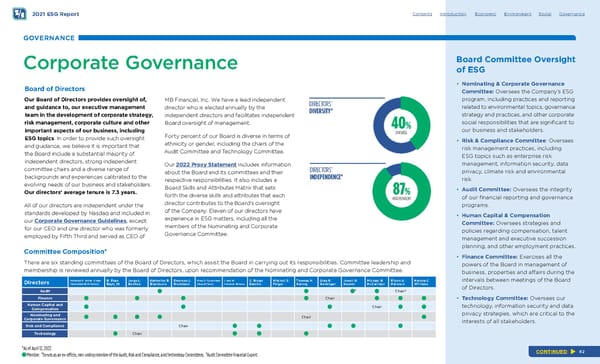

1 i - 2021 ESG Report Contents Introduction Economic Environment Social Governance GOVERNANCE Board Committee Oversight of ESG Corporate Governance • Nominating & Corporate Governance Board of Directors Committee: Oversees the Company’s ESG Our Board of Directors provides oversight of, MB Financial, Inc. We have a lead independent 40 % DIVERSE 87 % INDEPENDENT program, including practices and reporting DIRECTORS’ and guidance to, our executive management director who is elected annually by the related to environmental topics, governance DIVERSITY* team in the development of corporate strategy, independent directors and facilitates independent strategy and practices, and other corporate risk management, corporate culture and other Board oversight of management. social responsibilities that are signifcant to important aspects of our business, including our business and stakeholders. Forty percent of our Board is diverse in terms of ESG topics . In order to provide such oversight • Risk & Compliance Committee : Oversees ethnicity or gender, including the chairs of the and guidance, we believe it is important that risk management practices, including Audit Committee and Technology Committee. the Board include a substantial majority of ESG topics such as enterprise risk independent directors, strong independent Our 2022 Proxy Statement includes information management, information security, data committee chairs and a diverse range of about the Board and its committees and their DIRECTORS’ privacy, climate risk and environmental backgrounds and experiences calibrated to the INDEPENDENCE* respective responsibilities. It also includes a risk. evolving needs of our business and stakeholders. Board Skills and Attributes Matrix that sets • Audit Committee: Oversees the integrity Our directors’ average tenure is 7.3 years. forth the diverse skills and attributes that each of our fnancial reporting and governance director contributes to the Board’s oversight All of our directors are independent under the programs. of the Company. Eleven of our directors have standards developed by Nasdaq and included in • Human Capital & Compensation experience in ESG matters, including all the our Corporate Governance Guidelines , except Committee: Oversees strategies and members of the Nominating and Corporate for our CEO and one director who was formerly policies regarding compensation, talent Governance Committee. employed by Fifth Third and served as CEO of management and executive succession planning, and other employment practices. Committee Composition* • Finance Committee: Exercises all the There are six standing committees of the Board of Directors, which assist the Board in carrying out its responsibilities. Committee leadership and powers of the Board in management of membership is reviewed annually by the Board of Directors, upon recommendation of the Nominating and Corporate Governance Committee. business, properties and afairs during the Directors Nicholas K. Akins (Lead Independent Director) B. Evan Bayh, III Jorge L. Benitez Katherine B. Blackburn Emerson L. Brumback Greg D. Carmichael (Board Chair) L nda W. Clement Holmes C. Bryan Daniels Mitchell S. Feiger Thomas H. Harvey Gray R. Heminger Jewell D. Hoover Michael B. McCallister Eileen A. Mallesch Marsha C. Williams Audit 2 Chair 2 Finance Chair Human Capital and Compensation Chair Nominating and Corporate Governance Chair Risk and Compliance Chair Technology Chair *As of April 12, 2022. Member. ¹Serves as an ex-ofcio, non-voting member of the Audit, Risk and Compliance, and Technology Committees. ²Audit Committee Financial Expert. intervals between meetings of the Board of Directors. • Technology Committee: Oversees our technology, information security and data privacy strategies, which are critical to the interests of all stakeholders. CONTINUED 82

Fifth Third ESG Report Page 81 Page 83

Fifth Third ESG Report Page 81 Page 83