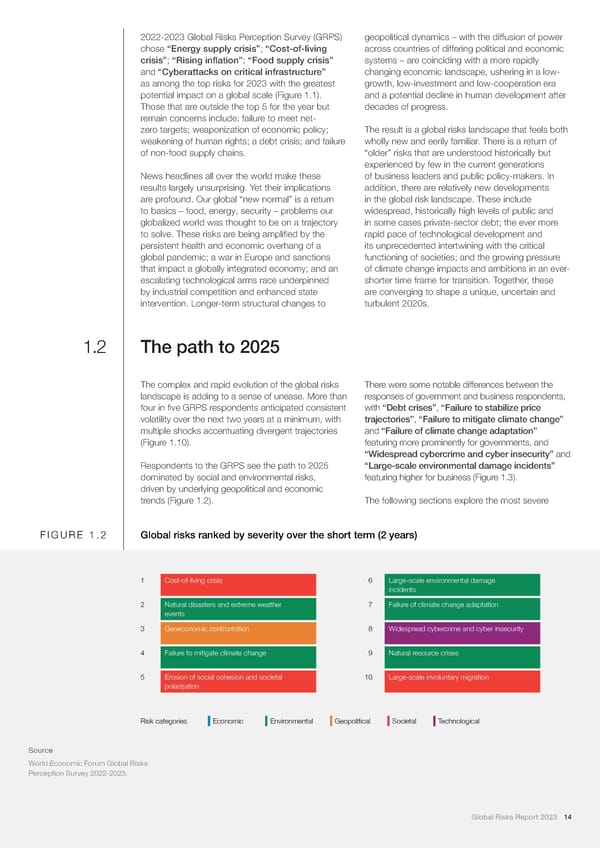

2022-2023 Global Risks Perception Survey (GRPS) geopolitical dynamics – with the diffusion of power chose “Energy supply crisis”; “Cost-of-living across countries of differing political and economic crisis”; “Rising in昀氀ation”; “Food supply crisis” systems – are coinciding with a more rapidly and “Cyberattacks on critical infrastructure” changing economic landscape, ushering in a low- as among the top risks for 2023 with the greatest growth, low-investment and low-cooperation era potential impact on a global scale (Figure 1.1). and a potential decline in human development after Those that are outside the top 5 for the year but decades of progress. remain concerns include: failure to meet net- zero targets; weaponization of economic policy; The result is a global risks landscape that feels both weakening of human rights; a debt crisis; and failure wholly new and eerily familiar. There is a return of of non-food supply chains. “older” risks that are understood historically but experienced by few in the current generations News headlines all over the world make these of business leaders and public policy-makers. In results largely unsurprising. Yet their implications addition, there are relatively new developments are profound. Our global “new normal” is a return in the global risk landscape. These include to basics – food, energy, security – problems our widespread, historically high levels of public and globalized world was thought to be on a trajectory in some cases private-sector debt; the ever more to solve. These risks are being ampli昀椀ed by the rapid pace of technological development and persistent health and economic overhang of a its unprecedented intertwining with the critical global pandemic; a war in Europe and sanctions functioning of societies; and the growing pressure that impact a globally integrated economy; and an of climate change impacts and ambitions in an ever- escalating technological arms race underpinned shorter time frame for transition. Together, these by industrial competition and enhanced state are converging to shape a unique, uncertain and intervention. Longer-term structural changes to turbulent 2020s. 1.2 The path to 2025 The complex and rapid evolution of the global risks There were some notable differences between the landscape is adding to a sense of unease. More than responses of government and business respondents, four in 昀椀ve GRPS respondents anticipated consistent with “Debt crises”, “Failure to stabilize price volatility over the next two years at a minimum, with trajectories”, “Failure to mitigate climate change” multiple shocks accentuating divergent trajectories and “Failure of climate change adaptation” (Figure 1.10). featuring more prominently for governments, and “Widespread cybercrime and cyber insecurity” and Respondents to the GRPS see the path to 2025 “Large-scale environmental damage incidents” dominated by social and environmental risks, featuring higher for business (Figure 1.3). driven by underlying geopolitical and economic trends (Figure 1.2). The following sections explore the most severe FIGURE 1.2 Global risks ranked by severity over the short term (2 years) 1 Cost-of-living crisis 6 Large-scale environmental damage incidents 2 Natural disasters and extreme weather 7 Failure of climate change adaptation events 3 Geoeconomic confrontation 8 Widespread cybercrime and cyber insecurity 4 Failure to mitigate climate change 9 Natural resource crises 5 Erosion of social cohesion and societal 10 Large-scale involuntary migration polarization Risk categories Economic Environmental Geopolitical Societal Technological Source World Economic Forum Global Risks Perception Survey 2022-2023. Global Risks Report 2023 14

Global Risks Report 2023 Page 13 Page 15

Global Risks Report 2023 Page 13 Page 15