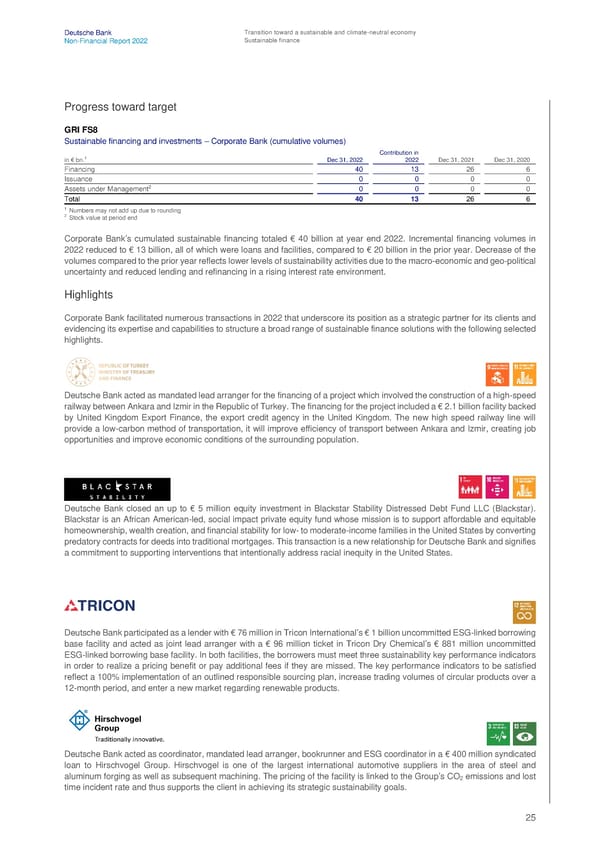

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance Progress toward target GRI FS8 Sustainable financing and investments – Corporate Bank (cumulative volumes) Contribution in 1 in € bn. Dec 31, 2022 2022 Dec 31, 2021 Dec 31, 2020 Financing 40 13 26 6 Issuance 0 0 0 0 2 Assets under Management 0 0 0 0 Total 40 13 26 6 1 Numbers may not add up due to rounding 2 Stock value at period end Corporate Bank’s cumulated sustainable financing totaled € 40 billion at year end 2022. Incremental financing volumes in 2022 reduced to € 13 billion, all of which were loans and facilities, compared to € 20 billion in the prior year. Decrease of the volumes compared to the prior year reflects lower levels of sustainability activities due to the macro-economic and geo-political uncertainty and reduced lending and refinancing in a rising interest rate environment. Highlights Corporate Bank facilitated numerous transactions in 2022 that underscore its position as a strategic partner for its clients and evidencing its expertise and capabilities to structure a broad range of sustainable finance solutions with the following selected highlights. Deutsche Bank acted as mandated lead arranger for the financing of a project which involved the construction of a high-speed railway between Ankara and Izmir in the Republic of Turkey. The financing for the project included a € 2.1 billion facility backed by United Kingdom Export Finance, the export credit agency in the United Kingdom. The new high speed railway line will provide a low-carbon method of transportation, it will improve efficiency of transport between Ankara and Izmir, creating job opportunities and improve economic conditions of the surrounding population. Deutsche Bank closed an up to € 5 million equity investment in Blackstar Stability Distressed Debt Fund LLC (Blackstar). Blackstar is an African American-led, social impact private equity fund whose mission is to support affordable and equitable homeownership, wealth creation, and financial stability for low- to moderate-income families in the United States by converting predatory contracts for deeds into traditional mortgages. This transaction is a new relationship for Deutsche Bank and signifies a commitment to supporting interventions that intentionally address racial inequity in the United States. Deutsche Bank participated as a lender with € 76 million in Tricon International’s € 1 billion uncommitted ESG-linked borrowing base facility and acted as joint lead arranger with a € 96 million ticket in Tricon Dry Chemical’s € 881 million uncommitted ESG-linked borrowing base facility. In both facilities, the borrowers must meet three sustainability key performance indicators in order to realize a pricing benefit or pay additional fees if they are missed. The key performance indicators to be satisfied reflect a 100% implementation of an outlined responsible sourcing plan, increase trading volumes of circular products over a 12-month period, and enter a new market regarding renewable products. Deutsche Bank acted as coordinator, mandated lead arranger, bookrunner and ESG coordinator in a € 400 million syndicated loan to Hirschvogel Group. Hirschvogel is one of the largest international automotive suppliers in the area of steel and aluminum forging as well as subsequent machining. The pricing of the facility is linked to the Group’s CO emissions and lost 2 time incident rate and thus supports the client in achieving its strategic sustainability goals. 25

Deutsche Bank Non Financial Report Page 25 Page 27

Deutsche Bank Non Financial Report Page 25 Page 27