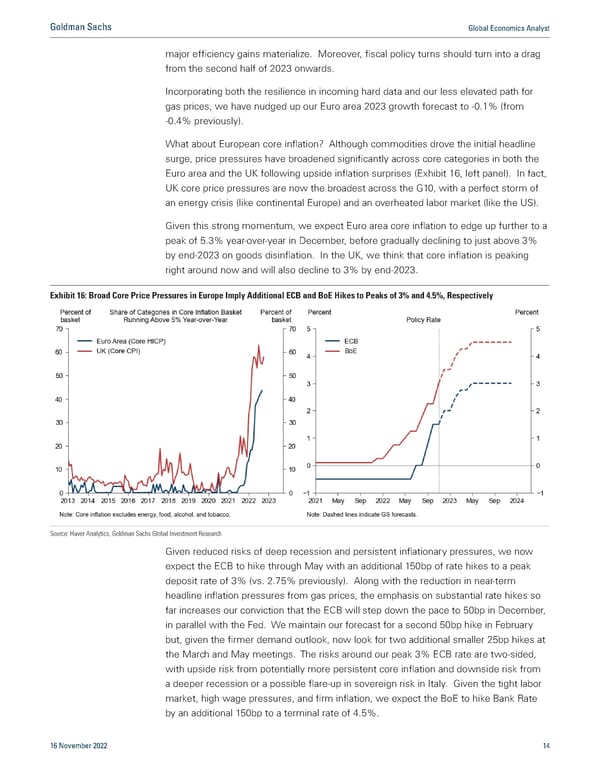

Goldman Sachs Global Economics Analyst major efficiency gains materialize. Moreover, fiscal policy turns should turn into a drag from the second half of 2023 onwards. Incorporating both the resilience in incoming hard data and our less elevated path for gas prices, we have nudged up our Euro area 2023 growth forecast to -0.1% (from -0.4% previously). What about European core inflation? Although commodities drove the initial headline surge, price pressures have broadened significantly across core categories in both the Euro area and the UK following upside inflation surprises (Exhibit 16, left panel). In fact, UK core price pressures are now the broadest across the G10, with a perfect storm of an energy crisis (like continental Europe) and an overheated labor market (like the US). Given this strong momentum, we expect Euro area core inflation to edge up further to a peak of 5.3% year-over-year in December, before gradually declining to just above 3% by end-2023 on goods disinflation. In the UK, we think that core inflation is peaking right around now and will also decline to 3% by end-2023. Exhibit 16: Broad Core Price Pressures in Europe Imply Additional ECB and BoE Hikes to Peaks of 3% and 4.5%, Respectively Source: Haver Analytics, Goldman Sachs Global Investment Research Given reduced risks of deep recession and persistent inflationary pressures, we now expect the ECB to hike through May with an additional 150bp of rate hikes to a peak deposit rate of 3% (vs. 2.75% previously). Along with the reduction in near-term headline inflation pressures from gas prices, the emphasis on substantial rate hikes so far increases our conviction that the ECB will step down the pace to 50bp in December, in parallel with the Fed. We maintain our forecast for a second 50bp hike in February but, given the firmer demand outlook, now look for two additional smaller 25bp hikes at the March and May meetings. The risks around our peak 3% ECB rate are two-sided, with upside risk from potentially more persistent core inflation and downside risk from a deeper recession or a possible flare-up in sovereign risk in Italy. Given the tight labor market, high wage pressures, and firm inflation, we expect the BoE to hike Bank Rate by an additional 150bp to a terminal rate of 4.5%. 16 November 2022 14

Goldman Sachs Global Economics Analyst Macro Outlook 2023 Page 13 Page 15

Goldman Sachs Global Economics Analyst Macro Outlook 2023 Page 13 Page 15