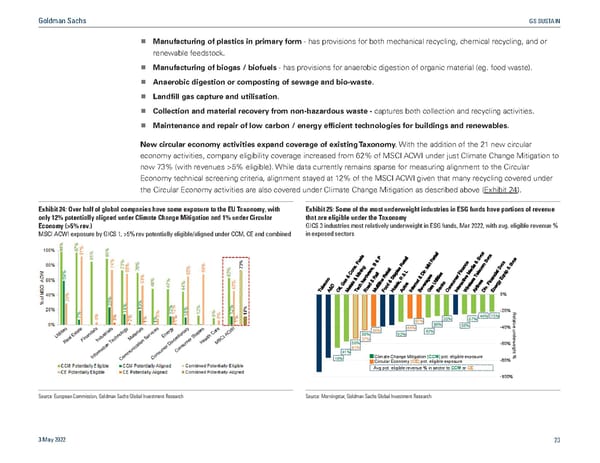

Goldman Sachs GS SUSTAIN n Manufacturing of plastics in primary form - has provisions for both mechanical recycling, chemical recycling, and or renewable feedstock. n Manufacturing of biogas / biofuels - has provisions for anaerobic digestion of organic material (eg. food waste). n Anaerobic digestion or composting of sewage and bio-waste. n Landfill gas capture and utilisation. n Collection and material recovery from non-hazardous waste - captures both collection and recycling activities. n Maintenance and repair of low carbon / energy efficient technologies for buildings and renewables. New circular economy activities expand coverage of existing Taxonomy. With the addition of the 21 new circular economy activities, company eligibility coverage increased from 62% of MSCI ACWI under just Climate Change Mitigation to now 73% (with revenues >5% eligible). While data currently remains sparse for measuring alignment to the Circular Economy technical screening criteria, alignment stayed at 12% of the MSCI ACWI given that many recycling covered under the Circular Economy activities are also covered under Climate Change Mitigation as described above (Exhibit 24). Exhibit 24: Over half of global companies have some exposure to the EU Taxonomy, with Exhibit 25: Some of the most underweight industries in ESG funds have portions of revenue only 12% potentially aligned under Climate Change Mitigation and 1% under Circular that are eligible under the Taxonomy Economy (>5% rev.) GICS 3 industries most relatively underweight in ESG funds, Mar 2022, with avg. eligible revenue % MSCI ACWI exposure by GICS 1, >5% rev potentially eligible/aligned under CCM, CE and combined in exposed sectors 0% -20% Relativ 20% 87% 44% 13% 97% 96% 88% e 65% -40% 86% u 62% n 88% 82% d e 37% r w 55% -60% eigh 91% 41% t 16% Climate Change Mitigation (CCM) pot. eligible exposure -80% % Circular Economy (CE) pot. eligible exposure Avg pot. eligible revenue % in sector to CCM or CE -100% Source: European Commission, Goldman Sachs Global Investment Research Source: Morningstar, Goldman Sachs Global Investment Research 3 May 2022 23

GS SUSTAIN: Circular Economy Report Page 23 Page 25

GS SUSTAIN: Circular Economy Report Page 23 Page 25