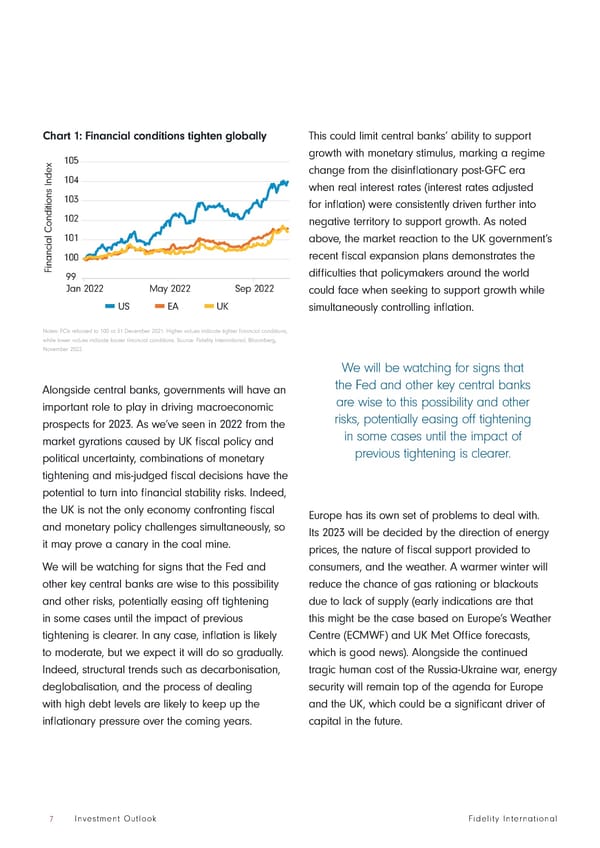

Chart 1: Financial conditions tighten globally This could limit central banks’ ability to support 105 growth with monetary stimulus, marking a regime change from the disinflationary post-GFC era 104 when real interest rates (interest rates adjusted 103 for inflation) were consistently driven further into 102 negative territory to support growth. As noted 101 above, the market reaction to the UK government’s 100 recent fiscal expansion plans demonstrates the Financial Conditions Index99 difficulties that policymakers around the world Jan 2022 May 2022 Sep 2022 could face when seeking to support growth while US EA UK simultaneously controlling inflation. Notes: FCIs rebased to 100 at 31 December 2021. Higher values indicate tighter financial conditions, while lower values indicate looser financial conditions. Source: Fidelity International, Bloomberg, November 2022. We will be watching for signs that Alongside central banks, governments will have an the Fed and other key central banks important role to play in driving macroeconomic are wise to this possibility and other prospects for 2023. As we’ve seen in 2022 from the risks, potentially easing off tightening market gyrations caused by UK fiscal policy and in some cases until the impact of political uncertainty, combinations of monetary previous tightening is clearer. tightening and mis-judged fiscal decisions have the potential to turn into financial stability risks. Indeed, the UK is not the only economy confronting fiscal Europe has its own set of problems to deal with. and monetary policy challenges simultaneously, so Its 2023 will be decided by the direction of energy it may prove a canary in the coal mine. prices, the nature of fiscal support provided to We will be watching for signs that the Fed and consumers, and the weather. A warmer winter will other key central banks are wise to this possibility reduce the chance of gas rationing or blackouts and other risks, potentially easing off tightening due to lack of supply (early indications are that in some cases until the impact of previous this might be the case based on Europe’s Weather tightening is clearer. In any case, inflation is likely Centre (ECMWF) and UK Met Office forecasts, to moderate, but we expect it will do so gradually. which is good news). Alongside the continued Indeed, structural trends such as decarbonisation, tragic human cost of the Russia-Ukraine war, energy deglobalisation, and the process of dealing security will remain top of the agenda for Europe with high debt levels are likely to keep up the and the UK, which could be a significant driver of inflationary pressure over the coming years. capital in the future. 7 Investment Outlook Fidelity International

Fidelity International Outlook 2023 Page 6 Page 8

Fidelity International Outlook 2023 Page 6 Page 8