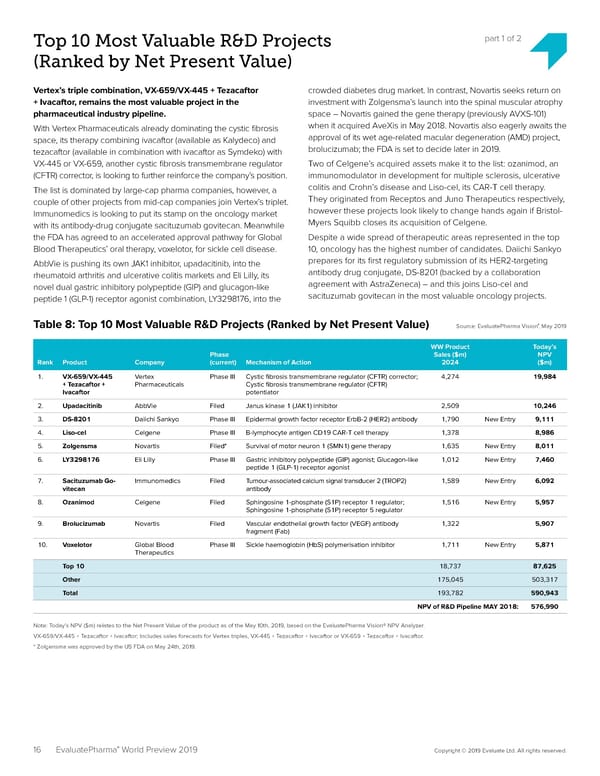

Top 10 Most Valuable R&D Projects part 1 of 2 (Ranked by Net Present Value) Vertex’s triple combination, VX-659/VX-445 + Tezacaftor crowded diabetes drug market. In contrast, Novartis seeks return on + Ivacaftor, remains the most valuable project in the investment with Zolgensma’s launch into the spinal muscular atrophy pharmaceutical industry pipeline. space – Novartis gained the gene therapy (previously AVXS-101) With Vertex Pharmaceuticals already dominating the cystic 昀椀brosis when it acquired AveXis in May 2018. Novartis also eagerly awaits the space, its therapy combining ivacaftor (available as Kalydeco) and approval of its wet age-related macular degeneration (AMD) project, tezacaftor (available in combination with ivacaftor as Symdeko) with brolucizumab; the FDA is set to decide later in 2019. VX-445 or VX-659, another cystic 昀椀brosis transmembrane regulator Two of Celgene’s acquired assets make it to the list: ozanimod, an (CFTR) corrector, is looking to further reinforce the company’s position. immunomodulator in development for multiple sclerosis, ulcerative The list is dominated by large-cap pharma companies, however, a colitis and Crohn’s disease and Liso-cel, its CAR-T cell therapy. couple of other projects from mid-cap companies join Vertex’s triplet. They originated from Receptos and Juno Therapeutics respectively, Immunomedics is looking to put its stamp on the oncology market however these projects look likely to change hands again if Bristol- with its antibody-drug conjugate sacituzumab govitecan. Meanwhile Myers Squibb closes its acquisition of Celgene. the FDA has agreed to an accelerated approval pathway for Global Despite a wide spread of therapeutic areas represented in the top Blood Therapeutics’ oral therapy, voxelotor, for sickle cell disease. 10, oncology has the highest number of candidates. Daiichi Sankyo AbbVie is pushing its own JAK1 inhibitor, upadacitinib, into the prepares for its 昀椀rst regulatory submission of its HER2-targeting rheumatoid arthritis and ulcerative colitis markets and Eli Lilly, its antibody drug conjugate, DS-8201 (backed by a collaboration novel dual gastric inhibitory polypeptide (GIP) and glucagon-like agreement with AstraZeneca) – and this joins Liso-cel and peptide 1 (GLP-1) receptor agonist combination, LY3298176, into the sacituzumab govitecan in the most valuable oncology projects. ® Table 8: Top 10 Most Valuable R&D Projects (Ranked by Net Present Value) Source: EvaluatePharma Vision, May 2019 WW Product Today’s Phase Sales ($m) NPV Rank Product Company (current) Mechanism of Action 2024 ($m) 1. VX-659/VX-445 Vertex Phase III Cystic 昀椀brosis transmembrane regulator (CFTR) corrector; 4,274 19,984 + Tezacaftor + Pharmaceuticals Cystic 昀椀brosis transmembrane regulator (CFTR) Ivacaftor potentiator 2. Upadacitinib AbbVie Filed Janus kinase 1 (JAK1) inhibitor 2,509 10,246 3. DS-8201 Daiichi Sankyo Phase III Epidermal growth factor receptor ErbB-2 (HER2) antibody 1,790 New Entry 9,111 4. Liso-cel Celgene Phase III B-lymphocyte antigen CD19 CAR-T cell therapy 1,378 8,986 5. Zolgensma Novartis Filed* Survival of motor neuron 1 (SMN1) gene therapy 1,635 New Entry 8,011 6. LY3298176 Eli Lilly Phase III Gastric inhibitory polypeptide (GIP) agonist; Glucagon-like 1,012 New Entry 7,460 peptide 1 (GLP-1) receptor agonist 7. Sacituzumab Go- Immunomedics Filed Tumour-associated calcium signal transducer 2 (TROP2) 1,589 New Entry 6,092 vitecan antibody 8. Ozanimod Celgene Filed Sphingosine 1-phosphate (S1P) receptor 1 regulator; 1,516 New Entry 5,957 Sphingosine 1-phosphate (S1P) receptor 5 regulator 9. Brolucizumab Novartis Filed Vascular endothelial growth factor (VEGF) antibody 1,322 5,907 fragment (Fab) 10. Voxelotor Global Blood Phase III Sickle haemoglobin (HbS) polymerisation inhibitor 1,711 New Entry 5,871 Therapeutics Top 10 18,737 87,625 Other 175,045 503,317 Total 193,782 590,943 NPV of R&D Pipeline MAY 2018: 576,990 Note: Today’s NPV ($m) relates to the Net Present Value of the product as of the May 10th, 2019, based on the EvaluatePharma Vision® NPV Analyzer. VX-659/VX-445 + Tezacaftor + Ivacaftor; Includes sales forecasts for Vertex triples, VX-445 + Tezacaftor + Ivacaftor or VX-659 + Tezacaftor + Ivacaftor. * Zolgensma was approved by the US FDA on May 24th, 2019. ® 16 EvaluatePharma World Preview 2019 Copyright © 2019 Evaluate Ltd. All rights reserved.

EvaluatePharma 2024 Page 15 Page 17

EvaluatePharma 2024 Page 15 Page 17