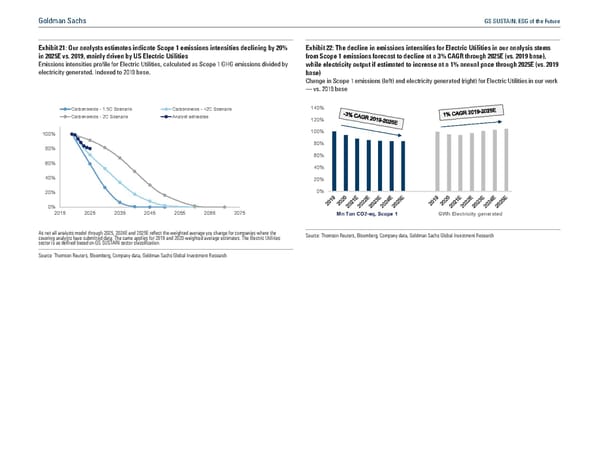

Goldman Sachs GS SUSTAIN: ESG of the Future Exhibit 21: Our analysts estimates indicate Scope 1 emissions intensities declining by 20% Exhibit 22: The decline in emissions intensities for Electric Utilities in our analysis stems in 2025E vs. 2019, mainly driven by US Electric Utilities from Scope 1 emissions forecast to decline at a 3% CAGR through 2025E (vs. 2019 base), Emissions intensities profile for Electric Utilities, calculated as Scope 1 GHG emissions divided by while electricity output if estimated to increase at a 1% annual pace through 2025E (vs. 2019 electricity generated. Indexed to 2019 base. base) Change in Scope 1 emissions (left) and electricity generated (right) for Electric Utilities in our work — vs. 2019 base Carbonomics - 1.5C Scenario Carbonomics - <2C Scenario 140% Carbonomics - 2C Scenario Analyst estimates 120% 100% 100% 80% 80% 60% 60% 40% 40% 20% 20% 0% 0% 2015 2025 2035 2045 2055 2065 2075 Mn Ton CO2-eq, Scope 1 GWh Electricity generated As not all analysts model through 2025, 2024E and 2025E reflect the weighted average yoy change for companies where the Source: Thomson Reuters, Bloomberg, Company data, Goldman Sachs Global Investment Research covering analysts have submitted data. The same applies for 2019 and 2020 weighted average estimates. The Electric Utilities sector is as de“ned based on GS SUSTAIN sector classi“cation. Source: Thomson Reuters, Bloomberg, Company data, Goldman Sachs Global Investment Research

GS SUSTAIN: ESG of the Future Page 33 Page 35

GS SUSTAIN: ESG of the Future Page 33 Page 35