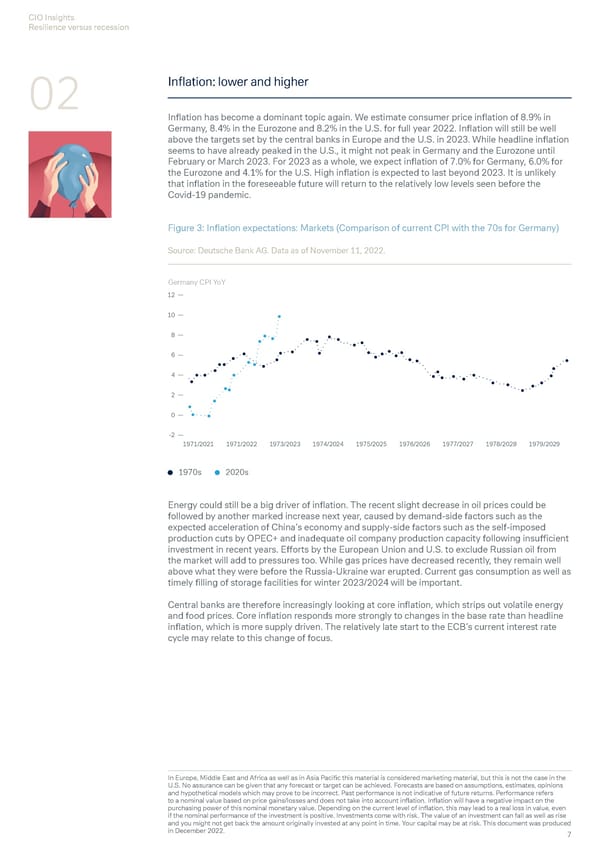

CIO Insights Resilience versus recession 02 Inflation: lower and higher Inflation has become a dominant topic again. We estimate consumer price inflation of 8.9% in Germany, 8.4% in the Eurozone and 8.2% in the U.S. for full year 2022. Inflation will still be well above the targets set by the central banks in Europe and the U.S. in 2023. While headline inflation seems to have already peaked in the U.S., it might not peak in Germany and the Eurozone until February or March 2023. For 2023 as a whole, we expect inflation of 7.0% for Germany, 6.0% for the Eurozone and 4.1% for the U.S. High inflation is expected to last beyond 2023. It is unlikely that inflation in the foreseeable future will return to the relatively low levels seen before the Covid-19 pandemic. Figure 3: Inflation expectations: Markets (Comparison of current CPI with the 70s for Germany) Source: Deutsche Bank AG. Data as of November 11, 2022. Germany CPI YoY 12 10 8 6 4 2 0 -2 1971/2021 1971/2022 1973/2023 1974/2024 1975/2025 1976/2026 1977/2027 1978/2028 1979/2029 1970s 2020s Energy could still be a big driver of inflation. The recent slight decrease in oil prices could be followed by another marked increase next year, caused by demand-side factors such as the expected acceleration of China’s economy and supply-side factors such as the self-imposed production cuts by OPEC+ and inadequate oil company production capacity following insufficient investment in recent years. Efforts by the European Union and U.S. to exclude Russian oil from the market will add to pressures too. While gas prices have decreased recently, they remain well above what they were before the Russia-Ukraine war erupted. Current gas consumption as well as timely filling of storage facilities for winter 2023/2024 will be important. Central banks are therefore increasingly looking at core inflation, which strips out volatile energy and food prices. Core inflation responds more strongly to changes in the base rate than headline inflation, which is more supply driven. The relatively late start to the ECB’s current interest rate cycle may relate to this change of focus. In Europe, Middle East and Africa as well as in Asia Pacific this material is considered marketing material, but this is not the case in the U.S. No assurance can be given that any forecast or target can be achieved. Forecasts are based on assumptions, estimates, opinions and hypothetical models which may prove to be incorrect. Past performance is not indicative of future returns. Performance refers to a nominal value based on price gains/losses and does not take into account inflation. Inflation will have a negative impact on the purchasing power of this nominal monetary value. Depending on the current level of inflation, this may lead to a real loss in value, even if the nominal performance of the investment is positive. Investments come with risk. The value of an investment can fall as well as rise and you might not get back the amount originally invested at any point in time. Your capital may be at risk. This document was produced in December 2022. 7

Deutsche Bank Economic and Investment Outlook Page 8 Page 10

Deutsche Bank Economic and Investment Outlook Page 8 Page 10