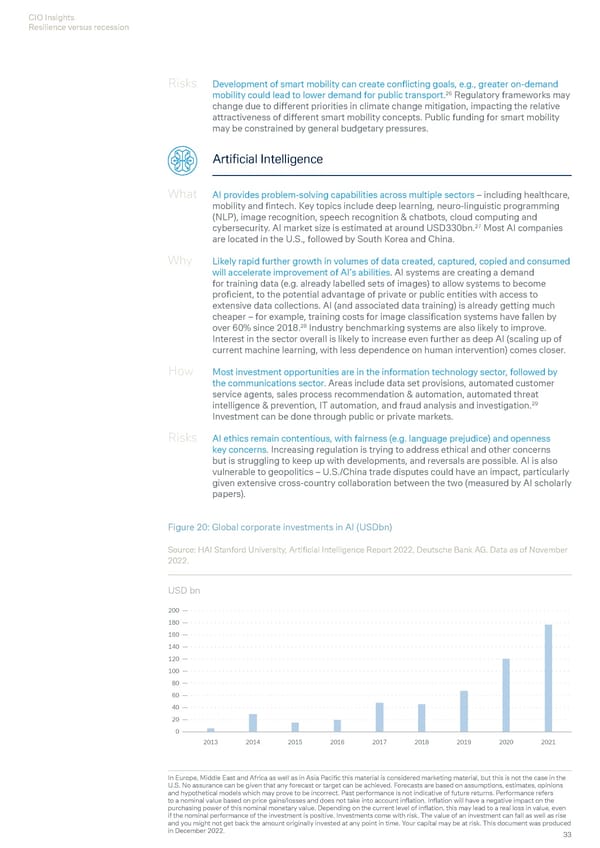

CIO Insights Resilience versus recession Risks Development of smart mobility can create conflicting goals, e.g., greater on-demand 26 mobility could lead to lower demand for public transport. Regulatory frameworks may change due to different priorities in climate change mitigation, impacting the relative attractiveness of different smart mobility concepts. Public funding for smart mobility may be constrained by general budgetary pressures. Artificial Intelligence What AI provides problem-solving capabilities across multiple sectors – including healthcare, mobility and fintech. Key topics include deep learning, neuro-linguistic programming (NLP), image recognition, speech recognition & chatbots, cloud computing and cybersecurity. AI market size is estimated at around USD330bn.27 Most AI companies are located in the U.S., followed by South Korea and China. Why Likely rapid further growth in volumes of data created, captured, copied and consumed will accelerate improvement of AI’s abilities. AI systems are creating a demand for training data (e.g. already labelled sets of images) to allow systems to become proficient, to the potential advantage of private or public entities with access to extensive data collections. AI (and associated data training) is already getting much cheaper – for example, training costs for image classification systems have fallen by over 60% since 2018.28 Industry benchmarking systems are also likely to improve. Interest in the sector overall is likely to increase even further as deep AI (scaling up of current machine learning, with less dependence on human intervention) comes closer. How Most investment opportunities are in the information technology sector, followed by the communications sector. Areas include data set provisions, automated customer service agents, sales process recommendation & automation, automated threat 29 intelligence & prevention, IT automation, and fraud analysis and investigation. Investment can be done through public or private markets. Risks AI ethics remain contentious, with fairness (e.g. language prejudice) and openness key concerns. Increasing regulation is trying to address ethical and other concerns but is struggling to keep up with developments, and reversals are possible. AI is also vulnerable to geopolitics – U.S./China trade disputes could have an impact, particularly given extensive cross-country collaboration between the two (measured by AI scholarly papers). Figure 20: Global corporate investments in AI (USDbn) Source: HAI Stanford University, Artificial Intelligence Report 2022, Deutsche Bank AG. Data as of November 2022. USD bn 200 180 160 140 120 100 80 60 40 20 0 2013 2014 2015 2016 2017 2018 2019 2020 2021 In Europe, Middle East and Africa as well as in Asia Pacific this material is considered marketing material, but this is not the case in the U.S. No assurance can be given that any forecast or target can be achieved. Forecasts are based on assumptions, estimates, opinions and hypothetical models which may prove to be incorrect. Past performance is not indicative of future returns. Performance refers to a nominal value based on price gains/losses and does not take into account inflation. Inflation will have a negative impact on the purchasing power of this nominal monetary value. Depending on the current level of inflation, this may lead to a real loss in value, even if the nominal performance of the investment is positive. Investments come with risk. The value of an investment can fall as well as rise and you might not get back the amount originally invested at any point in time. Your capital may be at risk. This document was produced in December 2022. 33

Deutsche Bank Economic and Investment Outlook Page 34 Page 36

Deutsche Bank Economic and Investment Outlook Page 34 Page 36