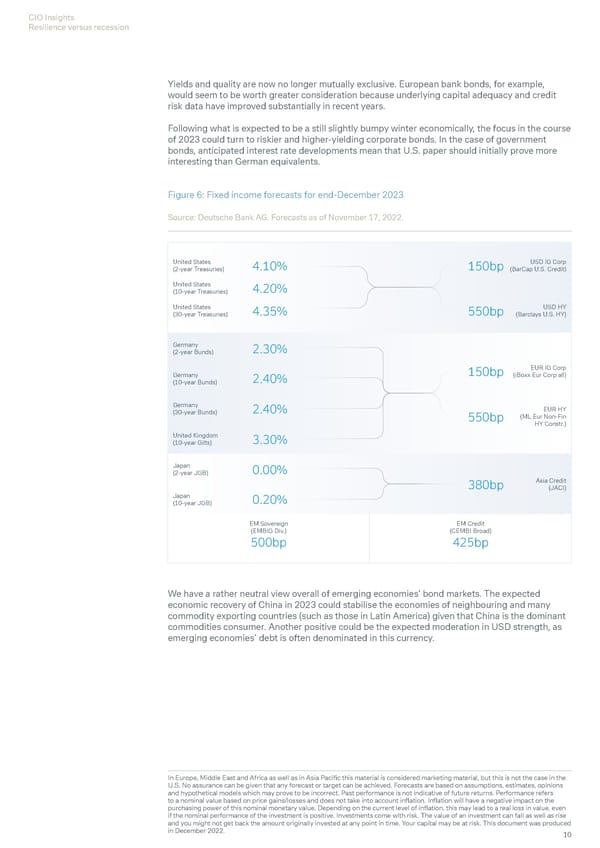

CIO Insights Resilience versus recession Yields and quality are now no longer mutually exclusive. European bank bonds, for example, would seem to be worth greater consideration because underlying capital adequacy and credit risk data have improved substantially in recent years. Following what is expected to be a still slightly bumpy winter economically, the focus in the course of 2023 could turn to riskier and higher-yielding corporate bonds. In the case of government bonds, anticipated interest rate developments mean that U.S. paper should initially prove more interesting than German equivalents. Figure 6: Fixed income forecasts for end-December 2023 Source: Deutsche Bank AG. Forecasts as of November 17, 2022. United States 4.10% 150bp USD IG Corp (2-year Treasuries) (BarCap U.S. Credit) United States 4.20% (10-year Treasuries) United States 4.35% 550bp USD HY (30-year Treasuries) (Barclays U.S. HY) Germany 2.30% (2-year Bunds) 150bp EUR IG Corp Germany 2.40% (iBoxx Eur Corp all) (10-year Bunds) Germany 2.40% EUR HY (30-year Bunds) 550bp (ML Eur Non-Fin HY Constr.) United Kingdom 3.30% (10-year Gilts) Japan 0.00% (2-year JGB) 380bp Asia Credit (JACI) Japan 0.20% (10-year JGB) EM Sovereign EM Credit (EMBIG Div.) (CEMBI Broad) 500bp 425bp We have a rather neutral view overall of emerging economies’ bond markets. The expected economic recovery of China in 2023 could stabilise the economies of neighbouring and many commodity exporting countries (such as those in Latin America) given that China is the dominant commodities consumer. Another positive could be the expected moderation in USD strength, as emerging economies’ debt is often denominated in this currency. In Europe, Middle East and Africa as well as in Asia Pacific this material is considered marketing material, but this is not the case in the U.S. No assurance can be given that any forecast or target can be achieved. Forecasts are based on assumptions, estimates, opinions and hypothetical models which may prove to be incorrect. Past performance is not indicative of future returns. Performance refers to a nominal value based on price gains/losses and does not take into account inflation. Inflation will have a negative impact on the purchasing power of this nominal monetary value. Depending on the current level of inflation, this may lead to a real loss in value, even if the nominal performance of the investment is positive. Investments come with risk. The value of an investment can fall as well as rise and you might not get back the amount originally invested at any point in time. Your capital may be at risk. This document was produced in December 2022. 10

Deutsche Bank Economic and Investment Outlook Page 11 Page 13

Deutsche Bank Economic and Investment Outlook Page 11 Page 13