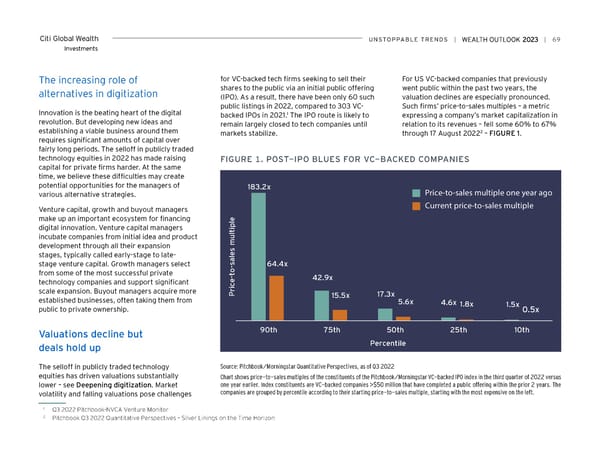

Citi Global Wealth UNSToPPABLe TreNDS | | 69 Investments The increasing role of for VC-backed tech firms seeking to sell their For US VC-backed companies that previously alternatives in digitization shares to the public via an initial public offering went public within the past two years, the (IPO). As a result, there have been only 60 such valuation declines are especially pronounced. public listings in 2022, compared to 303 VC- Such firms’ price-to-sales multiples – a metric Innovation is the beating heart of the digital 1 expressing a company’s market capitalization in backed IPOs in 2021. The IPO route is likely to revolution. But developing new ideas and remain largely closed to tech companies until relation to its revenues – fell some 60% to 67% establishing a viable business around them markets stabilize. through 17 August 20222 – FIGURE 1. requires significant amounts of capital over fairly long periods. The selloff in publicly traded technology equities in 2022 has made raising FiGUre 1. PoST-iPo BLUeS For vC-BACKeD CoMPANieS capital for private firms harder. At the same time, we believe these difficulties may create potential opportunities for the managers of 183.2x various alternative strategies. Price-to-sales multiple one year ago Venture capital, growth and buyout managers Current price-to-sales multiple make up an important ecosystem for financing e l p digital innovation. Venture capital managers i t l incubate companies from initial idea and product u m development through all their expansion stages, typically called early-stage to late- es al 64.4x stage venture capital. Growth managers select o-s from some of the most successful private e-t 42.9x technology companies and support significant c i scale expansion. Buyout managers acquire more r P 15.5x 17.3x established businesses, often taking them from 5.6x 4.6x 1.8x 1.5x public to private ownership. 0.5x Valuations decline but 90th 75th 50th 25th 10th deals hold up Percentile The selloff in publicly traded technology Source: Pitchbook/Morningstar Quantitative Perspectives, as of Q3 2022 equities has driven valuations substantially Chart shows price-to-sales multiples of the constituents of the Pitchbook/Morningstar VC-backed IPO index in the third quarter of 2022 versus lower – see Deepening digitization. Market one year earlier. Index constituents are VC-backed companies >$50 million that have completed a public offering within the prior 2 years. The volatility and falling valuations pose challenges companies are grouped by percentile according to their starting price-to-sales multiple, starting with the most expensive on the left. 1 Q3 2022 Pitchbook-NVCA Venture Monitor 2 Pitchbook Q3 2022 Quantitative Perspectives – Silver Linings on the Time Horizon

Citi Wealth Outlook 2023 Page 68 Page 70

Citi Wealth Outlook 2023 Page 68 Page 70