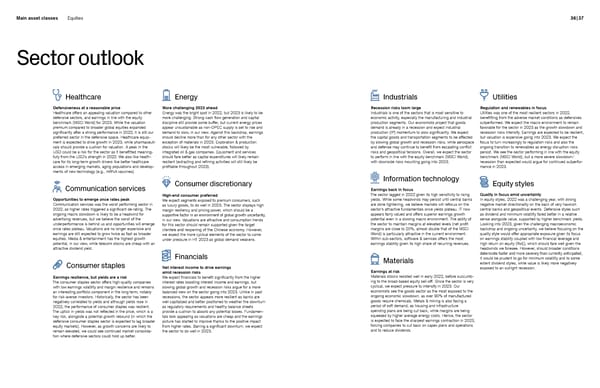

Main asset classes Equities 36 | 37 Sector outlook Healthcare Energy Industrials Utilities Defensiveness at a reasonable price More challenging 2023 ahead Recession risks loom large Regulation and renewables in focus Healthcare offers an appealing valuation compared to other Energy was the bright spot in 2022, but 2023 is likely to be Industrials is one of the sectors that is most sensitive to Utilities was one of the most resilient sectors in 2022, defensive sectors, and earnings in line with the equity more challenging. Strong cash flow generation and capital economic activity, especially the manufacturing and industrial benefitting from the adverse market conditions as defensives benchmark (MSCI World) for 2023. While the valuation discipline still provide some buffer, but current energy prices production segments. Our economists project that goods outperformed. We expect the macro environment to remain premium compared to broader global equities expanded appear unsustainable as non-OPEC supply is set to rise and demand is already in a recession and expect industrial favorable for the sector in 2023 as the growth slowdown and significantly after a strong performance in 2022, it is still our demand to slow, in our view. Against this backdrop, earnings production (IP) momentum to slow significantly. We expect recession risks intensify. Earnings are expected to be resilient, preferred sector in the defensive space. Healthcare equip- should decline more than for any other sector with the the capital goods and transportation segments to be affected but valuation is expensive going into 2023. We expect the ment is expected to drive growth in 2023, while pharmaceuti- exception of materials in 2023. Exploration & production by slowing global growth and recession risks, while aerospace focus to turn increasingly to regulation risks and also the cals should provide a cushion for valuation. A peak in the stocks will likely be the most vulnerable, followed by and defense may continue to benefit from escalating conflict ongoing transition to renewables as energy disruption risks USD could be a risk for the sector as it benefitted meaning- integrated oil & gas companies. Equipment and services risks and geopolitical tensions. Overall, we expect the sector persist. We see the sector performing in line with the equity fully from the USD’s strength in 2022. We also like health- should fare better as capital expenditures will likely remain to perform in line with the equity benchmark (MSCI World), benchmark (MSCI World), but a more severe slowdown/ care for its long-term growth drivers like better healthcare resilient (extracting and refining activities will still likely be with downside risks mounting going into 2023. recession than expected would argue for continued outperfor- access in emerging markets, aging populations and develop- profitable throughout 2023). mance in 2023. ments of new technology (e.g., mRNA vaccines). Consumer discretionary Information technology Equity styles Communication services Earnings back in focus High-end consumer preferred The sector lagged in 2022 given its high sensitivity to rising Quality in focus amid uncertainty Opportunities to emerge once rates peak We expect segments exposed to premium consumers, such yields. While some headwinds may persist until central banks In equity styles, 2022 was a challenging year, with strong Communication services was the worst performing sector in as luxury goods, to do well in 2023. The sector displays high are done tightening, we believe markets will refocus on the negative market directionality on the back of very hawkish 2022, as higher rates triggered a significant de-rating. The margin resiliency and pricing power, which should be a sector’s attractive fundamentals once yields plateau. IT now central banks and geopolitical events. Defensive styles such ongoing macro slowdown is likely to be a headwind for supportive factor in an environment of global growth uncertainty, appears fairly valued and offers superior earnings growth as dividend and minimum volatility fared better in a relative advertising revenues, but we believe the worst of the in our view. Valuations are attractive and consumption trends potential even in a slowing macro environment. The ability of sense alongside value, supported by higher benchmark yields. underperformance is behind us and opportunities will emerge for this sector should remain supported given the target the sector to maintain margins at elevated levels (net profit Looking into 2023, given the challenging macroeconomic once rates plateau. Valuations are no longer expensive and clientele and reopening of the Chinese economy. However, margins are close to 20%, almost double that of the MSCI backdrop and ongoing uncertainty, we believe focusing on the earnings are still expected to grow twice as fast as broader we expect the more cyclical elements of the sector to come World) is particularly attractive in the current environment. quality style would offer appropriate exposure given its focus equities. Media & entertainment has the highest growth under pressure in H1 2023 as global demand weakens. Within sub-sectors, software & services offers the most on earnings stability coupled with low financial leverage and potential, in our view, while telecom stocks are cheap with an earnings stability given its high share of recurring revenues. high return on equity (RoE), which should fare well given the attractive dividend yield. headwinds we foresee. However, should broader conditions Financials deteriorate faster and more severely than currently anticipated, Materials it would be prudent to go for minimum volatility and to some Consumer staples extent dividend styles, while value is likely more negatively Net interest income to drive earnings exposed to an outright recession. amid recession risks Earnings at risk Earnings resilience, but yields are a risk We expect financials to benefit significantly from the higher Materials stocks resisted well in early 2022, before succumb- The consumer staples sector offers high-quality companies interest rates boosting interest income and earnings, but ing to the broad-based equity sell-off. Since the sector is very with low earnings volatility and margin resilience and remains slowing global growth and recession risks argue for a more cyclical, we expect pressure to intensify in 2023. Our an interesting portfolio component in the long term, notably balanced view on the sector going into 2023. Unlike in past economists see the goods sector as the most exposed to the for risk-averse investors. Historically, the sector has been recessions, the sector appears more resilient as banks are ongoing economic slowdown, as over 90% of manufactured negatively correlated to yields and although yields rose in well capitalized and better positioned to weather the downturn goods require chemicals. Metals & mining is also facing a 2022, the performance of consumer staples was resilient. as regulatory requirements and healthy balance sheets period of soft demand, as housing and infrastructure The uptick in yields was not reflected in the price, which is a provide a cushion to absorb any potential losses. Fundamen- spending plans are being cut back, while margins are being key risk, alongside a potential growth rebound (in which the tals look appealing as valuations are cheap and the earnings squeezed by higher average energy costs. Hence, the sector defensive consumer staples sector is expected to lag broader picture has started to improve thanks to the positive impact is expected to face the sharpest earnings contraction in 2023, equity markets). However, as growth concerns are likely to from higher rates. Barring a significant downturn, we expect forcing companies to cut back on capex plans and operations remain elevated, we could see continued market consolida- the sector to do well in 2023. and to reduce dividends. tion where defensive sectors could hold up better.

Credit Suisse Investment Outlook 2023 Page 18 Page 20

Credit Suisse Investment Outlook 2023 Page 18 Page 20