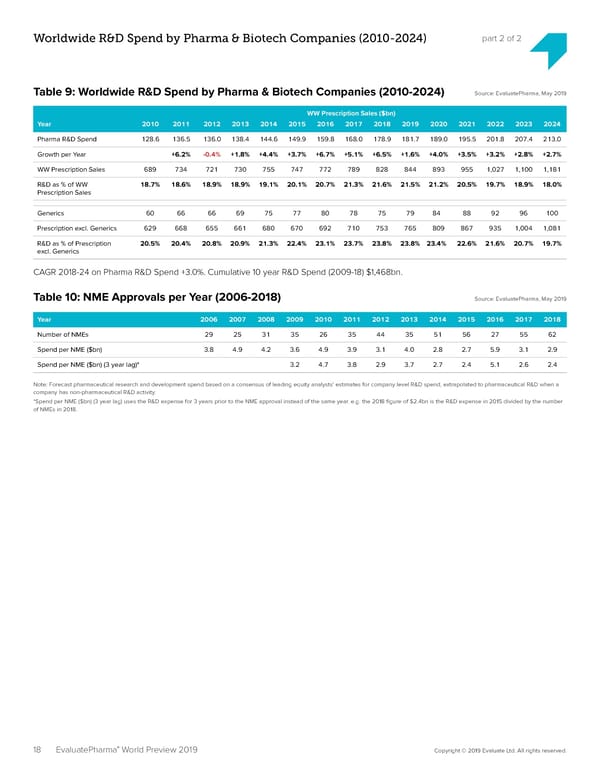

Worldwide R&D Spend by Pharma & Biotech Companies (2010-2024) part 2 of 2 Table 9: Worldwide R&D Spend by Pharma & Biotech Companies (2010-2024) Source: EvaluatePharma, May 2019 WW Prescription Sales ($bn) Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Pharma R&D Spend 128.6 136.5 136.0 138.4 144.6 149.9 159.8 168.0 178.9 181.7 189.0 195.5 201.8 207.4 213.0 Growth per Year +6.2% -0.4% +1.8% +4.4% +3.7% +6.7% +5.1% +6.5% +1.6% +4.0% +3.5% +3.2% +2.8% +2.7% WW Prescription Sales 689 734 721 730 755 747 772 789 828 844 893 955 1,027 1,100 1,181 R&D as % of WW 18.7% 18.6% 18.9% 18.9% 19.1% 20.1% 20.7% 21.3% 21.6% 21.5% 21.2% 20.5% 19.7% 18.9% 18.0% Prescription Sales Generics 60 66 66 69 75 77 80 78 75 79 84 88 92 96 100 Prescription excl. Generics 629 668 655 661 680 670 692 710 753 765 809 867 935 1,004 1,081 R&D as % of Prescription 20.5% 20.4% 20.8% 20.9% 21.3% 22.4% 23.1% 23.7% 23.8% 23.8% 23.4% 22.6% 21.6% 20.7% 19.7% excl. Generics CAGR 2018-24 on Pharma R&D Spend +3.0%. Cumulative 10 year R&D Spend (2009-18) $1,468bn. Table 10: NME Approvals per Year (2006-2018) Source: EvaluatePharma, May 2019 Year 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Number of NMEs 29 25 31 35 26 35 44 35 51 56 27 55 62 Spend per NME ($bn) 3.8 4.9 4.2 3.6 4.9 3.9 3.1 4.0 2.8 2.7 5.9 3.1 2.9 Spend per NME ($bn) (3 year lag)* 3.2 4.7 3.8 2.9 3.7 2.7 2.4 5.1 2.6 2.4 Note: Forecast pharmaceutical research and development spend based on a consensus of leading equity analysts’ estimates for company level R&D spend, extrapolated to pharmaceutical R&D when a company has non-pharmaceutical R&D activity. *Spend per NME ($bn) (3 year lag) uses the R&D expense for 3 years prior to the NME approval instead of the same year. e.g. the 2018 昀椀gure of $2.4bn is the R&D expense in 2015 divided by the number of NMEs in 2018. ® 18 EvaluatePharma World Preview 2019 Copyright © 2019 Evaluate Ltd. All rights reserved.

EvaluatePharma 2024 Page 17 Page 19

EvaluatePharma 2024 Page 17 Page 19