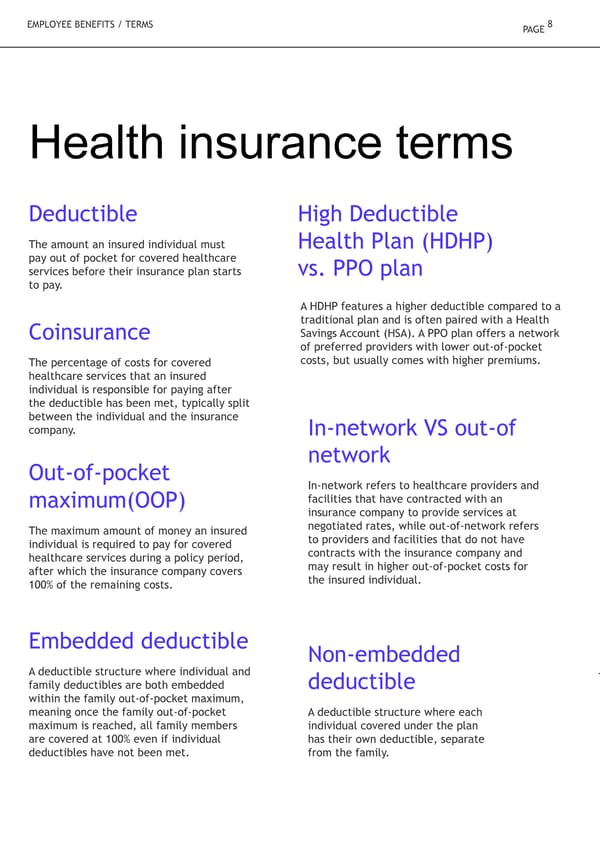

8 EMPLOYEE BENEFITS / TERMS PAGE Health insurance terms Deductible High Deductible The amount an insured individual must Health Plan (HDHP) pay out of pocket for covered healthcare services before their insurance plan starts vs. PPO plan to pay. A HDHP features a higher deductible compared to a traditional plan and is often paired with a Health Savings Account (HSA). A PPO plan offers a network Coinsurance of preferred providers with lower out-of-pocket costs, but usually comes with higher premiums. The percentage of costs for covered healthcare services that an insured individual is responsible for paying after the deductible has been met, typically split between the individual and the insurance company. In-network VS out-of network Out-of-pocket In-network refers to healthcare providers and facilities that have contracted with an maximum(OOP) insurance company to provide services at negotiated rates, while out-of-network refers The maximum amount of money an insured to providers and facilities that do not have individual is required to pay for covered contracts with the insurance company and healthcare services during a policy period, may result in higher out-of-pocket costs for after which the insurance company covers the insured individual. 100% of the remaining costs. Embedded deductible Non-embedded A deductible structure where individual and family deductibles are both embedded deductible within the family out-of-pocket maximum, meaning once the family out-of-pocket A deductible structure where each maximum is reached, all family members individual covered under the plan are covered at 100% even if individual has their own deductible, separate deductibles have not been met. from the family.

Employee Benefits Brochure Template Page 7 Page 9

Employee Benefits Brochure Template Page 7 Page 9