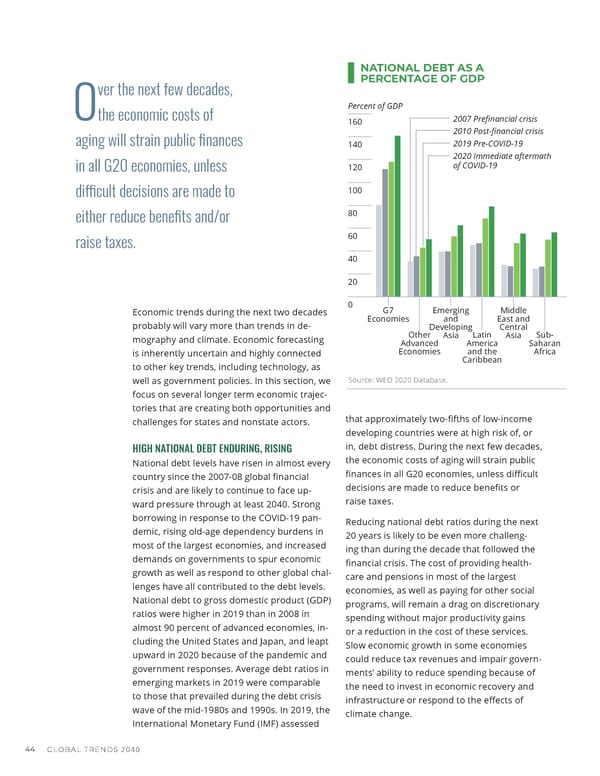

NATIONAL DEBT AS A ver the next few decades, PERCENTAGE OF GDP Othe economic costs of Percent of GDP 160 2007 Prefinancial crisis 2010 Post-financial crisis aging will strain public 昀椀nances 140 2019 Pre-COVID-19 2020 Immediate aftermath in all G20 economies, unless 120 of COVID-19 100 di昀케cult decisions are made to 80 either reduce bene昀椀ts and/or raise taxes. 60 40 20 Economic trends during the next two decades 0 G7 Emerging Middle probably will vary more than trends in de- Economies and East and Developing Central mography and climate. Economic forecasting Other Asia Latin Asia Sub- Advanced America Saharan is inherently uncertain and highly connected Economies and the Africa to other key trends, including technology, as Caribbean well as government policies. In this section, we Source: WEO 2020 Database. focus on several longer term economic trajec- tories that are creating both opportunities and challenges for states and nonstate actors. that approximately two-昀椀fths of low-income developing countries were at high risk of, or HIGH NATIONAL DEBT ENDURING, RISING in, debt distress. During the next few decades, National debt levels have risen in almost every the economic costs of aging will strain public 昀椀nances in all G20 economies, unless di昀케cult country since the 2007-08 global 昀椀nancial crisis and are likely to continue to face up- decisions are made to reduce bene昀椀ts or ward pressure through at least 2040. Strong raise taxes. borrowing in response to the COVID-19 pan- Reducing national debt ratios during the next demic, rising old-age dependency burdens in 20 years is likely to be even more challeng- most of the largest economies, and increased ing than during the decade that followed the demands on governments to spur economic 昀椀nancial crisis. The cost of providing health- growth as well as respond to other global chal- care and pensions in most of the largest lenges have all contributed to the debt levels. economies, as well as paying for other social National debt to gross domestic product (GDP) programs, will remain a drag on discretionary ratios were higher in 2019 than in 2008 in spending without major productivity gains almost 90 percent of advanced economies, in- or a reduction in the cost of these services. cluding the United States and Japan, and leapt Slow economic growth in some economies upward in 2020 because of the pandemic and could reduce tax revenues and impair govern- government responses. Average debt ratios in ments’ ability to reduce spending because of emerging markets in 2019 were comparable the need to invest in economic recovery and to those that prevailed during the debt crisis infrastructure or respond to the e昀昀ects of wave of the mid-1980s and 1990s. In 2019, the climate change. International Monetary Fund (IMF) assessed 44 GLOBAL TRENDS 2040

GlobalTrends 2040 Page 51 Page 53

GlobalTrends 2040 Page 51 Page 53