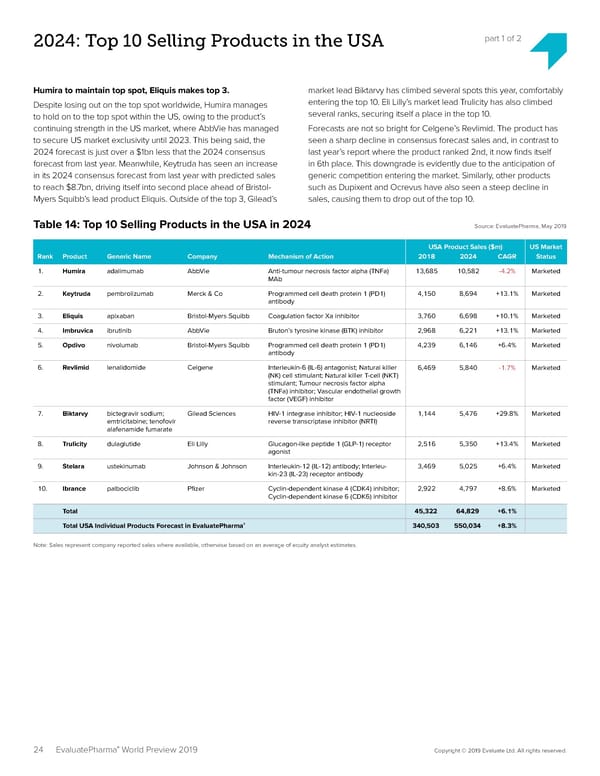

2024: Top 10 Selling Products in the USA part 1 of 2 Humira to maintain top spot, Eliquis makes top 3. market lead Biktarvy has climbed several spots this year, comfortably Despite losing out on the top spot worldwide, Humira manages entering the top 10. Eli Lilly’s market lead Trulicity has also climbed to hold on to the top spot within the US, owing to the product’s several ranks, securing itself a place in the top 10. continuing strength in the US market, where AbbVie has managed Forecasts are not so bright for Celgene’s Revlimid. The product has to secure US market exclusivity until 2023. This being said, the seen a sharp decline in consensus forecast sales and, in contrast to 2024 forecast is just over a $1bn less that the 2024 consensus last year’s report where the product ranked 2nd, it now 昀椀nds itself forecast from last year. Meanwhile, Keytruda has seen an increase in 6th place. This downgrade is evidently due to the anticipation of in its 2024 consensus forecast from last year with predicted sales generic competition entering the market. Similarly, other products to reach $8.7bn, driving itself into second place ahead of Bristol- such as Dupixent and Ocrevus have also seen a steep decline in Myers Squibb’s lead product Eliquis. Outside of the top 3, Gilead’s sales, causing them to drop out of the top 10. Table 14: Top 10 Selling Products in the USA in 2024 Source: EvaluatePharma, May 2019 USA Product Sales ($m) US Market Rank Product Generic Name Company Mechanism of Action 2018 2024 CAGR Status 1. Humira adalimumab AbbVie Anti-tumour necrosis factor alpha (TNFa) 13,685 10,582 -4.2% Marketed MAb 2. Keytruda pembrolizumab Merck & Co Programmed cell death protein 1 (PD1) 4,150 8,694 +13.1% Marketed antibody 3. Eliquis apixaban Bristol-Myers Squibb Coagulation factor Xa inhibitor 3,760 6,698 +10.1% Marketed 4. Imbruvica ibrutinib AbbVie Bruton’s tyrosine kinase (BTK) inhibitor 2,968 6,221 +13.1% Marketed 5. Opdivo nivolumab Bristol-Myers Squibb Programmed cell death protein 1 (PD1) 4,239 6,146 +6.4% Marketed antibody 6. Revlimid lenalidomide Celgene Interleukin-6 (IL-6) antagonist; Natural killer 6,469 5,840 -1.7% Marketed (NK) cell stimulant; Natural killer T-cell (NKT) stimulant; Tumour necrosis factor alpha (TNFa) inhibitor; Vascular endothelial growth factor (VEGF) inhibitor 7. Biktarvy bictegravir sodium; Gilead Sciences HIV-1 integrase inhibitor; HIV-1 nucleoside 1,144 5,476 +29.8% Marketed emtricitabine; tenofovir reverse transcriptase inhibitor (NRTI) alafenamide fumarate 8. Trulicity dulaglutide Eli Lilly Glucagon-like peptide 1 (GLP-1) receptor 2,516 5,350 +13.4% Marketed agonist 9. Stelara ustekinumab Johnson & Johnson Interleukin-12 (IL-12) antibody; Interleu- 3,469 5,025 +6.4% Marketed kin-23 (IL-23) receptor antibody 10. Ibrance palbociclib P昀椀zer Cyclin-dependent kinase 4 (CDK4) inhibitor; 2,922 4,797 +8.6% Marketed Cyclin-dependent kinase 6 (CDK6) inhibitor Total 45,322 64,829 +6.1% ® Total USA Individual Products Forecast in EvaluatePharma 340,503 550,034 +8.3% Note: Sales represent company reported sales where available, otherwise based on an average of equity analyst estimates. ® World Preview 2019 Copyright © 2019 Evaluate Ltd. All rights reserved. 24 EvaluatePharma

EvaluatePharma 2024 Page 23 Page 25

EvaluatePharma 2024 Page 23 Page 25