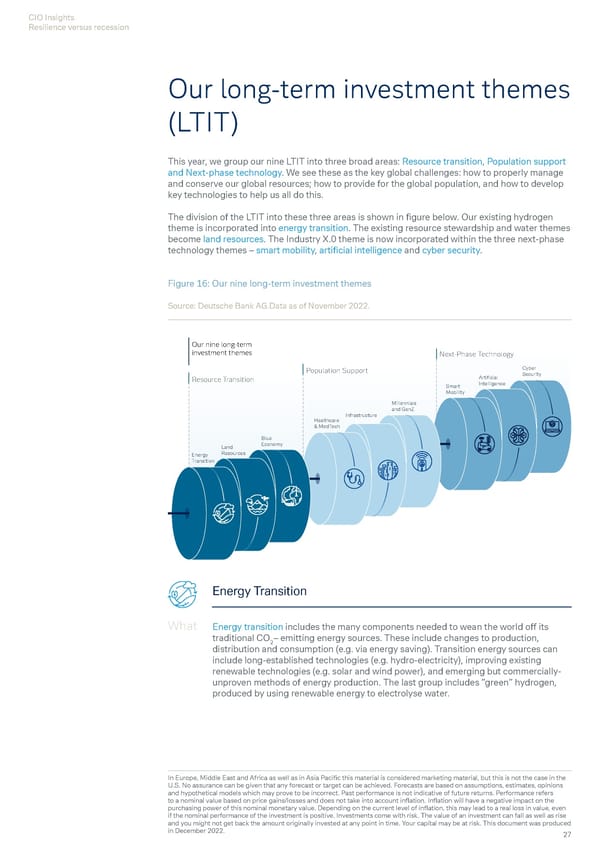

CIO Insights Resilience versus recession Our long-term investment themes (LTIT) This year, we group our nine LTIT into three broad areas: Resource transition, Population support and Next-phase technology. We see these as the key global challenges: how to properly manage and conserve our global resources; how to provide for the global population, and how to develop key technologies to help us all do this. The division of the LTIT into these three areas is shown in figure below. Our existing hydrogen theme is incorporated into energy transition. The existing resource stewardship and water themes become land resources. The Industry X.0 theme is now incorporated within the three next-phase technology themes – smart mobility, artificial intelligence and cyber security. Figure 16: Our nine long-term investment themes Source: Deutsche Bank AG.Data as of November 2022. Our nine long-term investment themes Next-Phase Technology Population Support Cyber Resource Transition Artificial Security Smart Intelligence Mobility Millennials and GenZ Infrastructure Healthcare & MedTech Blue Land Economy Energy Resources Transition Energy Transition What Energy transition includes the many components needed to wean the world off its traditional CO2– emitting energy sources. These include changes to production, distribution and consumption (e.g. via energy saving). Transition energy sources can include long-established technologies (e.g. hydro-electricity), improving existing renewable technologies (e.g. solar and wind power), and emerging but commercially- unproven methods of energy production. The last group includes ”green” hydrogen, produced by using renewable energy to electrolyse water. In Europe, Middle East and Africa as well as in Asia Pacific this material is considered marketing material, but this is not the case in the U.S. No assurance can be given that any forecast or target can be achieved. Forecasts are based on assumptions, estimates, opinions and hypothetical models which may prove to be incorrect. Past performance is not indicative of future returns. Performance refers to a nominal value based on price gains/losses and does not take into account inflation. Inflation will have a negative impact on the purchasing power of this nominal monetary value. Depending on the current level of inflation, this may lead to a real loss in value, even if the nominal performance of the investment is positive. Investments come with risk. The value of an investment can fall as well as rise and you might not get back the amount originally invested at any point in time. Your capital may be at risk. This document was produced in December 2022. 27

Deutsche Bank Economic and Investment Outlook Page 28 Page 30

Deutsche Bank Economic and Investment Outlook Page 28 Page 30