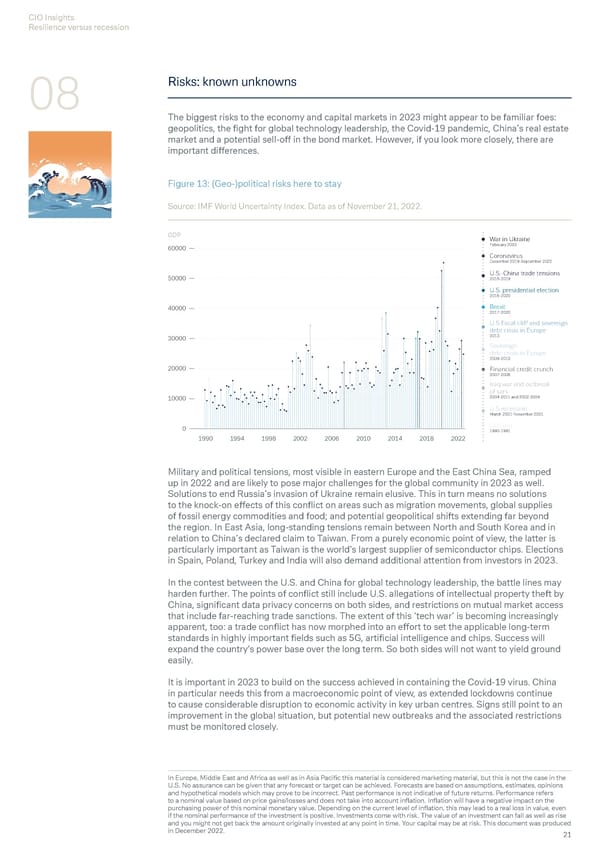

CIO Insights Resilience versus recession 08 Risks: known unknowns The biggest risks to the economy and capital markets in 2023 might appear to be familiar foes: geopolitics, the fight for global technology leadership, the Covid-19 pandemic, China’s real estate market and a potential sell-off in the bond market. However, if you look more closely, there are important differences. Figure 13: (Geo-)political risks here to stay Source: IMF World Uncertainty Index. Data as of November 21, 2022. GDP War in Ukraine 60000 February 2022 Coronavirus December 2019-September 2022 U.S.-China trade tensions 50000 2018-2019 U.S. presidential election 2016-2020 40000 Brexit 2017-2020 U.S fiscal cliff and sovereign debt crisis in Europe 30000 2013 Sovereign debt crisis in Europe 2009-2010 20000 Financial credit crunch 2007-2008 Iraq war and outbreak of sars 10000 2004-2011 and 2002-2004 U.S recession March 2001-November 2001 0 Gulf war 1990-1991 1990 1994 1998 2002 2006 2010 2014 2018 2022 Military and political tensions, most visible in eastern Europe and the East China Sea, ramped up in 2022 and are likely to pose major challenges for the global community in 2023 as well. Solutions to end Russia’s invasion of Ukraine remain elusive. This in turn means no solutions to the knock-on effects of this conflict on areas such as migration movements, global supplies of fossil energy commodities and food; and potential geopolitical shifts extending far beyond the region. In East Asia, long-standing tensions remain between North and South Korea and in relation to China’s declared claim to Taiwan. From a purely economic point of view, the latter is particularly important as Taiwan is the world’s largest supplier of semiconductor chips. Elections in Spain, Poland, Turkey and India will also demand additional attention from investors in 2023. In the contest between the U.S. and China for global technology leadership, the battle lines may harden further. The points of conflict still include U.S. allegations of intellectual property theft by China, significant data privacy concerns on both sides, and restrictions on mutual market access that include far-reaching trade sanctions. The extent of this ‘tech war’ is becoming increasingly apparent, too: a trade conflict has now morphed into an effort to set the applicable long-term standards in highly important fields such as 5G, artificial intelligence and chips. Success will expand the country's power base over the long term. So both sides will not want to yield ground easily. It is important in 2023 to build on the success achieved in containing the Covid-19 virus. China in particular needs this from a macroeconomic point of view, as extended lockdowns continue to cause considerable disruption to economic activity in key urban centres. Signs still point to an improvement in the global situation, but potential new outbreaks and the associated restrictions must be monitored closely. In Europe, Middle East and Africa as well as in Asia Pacific this material is considered marketing material, but this is not the case in the U.S. No assurance can be given that any forecast or target can be achieved. Forecasts are based on assumptions, estimates, opinions and hypothetical models which may prove to be incorrect. Past performance is not indicative of future returns. Performance refers to a nominal value based on price gains/losses and does not take into account inflation. Inflation will have a negative impact on the purchasing power of this nominal monetary value. Depending on the current level of inflation, this may lead to a real loss in value, even if the nominal performance of the investment is positive. Investments come with risk. The value of an investment can fall as well as rise and you might not get back the amount originally invested at any point in time. Your capital may be at risk. This document was produced in December 2022. 21

Deutsche Bank Economic and Investment Outlook Page 22 Page 24

Deutsche Bank Economic and Investment Outlook Page 22 Page 24